Oil & Gas Sector Update : Crude Compass - Weekly Oil Market Dossier 07 Nov 2025 by Choice Institutional Equities

In our opinion:

* It’s no longer the just about market share; it’s about sustainable production, now. As observed previously in 2014, wherein the oil price corrected significantly as OPEC massively increased the oil production to push the competition out of the supply landscape.

* The planned pause in output hike by OPEC+ may not only support oil prices but will ultimately aid Saudi Arabia’s fiscal budget. The (Jan–March 2026) pause underlines the estimated flat or bearish demand for Q1CY26.

* Meanwhile, US producers continue drilling even at lower oil prices. We anticipate non-OPEC producers will further expand their market share. However, after March 2026 – when seasonal demand typically recovers – there may be a sharper output increase from OPEC+ compared to modest 137 kbd hike announced for December 2025.

In such a scenario of lower demand in 2026 alongside rising supply from both, OPEC and non-OPEC, producers, oil prices may remain subdued for an extended period. In our view, this situation is likely to continue, benefiting Indian refiners, supporting year-on-year margin expansion, at least through Q1FY27.

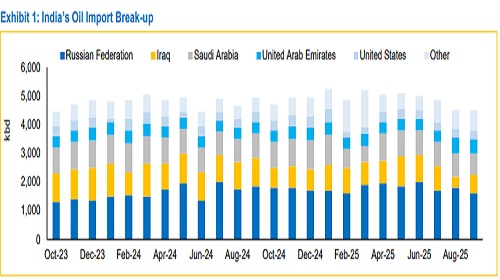

In the near term, Indian refiners are stepping up sourcing of Middle-Eastern crude ahead of the November 21, 2025 deadline to wind down purchases of Russian crude. Although recent crude purchases by Indian refiners are at premiums to Brent, unlike Urals which trade at a discount, overall crude prices are down ~15% YoY. As a result, profitability is expected to remain robust for refiners in Q3FY26.

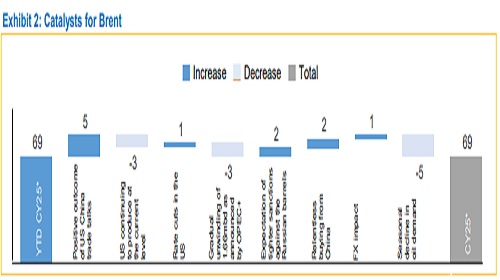

We maintain our Brent estimate of USD69.0/barrel (b) for the Calendar Year 2025 (as published on June 13th, 2025), as compared to YTD average of USD 69.0/b. We estimate the Brent to average at USD65.0/b in CY26.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131