Neutral ALKEM Laboratories Ltd for the Target Rs. 525 by Motilal Oswal Financial Services Ltd

Acquisition of Occlutech to open opportunities in Med-tech segment

Segmental mix, operating leverage drive beat on earnings

? ALKEM is taking significant steps in its Medtech journey through acquiring Occlutech (develops, manufactures, and commercialized medical devices for congenital heart disease, stroke prevention and heart failure).

? ALKEM would be buying up to 55% stake for a consideration of EUR99m (INR10.6b). Revenue/EBITDA/loss of this company in CY25 was EUR49m/EUR2m/EUR6.8m. ALKEM expects to improve EBITDA margins to 23-24% over the next 3-4 years.

? ALKEM Laboratories reported in-line revenue in 3QFY26. EBITDA/PAT came in 17%/20% higher than our estimates, aided by higher growth in export markets, partly supported by currency movement.

? Strong growth was seen in therapies like VMNs, anti-diabetic, respiratory and derma. This was offset to some extent by muted YoY growth in antiinfectives and gastro-intestinal segments.

? New launches, volume traction in base business and steady progress across non-US markets drove overall export growth for the quarter.

? We reduce our earnings estimates by 4%/5% for FY27/FY28, factoring in a) an increase in raw material prices due to the implementation of minimum import price (MIP) by the government of India, and b) ongoing weakness at industry level in certain therapies in DF segment. We value ALKEM at 28x 12M forward earnings to arrive at a TP of INR5,525.

? Increased efforts toward new ventures (med-tech and Enzene), as well as the step-up in the tax rate, are expected to keep growth in check over FY26-28. Maintain Neutral on limited upside from current levels.

Occlutech acquisition to form a Medtech platform for ALKEM to enter developed markets

? Occlutech is a leading specialist provider of minimally invasive structural heart occlusion devices with presence across congenital heart disease, stroke prevention and heart failure segments; commercialized in 70+ countries with manufacturing facilities in Germany and Turkey. ? Its portfolio comprises 10+ product lines across three therapeutic areas with 200,000+ devices sold since inception.

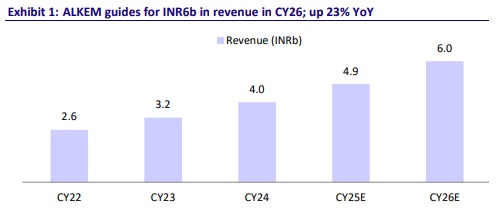

? It has delivered ~17% sales CAGR over CY22-24 to EUR43m; estimated to reach EUR49m (~INR4.9b) in CY25, implying ~16.5% CAGR over CY22-25. Over the next five years, ALKEM intends to scale up revenue to INR10b+ and expand EBITDA margin from ~5% currently to ~20-25%.

? This implies EV/EBITDA of ~15x/~7x on CY28E/CY30E EBITDA. The acquisition is 3.6x CY25 sales.

? ALKEM would leverage Occlutech as a global med-tech entry platform across Japan, the US and Europe.

? Our take: For ALKEM, acquiring an R&D-focused company with presence in developed markets is a good strategy to scale up its med-tech business. The profitability of Occlutech has yet to improve despite being present in this space for 15+ years. With ALKEM also in the process of building its positioning in this space, this would be the key monitorable. The valuation is decent if the performance happens as per guidance.

EBITDA/PAT better than expected

? 3Q revenue grew 10.7% YoY to INR37.4b (our est.: INR36.7b).

? Gross margin expanded 160bp YoY to 66%.

? EBITDA margin was steady YoY at 22.2% (our est.: 19.3%) as higher gross margin was offset by high other expenses/employee cost (up 140bp/80bp YoY as % of sales). R&D expense was stable YoY as % of sales.

? EBITDA grew 9% YoY to INR8.3b (our est. of INR7.1b).

? Adj. PAT grew 8.7% YoY to INR6.8b (our est.: INR5.8b).

? For 9MFY26, revenue/EBITDA/PAT grew 13%/17%/13% YoY.

International growth much higher than DF segment

? DF business grew 5.5% YoY to INR25b (67.2% of sales).

? International business grew 27% YoY to INR12.1b.

? US sales increased by 19% YoY to INR7.7b (20.3% of Sales).

? Other international sales rose 42% YoY to INR4.6b (12.5% of sales).

Highlights from the management commentary

? ALKEM had taken steps to change the distribution set-up in DF, leading to high base last year. Adj for the same, YoY growth would be double digits in 3Q.

? ALKEM expects Enzene and medtech to have EBITDA margin of 25% in 4-5 years.

? In addition to acquisition, ALKEM would invest INR1b-INR2b in R&D at Occlutech over next 1-2 years. Current GM of Occlutech is about 73%.

? There is a debt of INR4b-INR5b on the balance sheet of Occlutech. This can be re-financed using corporate guarantee of ALKEM. In CY25, Occlutech reported revenue of EUR49m, EBITDA of EUR2m, and a loss of EUR6.8m.

About Occlutech

? Occlutech is a leading specialist provider of minimally invasive cardiac devices. Occlutech has developed, produced, and commercialized first-class, minimally invasive, cardiac implants for congenital heart disease, stroke prevention, and heart failure. The devices are sold to hospitals and clinics in over 70 countries. It has manufacturing facilities in Germany and Turkey.

? Occlutech has 10+ product lines in three therapeutic areas. Occlutech has sold 2L+ devices till date since inception.

Financial snapshot: 16-17% sales CAGR over CY22-25E

? Occlutech has delivered 17% sales CAGR over CY22-24 to EUR43m. Considering estimated sales of EUR49m (INR4.9b) in CY25, the sales CAGR over CY22-25 is expected to be 16.5%. There was a net loss of EUR20m in CY24.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412