Neutral Eris Lifesciences Ltd for the Target Rs. 1,350 by Motilal Oswal Financial Services Ltd

Lower-than-est. 4Q due to supply disruption for select products

FY26 targets signal mid-teens to high-teens YoY revenue growth

* Eris Lifesciences (ERIS) posted lower-than-expected 4QFY25 performance. This has been largely due to a marginal slip in the execution, particularly in the insulin revenue.

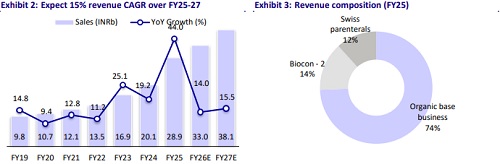

* Organic base business grew 10% YoY. The acquired (Biocon-2) business exhibited 11% YoY growth on a like-to-like basis.

* The Swiss parenteral business ended FY25 with a revenue/EBITDA margin of INR3.3b/33.5%.

* We cut our earnings estimates by 5%/3% for FY26/FY27, factoring in 1) recombinant human insulin (RHI)-related supply issues, 2) gradual pick-up in utilization of the Bhopal facility, and 3) gradual move to alternate prescriptions because of certain fixed-dose combninations (FDCs) being banned by regulatory authorities. We value ERIS at 25x 12M forward earnings to arrive at our TP of INR1,350.

* During FY24-25, ERIS progressed to secure building blocks in the Diabetes/ Obesity treatment through achieving regulatory milestones, building inhouse capacity for manufacturing, and enhancing its marketing reach. Further, it is building capacity and is in the process of getting relevant regulatory approvals for international business in the injectable segment. Considering these factors and the reduction in financial leverage, we estimate a 15%/17%/44% CAGR in sales/EBITDA/PAT over FY25-27. The current valuations (at 38xFY26E/27xFY27E earnings) adequately capture the earnings upside. Reiterate Neutral.

Operating performance hurt to some extent by depreciation/interest costs

* ERIS’ 4QFY25 revenue grew 28% YoY to INR7.1b (vs. our est: INR7.6).

* Gross margin contracted 270bp YoY to 76% due to a change in business mix.

* However, EBITDA margin expanded 500bp YoY to 36% (our est.36%), owing to better operating leverage (employee expenses/other expenses dipped 140bp/630bp as a % of sales).

* EBITDA jumped 49% YoY to INR2.5b (vs. our estimate of INR2.7).

* Adj. PAT increased 15% YoY to INR938m (vs. our estimate of INR1b).

* Revenue/EBITDA grew 44%/46%, while PAT declined 12.5% YoY to INR29b/ INR10b/INR3.5b in FY25.

Highlights from the management commentary

* ERIS guided for 15% organic YoY growth to reach INR29-INR30b in revenue in FY26. The EBITDA margin in this business is expected to be 37% (+50bp YoY as % of sales).

* ERIS indicated Swiss Parenterals business to the tune of INR3.8-INR3.9b (growth of 15-20% YoY) with an EBITDA margin of 35% for FY26.

* It targeted a net debt of INR18b at the end of FY26 vs. INR22b at the end of FY25.

* The Insulin franchise witnessed 22% YoY growth in revenue to INR3b. This was after facing product shortages throughout the year. The business loss due to product shortage was INR500m for FY25.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412