Neutral Balkrishna Industries Ltd for the Target Rs. 2,257 by Motilal Oswal Financial Services Ltd

Weak quarter

Demand outlook remains uncertain in key markets

* Balkrishna Industries’ (BIL) 2Q earnings at INR2.7b were below our estimate of INR3.7b due to an adverse mix, the impact of US tariffs, and weak demand.

* BIL continues to face demand headwinds in its key global markets. While the stock has underperformed in the recent past and valuations at 29.3x FY26E and 23.6x FY27E are not too demanding, its future target multiple is likely to depend on its ability to succeed in these new segments—not only by capturing market share, but by doing so without materially hurting core returns—which, in our view, is likely to be a challenge. We have not changed our target multiple for BIL yet and continue to value it at 22x Sep’27E. Reiterate Neutral with a TP of INR2,257.

Earnings miss due to weak demand and adverse mix

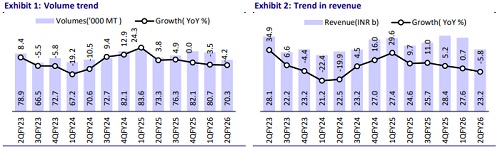

* BIL’s revenue declined ~6% YoY to INR23.2b, coming in below our estimates of INR25.5b. Volumes declined 4% YoY to 70,252MT and were below our estimate of 74k MT

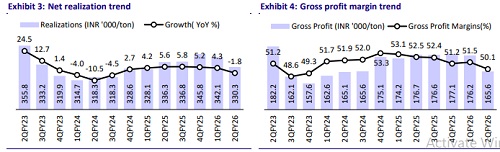

* Blended ASPs also declined 2% YoY to INR 330k/MT due to a weaker geographical as well as product mix.

* As a result, EBITDA margin sharply contracted 360bp YoY (230bp QoQ) to 21.5% (well below our estimate of 24.4%).

* EBITDA declined 19% YoY to INR5b (20% miss).

* Adj PAT declined 24% YoY to INR2.7b, sharply below our estimates of INR3.7b

* Operating cash flow for BIL during 1HFY26 stood at INR14.1b, while capex was INR16.7b. This resulted in negative free cash of INR2.6b.

* BIL has approved its 2nd interim dividend of INR4 per share.

* BIL’s volumes/revenue/EBITDA/PAT for 1HFY26 declined ~4%/2.4%/13.2%/33.2 to 151k MT/INR50.8b/INR11.6b/INR5.5b, respectively.

Highlights from the management commentary

* Currently, no global exporters are exporting to the US due to the sharp rise in tariffs. Most distributors are consuming existing stock and are adopting a wait-and-watch approach regarding the tariff situation. Thus, a favorable outcome on tariffs could prompt inventory restocking in the US.

* European demand remains weak but is showing early signs of stabilization. Management expects a gradual recovery in 2H.

* The impact of the EUDR regulation has started reflecting in 2Q and will be fully realized in 3Q. However, management expects this to be offset by the softening of commodity prices.

* Capex for 1HFY26 stood at INR16.7b, mainly towards the new TBR/PCR tire project and carbon black capacity expansion. FY26 capex is expected to be INR20-22b, with the remaining ~INR35b three-year plan to be incurred in subsequent years. Net debt currently stands at INR4.5b

Valuation and view

BIL continues to face demand headwinds in its key global markets. Further, its foray into the PCR/TBR segments is likely to be closely monitored for: 1) the pace at which it gains material traction and 2) whether margins and returns will be materially dilutive in the long run. While the stock has underperformed in the recent past and valuations at 29.3x FY26E and 23.6x FY27E are not too demanding, its future target multiple is likely to depend on its ability to succeed in these new segments—not only by capturing market share, but by doing so without materially hurting core returns—which, in our view, is likely to be a challenge. We have not changed our target multiple for BIL yet and continue to value it at 22x Sep’27E. However, this may warrant a change going forward if BIL’s returns plunge due to this foray. Reiterate Neutral with a TP of INR2,257.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412