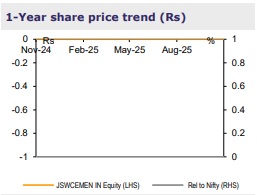

Reduce JSW Cement Ltd for the Target Rs.135 By Emkay Global Financial Services Ltd

Steady quarter; sustenance of operating-cost savings key

JSW Cement (JSWCL) reported consolidated EBITDA at Rs2.7bn (up 65% YoY; down 17% QoQ), which is broadly tracking the FY26E EBITDA run rate. Volume growth (YoY) in grey cement was better than the industry (~5%) at 6.5%, though the QoQ drop in realization was higher than the industry (~2%) at 5%. The GGBS segment saved the day, with GGBS volume growth at 20% YoY and a marginal QoQ drop in realization at <1%. JSWCL realized savings of ~Rs100/t in unit (RM + power and fuel) costs on a YoY and QoQ basis, led by lower slag costs. Overall variable cost/t savings were offset by sequential inflation in fixed cost due to higher branding spend and repair/maintenance costs. As a result, JSWCL reported blended EBITDA/t of Rs860 vs Rs600 YoY and Rs975 QoQ. Assuming EBITDA/t of Rs1,250 in the GGBS segment, we build in ~Rs550/t of unit EBITDA in the grey cement business which pushes JSWCL to the bottom quartile (profitability basis) of our cement universe, in Q2FY26.

View: Per our initiation report, we are positive on JSWCL’s ability to deliver robust volume growth, along with improving EBITDA/t; hence, we estimate 33% EBITDA CAGR over FY25-28E. Given that Q2FY26 performance was tracking FY26E EBITDA, we broadly retain our estimates. However, at 13x 1YF EV/E, risk-reward ratio appears balanced, and we see a limited upside to the stock. We still value JSWCL at 12x EV/E. We maintain REDUCE, with an unchanged TP of Rs135.

GGBS pulls up margins

JSWCL posted consolidated EBITDA of Rs2.7bn (up 65% YoY and down 17% QoQ), which is broadly tracking the FY26E EBITDA run rate. Grey cement saw 6.5% YoY (down ~11% QoQ) volume growth at 1.64mt, while realizations fell 5% QoQ, resulting in cement revenue at Rs7.6bn (up ~11% YoY, albeit down 16% QoQ). The GGBS segment compensated for the weak performance in the cement segment, as GGBS volumes grew 20%/6% YoY/QoQ, respectively, with a slight, 0.8% QoQ dip in realization, pulling GGBS revenue above Rs5bn. Unit RM+P&F costs saw a sharp fall of Rs100/t QoQ and YoY, primarily driven by lower input costs for slag. Fixed cost/t stood flat YoY (excl ESOP impact), though sharply up 20% QoQ due to higher branding spend and repair and maintenance costs. Overall, JSWCL reported EBITDA/t of Rs860 – assuming Rs1,250/t of unit EBITDA in the GGBS segment; this implies ~Rs550/t EBITDA in the cement business.

Capacity at >21mtpa; Rajasthan IU commissioning by early Q4FY26

JSWCL commissioned a 1mtpa GU at Sambalpur, Odisha, in Oct-25, and is on track to add 3.3/3.5mtpa clinker/cement capacities, taking the overall capacity to ~10/25mtpa, respectively, by Q2FY27E. On the back of a sustained capex plan (Rs58bn over FY26E28E), we estimate JSWCL’s total capacity to log ~30mtpa by FY28E. Healthy cash-flow generation (and IPO proceeds) is likely to result in net debt-to-EBITDA moderating to 2.6x in FY28E vs 4.6x in FY25.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)