Neutral Vodafone Idea Ltd for the Target Rs.9.5 by Motilal Oswal Financial Services Ltd

Potential AGR relief a positive, but several factors must align for sustained revival

* Vodafone Idea’s (Vi) pre-IND AS EBITDA at INR22.5b rose 3% QoQ (-3% YoY) and came in ~5% above our estimate, driven by better non-wireless revenue growth (+7% QoQ and YoY, ~5.5% beat) and lower normalized network opex (+5% YoY, ~2% below our estimate).

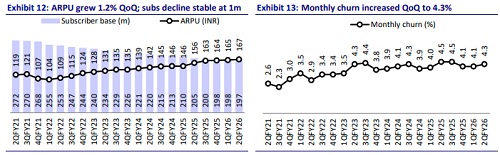

* Operationally, subscriber losses remain contained at ~1m (in line), while ARPU inched up 1.2% QoQ to INR167 (+7% YoY, our estimate of INR166).

* Vi’s capex moderated further to INR17.5b (~INR42b in 1H), with management expecting INR75-80b for FY26, based on its internal accruals. However, external fund raise remains critical for Vi to achieve its earlier guidance of INR500-550b capex plan over three years.

* Vi continued to lose market share as wireless revenue grew 0.8% QoQ (+2% YoY, in line), compared to ~3% QoQ growth for peers. On our estimate, Vi lost further ~20bp QoQ in revenue and subscriber market share to its private peers in 2QFY26. ? Recent Supreme Court judgement allowing the GoI to re-evaluate AGR dues for Vi is a positive outcome and could lead to the long-pending debt raise.

* However, beyond a potential reduction in AGR dues (we assume ~50% waiver), Vi will also require favorable payment terms for both AGR and spectrum dues, along with tariff hikes and a reduction in competitive intensity in customer acquisitions, to ensure a sustained revival. We note that the latter two factors are not entirely in Vi’s control, and we would expect competitive intensity to increase if Vi becomes more competitive on subscriber additions.

* We raise our FY26-28 pre-INDAS EBITDA estimates by 2-6%, driven mainly by Vi’s cost efficiency on containing network opex, despite accelerated 4G/5G rollouts. We reiterate our Neutral rating on Vi with a revised TP of INR9.5, based on DCF implied ~13x Dec’27E EV/EBITDA, as we see limited downside risks, given GoI’s unwavering support to ensure Vi’s LT survival.

Slightly ahead, driven by better non-wireless revenue

* Vi’s overall subscriber base at 196.7m declined 1m QoQ (vs. 0.5m net declines in 1QFY26 and in line with our estimates).

* Wireless ARPU rose 1.2% QoQ at INR167 (+7% YoY, vs. +1%/+2% QoQ for RJio/Bharti, and our est. of INR166), driven largely by one extra day QoQ and subscriber mix improvements (postpaid base ex-M2M up ~0.6m QoQ).

* Monthly churn inched up 20bp QoQ to 4.3% (vs. a 20bp QoQ uptick for Bharti at 2.9%) and remains a key monitorable.

* Wireless revenue at INR98.8b (+2% YoY, in line) was up 0.8% QoQ (vs. ~3% QoQ increase for Bharti/RJio), driven by a slightly better QoQ ARPU uptick.

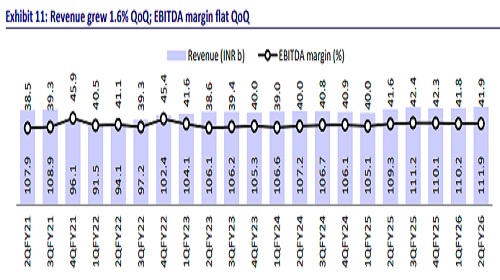

* Reported EBITDA at INR46.9b (+1.6% QoQ, +3% YoY, vs. ~3.5-4% QoQ for Bharti-India wireless and RJio) was ~2% above our estimate, driven by higher revenue and lower network opex (+1% QoQ, 2% below).

* EBITDA margin was stable QoQ at 41.8% (up ~25bp YoY, +90bp/+20bp QoQ for Bharti-India wireless and RJio) and was ~35bp above our estimate.

* Pre-Ind-AS 116 EBITDA at INR22.5b (+5% above) rose ~3% QoQ (-3% YoY), as margin expanded ~30bp QoQ to 20.1% (-115bp YoY, 80bp beat).

* Losses narrowed to INR55b (vs. INR66b QoQ and our estimate of INR66b), primarily due to lower interest cost (-26% QoQ, one-time settlement with a vendor, we believe, Indus Towers).

* Net debt (excluding leases but including interest accrued) increased INR56b QoQ to INR2t. Vi still owes ~INR2.01t to GoI for the deferred spectrum and AGR dues. External/banking debt declined to ~INR15.4b (vs. INR19.3b QoQ).

* Capex moderated further to INR17.5b (vs. INR 24.4b in 1QFY26).

Key highlights from the management commentary

* Leadership transition: Vi’s erstwhile COO, Mr. Abhijit Kishore, has assumed the role of CEO from Aug’25, while Mr. Tejas Mehta has taken over as the CFO. Management emphasized continuity of strategic priorities, with increased focus on customer experience.

* Capex: 2Q capex stood at INR17.5b, which led to 1,500+ new broadband towers additions and enhanced 5G coverage to 29 cities across 17 priority circles. Management expects INR75-80b capex for FY26 (vs. INR42b in 1H) from Vi’s internal cash flows, with a focus on enhancing coverage as well as capacity. A pick-up in capex beyond INR80b is contingent on closure of external fund raise.

* AGR and debt raise: Following the SC verdict on AGR dues, Vi believes GoI will take a suitable decision in the long-term interest of the company to maintain a 3+1 market structure in the Indian telecom industry. Management remains engaged with banks and NBFCs for long-pending debt raise and believes GoI’s support to Vi’s LT survival would support the company’s funding talks.

* Subscriber trends: The slight increase in subscriber decline and churn was attributed to seasonality (similar to Bharti’s commentary). However, management noted recent interventions such as Vi’s non-stop unlimited data offering, its guarantee of two extra days on recharge over INR199, and revamped family postpaid offerings are driving better customer retention and improved traction in terms of data usage on Vi’s network.

Valuation and view

* The recent Supreme Court judgement allowing GoI to re-evaluate the AGR dues for Vi is a positive outcome and could lead to its long-pending debt raise.

* However, besides the potential reduction in AGR dues (we assume ~50% waiver), Vi also needs favorable payment terms for both AGR as well as spectrum dues, along with tariff hikes and a reduction in the competitive intensity on customer acquisitions, to ensure a sustained revival. We note that the latter two factors are not entirely in Vi’s control, and we would expect competitive intensity to increase if Vi becomes competitive on subscriber additions.

* We raise our FY26-28 pre-INDAS EBITDA estimates by 2-6%, driven mainly by Vi’s cost efficiency on containing network opex, despite accelerated 4G/5G rollouts.

* We reiterate our Neutral rating on Vi with a revised TP of INR9.5, based on DCF implied ~13x Dec’27E EV/EBITDA, as we see limited downside risks, given GoI’s unwavering support to ensure Vi’s LT survival.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412