Healthcare Sector Update : 9% growth on a low base by JM Financial Services

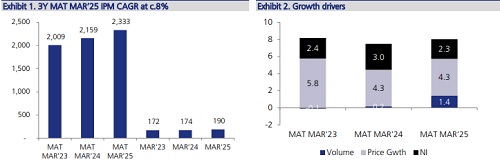

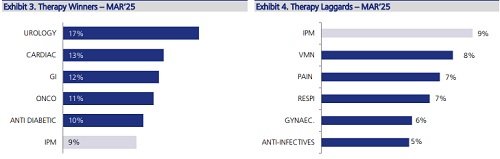

IPM grew by ~9% YoY in Mar’25 (up from ~4% in Feb’25), on a low base (Mar'24 growth was +1.4%). It grew 8% YoY based on MAT Mar’25, driven by 4% price, ~1% volume and 2% NI growth. In Mar’25, both acute and chronic growth recovered vs. Feb'25 levels. Chronic segment grew 11% YoY while acute growth came in at 8% YoY. Therapy outperformers during the month were Urology (+17%), Cardiac (+13%) and GI (+12%). Top performers in the listed universe were JBCP (+17%), CIPLA (+16%), FDC (+15%) and IPCA (+14%). In our coverage, DRRD and LPC were the only underperformers due to slow growth/decline in key brands Voveran and Omez for DRRD and Budanate, Tonact and Signoflam for LPC. We expect IPM volume growth to pick up gradually in FY26 on a low base of FY25, which was affected by low traction in acute therapies led by soft season.

* JBCP, CIPLA - top coverage performers: For the month of Mar'25, top performers from our coverage were JBCP and CIPLA delivering 17%/16% YoY growth respectively. IPCA, SUNP, ZYDUSLIF and TRP too outperformed while LPC and DRRD underperformed the IPM due to weak performance of top brands - Voveran/Omez for DRRD and Budamate/Tonact/Signoflam for LPC. Sun retained its top spot with ~8% market share (ms) and TRP, GSK and JBCP have improved their rank by 1 each to 7th, 13th and 22nd respectively. We expect chronic-focused players to continue to deliver double-digit growth. Indian companies registered 9% growth during the month while MNC’s grew 10.4%.

* Volume growth at ~1% in MAT Mar’25: IPM growth of 8% based on MAT Mar’25 was driven by price growth of 4%, NI growth of 2% and volume growth of 1.4%. Unit growth in Mar’25 picked up MoM to 2.5%. Among large listed companies, CIPLA led the way reporting 8%unit growth this month. Overall, we expect high single-digit growth for IPM in FY25 driven by price growth of 4-5%, NI of 2-3% and volume growth of 1%.

* Urology, Cardiac outperform: Urology and Cardiac which grew 17%/13% respectively were the fasterst growing in Mar'25. Within these therapies, the fastest growing subgroups were Tamsulosin (+29% YoY), Dutasteride+Tamsulosin (+27% YoY) in Urology and Sacubitril + Valsartan (+27% YoY) in Cardiac. Chronic and Acute therapies reported 11%/8% YoY growth respectively during the month. Underperformers during the month remained Anti-infectives, Gynaec and Respiratory. In the Anti-diabetic segment, SUNP, Abbott reported 19.4%/9.5% growth YoY. Ipca has consistently outperformed market growth in the Pain segment led by the Zerodol franchise. Derma growth picked up MoM delivering 8.4% YoY in Mar‘25, DRRD grew slower than the IPM within the therapy despite strong performance by Venusia (+14% YoY). While Cardiac has grown ahead of IPM, SUNP continues to underperform in this segment.

* Mar’25 Top brands’ performance: In Mar'25, Electral continued its strong growth trajectory of 41% YoY. Rybelsus (semaglutide) continued to scale-up with 55% growth. Cipla’s top 10 brands reported 15% YoY growth – Foracort (regained No. 1 position in the IPM) recorded 10% growth for the month. Zydus’ Lipaglyn maintained double-digit trajectoryof 96%. IPCA’s Zerodol franchise continued its growth, led by Zerodol-SP and Zerodol-TH which grew 10%/15% YoY. GLXO’s top brand Augmentin declined 8% YoY, with other key top brands, viz. Calpol, T-bact and Betnovate-C, reporting -6%/+9%/11% growth respectively. JB Pharma’s Azmarda registered robust growth of 64% YoY and DRRD’s Cidmus grew 2%. Sun’s growth was driven by steady performance of smaller brands. Sanofi’s Lantus declined 7% YoY (Toujeou grew +6%YoY).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

Tag News

Capital Goods Sector Update : Assessing Middle East risk exposure in light of US-Iran war b...