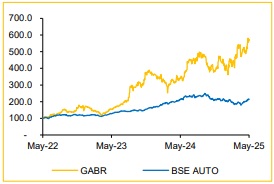

Reduce Gabriel India Ltd For Target Rs. 630- Choice Broking Ltd

Q4FY25: Revenue and PAT Beat Estimates; EBITDA Margins Significantly Ahead of Expectations

* Revenue up 17.0% YoY and 5.6% QoQ to INR 10,732 Mn (vs consensus est. at INR 10,252 Mn).

* EBITDA up 35.1% YoY and 18.9% QoQ to INR 1,088 Mn (vs consensus est. at INR 879 Mn). EBITDA margin up 136bps YoY and 114bps QoQ to 10.1% (vs consensus est. at 8.6%).

* APAT up 31.2% YoY and 7.1% QoQ to INR 644 Mn (vs consensus est. at INR 582 Mn).

Sunroof Business Expansion and Strategic Diversification:

The sunroof business is experiencing strong demand, and the company is set to double its existing capacity to 400K units per year by H2FY25 within existing facilities, supported by strong demand. Although no new orders were secured in the previous quarter, it has a robust pipeline and is in advanced discussions with several customers, including those in western India, where it may set up a new facility. Diversification into the sunroof segment, which offers higher EBITDA margins in the range of 12-14% compared to 8–9% percent for suspension systems, has improved the company’s overall margin profile and reduced its reliance on a single product line.

Diversified Bets into High-Growth and Margin-Accretive Niches:

Gabriel India is strategically expanding into two high-growth and margin-accretive segments, Solar Dampers and E-Bike components, which together are expected to generate over INR 4,000 Mn in revenue over the next two years. The solar damper business, driven by rising global adoption of solar trackers and a robust 15 percent CAGR, offers 2–3x higher price realization and better margins compared to conventional dampers, with production expected to commence in FY26. The ebike segment, supported by product development collaborations with leading European OEMs, is also expected to contribute INR 2,000 Mn in revenue, targeting a share of the $ 2 Bn global market. We estimate that by FY27, the combined contribution from these new businesses could account for approximately 2.5–3% of GARB overall revenues.

View and Valuation:

Gabriel India’s strategic push into high-growth, premium segments such as sunroofs, solar dampers, and e-bike components is expected to meaningfully diversify its revenue base and enhance its margin profile. The sunroof business is scaling up on the back of strong demand, while new adjacencies are projected to contribute ~2.5–3% of FY27 revenues. The improving product mix—driven by higher realization and better-margin offerings—is likely to drive EBITDA margin expansion of up to 60 bps over the medium term. These structural shifts support steady earnings upgrades and reinforce long-term growth visibility. We revise our FY26/27 EPS estimates upward by 1.2%/2.0% and raise our target multiple to 25x FY27E EPS, arriving at a revised target price of INR 630. We assign ‘REDUCE’ rating to the stock given the limited near-term upside.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131