Neutral Lupin Ltd for the Target Rs. 2,360 by Motilal Oswal Financial Services Ltd

Strong execution drives margin to decade high Competition and pipeline gestation to cap earnings trajectory

? Lupin (LPC) posted a better-than-expected financial performance in 3QFY26, with 6%/16%/22% beat on revenues/EBITDA/PAT. Robust traction in US and other developed markets helped LPC sustain profitable growth momentum in 3Q.

? LPC delivered its highest-ever quarterly EBITDA margin in the past 10 years.

? Breaking its own record, it delivered the highest-ever quarterly US sales of USD350m in 3Q, led by the scale-up in recent launches.

? The company continued to outperform the India pharma market (IPM), with increased focus on chronic therapies, footprint expansion, and innovative product pipeline (13 launches in YTD FY26).

? Further, LPC is leveraging its portfolio in other developed markets and emerging markets to increase R&D productivity and capacity utilization.

? We raise our earnings estimates by 7%/4%/7% for FY26/FY27/FY28, factoring in a) higher sales from certain limited competition products, b) improved outlook for domestic formulation (DF) segment through product launches and increased marketing efforts, and c) superior traction in other developed/emerging markets. We value LPC at 22x 12M forward earnings to arrive at a TP of INR2,360.

? We believe that FY26 will be the second consecutive year of strong earnings growth; however, competition in certain products and some gestation period for commercialization of complex product pipeline in inhalation, injectables and biosimilar space could limit LPC’s earnings growth over FY26- 28. Maintain Neutral on the stock.

Product mix, operating leverage drive robust earnings growth

? 3Q revenue grew 25.9% YoY to INR71.7b (our est. INR67.6b). ? Gross margin (GM) expanded 400bp YoY to 73.8%.

? EBITDA margin expanded 660bp YoY to 30.8% (our est: 28.1%), largely due to better GM.

? As a result, EBITDA grew 60.5% YoY to INR22.1b (vs our est: INR19.0b).

? Adj. PAT grew 71.4% YoY to INR14.7b (our est: INR12.0b).

? For 9MFY26, revenue/EBITDA/PAT grew 22%/51%/56% YoY.

Broad-based growth across key geographies

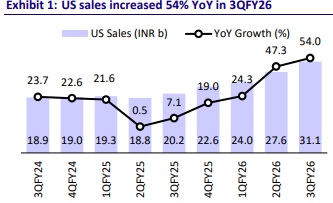

? US sales grew 54% YoY to INR31.1b (up 46% YoY in CC to USD350m; 44% of sales).

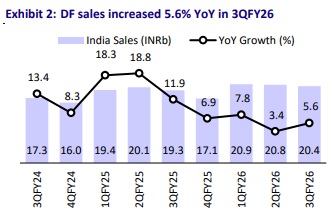

? DF sales grew 5.6% YoY to INR20.4b (29% of sales). Rx business rose 10.9% YoY.

? Other developed market sales grew 10.8% YoY to INR8b (11% of sales).

? Emerging market sales grew 42.4% YoY to INR 9.2b (13% of sales).

? API sales decreased 24.1% YoY to INR2.2b (3% of sales).

Highlights from the management commentary

? LPC has reiterated its EBITDA margin guidance of 24-25% in FY27.

? The company would have a licensing outgo of more than USD75 per unit licensing fee with respect to Mirabegron. Still LPC believes the profitability to remain healthy in this product.

? It added 600 MRs for Rx market in India.

? LPC has created a separate division comprising 200 MRs for the semaglutide opportunity to reach out to the doctor pool comprising diabetologist, cardiologist, and gastroenterologist.

? LPC expects to sustain US sales at USD1b over the next couple of years.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412