Defence & Aerospace Sector Update : Private sector outpaces DPSUs; Structural growth intact By Choice Broking

Geopolitical headwinds weigh on DPSU; private sector resilient

The Q1FY26 earnings season for India’s defence sector companies under our coverage delivered a mixed performance in Q1FY26, with DPSUs reporting moderate YoY growth but facing sharp sequential (QoQ) decline. Whereas, private sector peers demonstrated a stronger YoY momentum, albeit on a smaller base. The overall sector posted 9.9% YoY revenue growth to INR 1,05,719 Mn, while EBITDA rose 32.2% YoY, expanding margin by 423 bps to 25.2%.

DPSUs, such as HAL, BEL and BDL contributed the bulk of sector revenue, at ~90% of the total, clocking INR 95,066 Mn in Q1FY26, up 8.2% YoY. EBITDA surged 31.2% YoY, with margin improving to 26.0% (+456 bps YoY). on better cost-efficiency and operating leverage. PAT stood at INR 23,525 Mn (+5.7% YoY), reflecting a steady performance from HAL and BEL.

Private sector players (Data Patterns, DCX Systems, Astra Microwave, Centum, Apollo and Azad) delivered robust YoY growth, with revenue rising 27.9% YoY to INR 10,653 Mn. EBITDA margin expanded 219 bps YoY to 17.5%, supported by higher contribution from system integration and component exports. PAT surged 50.9% YoY to INR 975 Mn, underscoring scalability and rising order execution.

Defence manufacturing: A trillion-rupee arsenal in the making

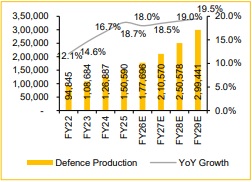

India’s defence sector is at an inflection point, poised for a structural growth cycle. We see production nearly tripling, from INR 94,845 Cr in FY22 to ~INR 3 lakh Cr by FY29E (18% CAGR), driven by aggressive indigenisation, supportive procurement policies and growing privatesector integration. We believe private players’ ~23% share would rise significantly as system integration & advanced tech solutions scale up.

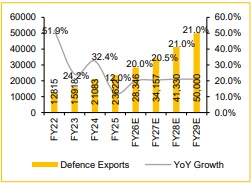

Exports are emerging as a key lever, likely crossing INR 50,000 Cr by FY29E, cementing India’s position as a credible global supplier. Partnerships with global OEMs and rising trust in indigenous platforms— ranging from AI-enabled drones to naval systems—add further conviction. With a sustained capex cycle, PSU-private collaboration and tech-led differentiation, India’s defence sector offers one of the most compelling multi-year growth opportunities in manufacturing.

Defence Production to expand ~18% CAGR over FY22-29E (INR Cr)

Defence export to expand 20.6% CAGR over FY25-29E (INR Cr)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

Consumer Durables & Apparel Sector Update : Durables/footwear?implications of a potential GS...