Neutral P&G Hygiene and Healthcare Ltd for the Target Rs. 15,000 by Motilal Oswal Financial Services Ltd

Miss on all fronts; quarterly inconsistency continues

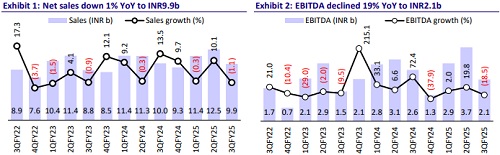

* P&G Hygiene and Healthcare’s (PGHH) 3QFY25 (FY ending June) performance missed our estimates on all fronts. We have noted such performance volatility on a quarterly basis in the past. Revenue was down 1% YoY at INR9.9b (vs. 14%/10% growth in 3QFY24/2QFY25).

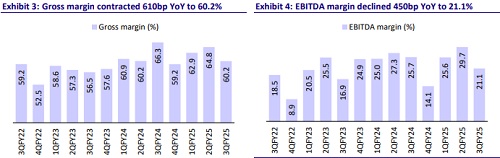

* Gross margin contracted 610bp YoY/460bp QoQ to 60.2% (est. 65%). Gross profit was down by 10% YoY. Ad spends were down 10% YoY (12.2% of sales). EBITDA declined 19% YoY to INR2.1b (est. INR2.7b). EBITDA margin contracted 450bp YoY and 860bp QoQ to 21.1% (est. 24.7%).

* PGHH delivered a 7% revenue CAGR during FY19-24, and we estimate a 7% CAGR during FY24-27E. The company is less predictable on a quarterly basis, but its annual performance is still quite steady. EBITDA margin has also seen consistent improvement, with 250bp expansion during FY19-24 to ~23.5%. We model 24%-25% EBITDA margin during FY24-27E. EBITDA saw a 10% CAGR during FY19-24, and we model a similar ~10% CAGR during FY24-27E.

* The stock trades at a rich valuation of 52x/48x FY26E/FY27E P/E. We reiterate Neutral rating at a TP of INR15,000 (50x Mar’27E EPS).

Revenue down 1%; sharp drop in gross margin

* Miss on revenue: Sales declined 1% YoY to INR9.9b (est. INR10.9b) after posting 10% growth in 2QFY25. Performance volatility in quarters has been witnessed in the past similarly.

* Sharp margin contraction: Gross margin contracted 610bp YoY and 460bp QoQ to 60.2% (est. 65%). Employee costs fell 18% YoY and A&P declined 10% YoY, while other expenses rose 2% YoY. EBITDA margin contracted 450bp YoY and 860bp QoQ to 21.1% (est. 24.7%).

* Pressure on profitability: EBITDA fell 19% YoY to INR2.1b (est. INR2.7b). EBITDA saw a beat in 2QFY25 with 20% YoY growth, indicating quarterly volatility in performance. Adj. PAT fell 16% YoY to INR1.6b. (est. INR2.0b).

* In 9MFY25, revenue/EBITDA/APAT grew by 3%/2%/2%.

Valuation and view

* We cut our EPS estimates by 2% each for FY25/FY26.

* Two factors make PGHH an attractive long-term core holding: 1) high growth potential for feminine hygiene segment (65-68% mix of FY24 sales), coupled with the potential for market share gains, aided by strategic initiatives, including the fortification of significant market advantages; and 2) potential to sustain high operating margin from the long-term trend of premiumization in the feminine hygiene segment.

* With a portfolio of essentials and healthcare, PGHH remains focused on product innovation-led customer acquisition. Penetration play would continue but at a stable pace, despite the high scope of user additions. The stock trades at rich valuations of 52x/48x FY26E/FY27E P/E. Further, we do not see any medium-term trigger. Reiterate Neutral with a TP of INR15,000, based on 50x Mar’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)