Buy Siemens Energy India Ltd for the Target Rs. 3,600 by Motilal Oswal Financial Services Ltd

Benefitting from strong demand for transformers

Siemens Energy’s 1QFY26 results came in above our estimates. Net profit growth of 57% YoY was driven by a beat in EBITDA margin and a low tax rate. EBITDA margin at 24.1% was ahead of our estimate, aided by a sharp decline in other expenses. With a strong domestic and export opportunity available for large power transformers, the company is scaling up its capacity by another 30,000MVA potentially, taking the total capacity to 60,000MVA after its existing capex and new capex program commission. The capex plan also indicates its confidence in the long-term sustainability of overall demand in power transformers, led by energy transition initiatives domestically and globally. We would keep a close watch on commodity price movement to assess its impact on margins. Since our last update on Siemens Energy, the stock has already moved up by 29%. We marginally tweak our estimates by 4%/1%/1% for FY26/27/28 and arrive at a revised TP of INR3,600 (earlier INR3,400), based on 55x Mar’28E EPS. Retain BUY

In-line revenue, beat on profitability

Siemens Energy reported in-line revenue but delivered a strong beat on profitability in 1QFY26. Revenue stood at INR19b, up 26% YoY, broadly in line with our estimates. Gross margin declined YoY to 44.1%; however, better control over other expenses led to a 200bp YoY expansion in EBITDA margin to 24.1% (est. 20.5%), with absolute EBITDA rising 37% YoY to INR4.6b. Supported by strong margins, higher-than-expected other income and a lower tax rate, PAT grew 57% YoY to INR3.6b (est. INR3b). During the quarter, the company recognized an exceptional item of INR519m related to the implementation of the new labor code. Order inflows increased 4% YoY to INR33.4b, taking the order backlog to INR176b, up 38% YoY.

Both segments perform well

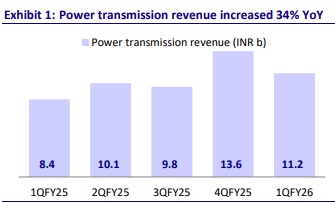

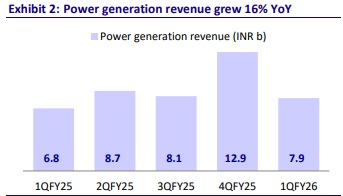

The power transmission and generation segments reported revenue broadly in line with our estimates in 1QFY26. Power transmission revenue increased 34% YoY to INR11b, EBIT rose 61% YoY to INR3b, and EBIT margin expanded 410bp YoY to 24.3%. Power generation revenue rose 16% YoY to INR8b, EBIT grew 7% YoY to INR2b, and EBIT margin at 19.7% contracted 170bp YoY but improved by 410bp QoQ. We expect the power transmission segment to continue to benefit from strong demand and ongoing capacity expansion plan. The power generation segment has grown well vs. single-digit-growth guidance given by the company earlier. We expect power generation segment to benefit from improving demand for both steam and gas turbines.

Ongoing and additional capex for capacity expansion to support growth

The company has approved additional capex of ~INR20.6b, to be funded by internal accruals, to expand its large power transformer capacity by ~30,000 MVA, over and above the ongoing capex of INR7.4b (INR4.6b for power transformers at Kalwa and INR2.8b for high-voltage switchgear capacity expansion at Chhatrapati Sambhaji Nagar). The ongoing capex is expected to be commissioned between 4QFY26 and 1QFY27 and new project is expected to commence during FY30-32, strengthening the company’s ability to cater to rising domestic and export demand for grid equipment. After this expansion, its capacity will increase to 60,000MVA.

Outlook across segments

Siemens Energy is positioned for a transmission-led growth profile over the medium to long term, supported by strong visibility from the domestic T&D capex cycle and its capabilities in high-voltage and HVDC solutions. We expect power transmission revenue to grow at 39% CAGR over FY25-28. Power generation segment, which has presence across steam and industrial gas turbines, is expected to benefit from sharp demand ramp-up for gas turbines. Management expects high-single-digit revenue growth in this business, while we model power generation revenue to grow at a 9% CAGR over FY25-28. Exports and services should continue to provide incremental support to overall growth and margins.

Financial outlook

We slightly revise our FY26/FY27/28 estimates to bake in 1QFY26 performance. We expect revenue/EBITDA/PAT CAGR of 27%/31%/32% over FY25-28E, led by strong growth across power transmission (39% CAGR) and power generation (9% CAGR). We expect EBITDA margins of 20.5%/20.8%/21.1% for FY26/27/28.

Valuation and view

Siemens Energy is currently trading at 46.6x/38.3x P/E on FY27/28E EPS. We tweak our estimates by 4%/1%/1% for FY26/27/28 and arrive at a revised TP of INR3,600 (earlier INR3,400), based on 55x P/E on Mar’28E earnings. Retain BUY.

Key risks and concerns

Key risks to our thesis can come from a slowdown in ordering and supply chain issues and a sharp rise in commodity prices, impacting margin.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412