Neutral Alembic Pharma Ltd for the Target Rs. 1020 by Motilal Oswal Financial Services Ltd

Exports (formulation/API) drive earnings

Utility Therapeutics acquisition marks entry into US prescription-led franchise

* Alembic Pharma (ALPM) delivered better-than-expected revenue/EBITDA (6%/6.5% beat) in 2QFY26. However, earnings were in line with our estimate due to a higher tax rate for the quarter.

* Non-US segment revenue remained on the robust growth path, with an alltime high quarterly run rate of INR3.9b. In addition to improved traction in established markets (Europe, Canada, Australia, Brazil, SA), ALPM is strategically expanding into new markets to better its growth prospects.

* Product launches boosted US sales to a quarterly run rate of USD64m in 2Q. Apart from generics, ALPM would be investing in products/field force in the urinary tract infection category for the prescription-led business model in US. The acquisition of Utility Therapeutics is the first step in this direction.

* Domestic formulation (DF) business has witnessed moderate growth for the past two quarters, partly due to the GST transition.

* We largely maintain our estimates for FY26/FY27/FY28. We value ALPM at 21x 12M forward earnings to arrive at a TP of INR1,020.

* We build 23% earnings CAGR over FY25-28, led by 21%/14%/8% sales CAGR in non-US/US/DF segments and 230bp margin expansion. We believe that the current valuation already factors in the earnings upside; hence, we maintain our Neutral stance on the stock

EBITDA grew 32% YoY driven by better operating leverage

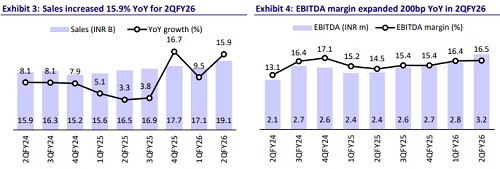

* ALPM sales grew 16% YoY to INR19b (our est: INR18b).

* US generics sales grew 21% YoY (14% YoY in CC) to INR5.7b (USD64m; 30% of sales). Ex-US generic, exports grew 31% YoY to INR3.9b (21% of sales).

* DF sales grew 5% YoY to INR6.4b (33% of sales). API sales rose 15% YoY to INR3.1b (16% of sales).

* Gross margin contracted 100bp YoY to 73%.

* EBITDA margin expanded 200bp YoY to 16.5% (in line), led by low employee expenses (-90bp YoY as % of sales) and low other expenses (- 420bp YoY as % of sales), partly offset by high R&D expenses (+200bp YoY as % of sales).

* Consequently, EBITDA grew 32% YoY to INR3.2b (our est: INR3.0b).

* Adj. PAT rose 20.4% YoY to INR1.7b (in-line).

* For 1HFY26, revenue/EBITDA/PAT grew 13%/25%/18% YoY to INR36b/ INR6b/INR3.2b

Key highlights from the management commentary

* ALPM intends to achieve 18-20% EBITDA margin over the next two years.

* While there was strong YoY growth in non-US segment in 2QFY26, ALPM indicated 15-20% YoY growth for FY26 in this segment.

* DF business was impacted by the transition to a lower GST rate. ALPM hopes to recoup growth to some extent in the coming quarter.

* A low base and improved demand led to healthy YoY growth in API segment. ALPM expects 10% YoY growth in this segment in FY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

Ltd ( 1 ).jpg)