Cement Sector Update : Ear to ground Muted trade pain ; deeper non-trade stress - By JM Financial Services

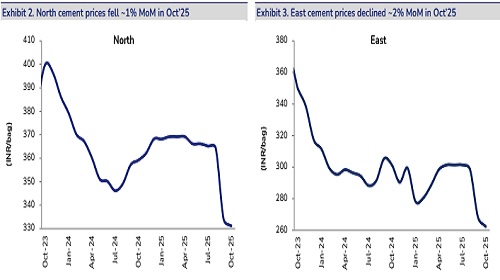

Our channel checks indicate that pan-India average cement prices declined ~1.5% MoM (up ~1% YoY, adjusted for GST rate cut) to INR 339/bag in Oct’25. Regionally, prices fell ~2% MoM in the East and the South, while other regions reported a ~1% decline. While trade segment prices witnessed only minor corrections across regions, the non-trade segment saw a sharper decline of INR 15–20/bag, widening the gap between trade and non-trade prices. On the demand front, industry volumes are likely to have been flat to marginally positive YoY in Oct’25, despite a favourable base. Construction activity was disrupted by prolonged rainfall, the arrival of cyclone Montha, regional festivities (Diwali, Chhath, Durga Puja), and labour unavailability across key regions. In general, the industry has seen a sequential recovery in profitability in 3Q (~INR 150– 200/tn), but this time the recovery appears challenging (likely below the historical range), given lower cement prices, rising input costs, and a gradual demand recovery. In the near term, cement price hike can be challenging given GST surveillance and anti-profiteering concerns. Any recovery in cement prices (especially in non-trade) will be a key monitorable over the coming months. Our top picks are UltraTech in largecaps and JK Cement in mid-caps.

* Pan-India cement prices decline~1.5% MoM; sharper correction in non-trade segment: Our channel checks indicate that pan-India average cement prices declined ~1.5% MoM (up ~1% YoY, adjusted for the GST rate cut) to INR 339/bag in Oct’25. Regionally, prices fell ~2% sequentially in the South and East, while other regions reported a ~1% MoM decline. Notably, the non-trade segment witnessed a sharper correction of INR 15–20/bag, higher than the modest decline seen in the trade segment, resulting in a further widening of the trade–non-trade price gap. In the near term, price hikes may remain challenging due to GST surveillance and antiprofiteering concerns. A sustained recovery in non-trade pricing will be a key monitorable over the coming months.

* Industry demand remains muted in Oct’25; recovery expected post-festive season: Despite a favourable base, persistent heavy rainfall along with regional festivities (Durga puja, Diwali and Chhath), and unavailability of labour continued to disrupt construction activity across several regions. Additionally, with the arrival of cyclone “Montha” over the southeast Bay of Bengal, parts of the South and the East have been significantly impacted. We estimate both regions have likely contracted on YoY basis. With the early exit of the festive season along and gradual improvement in labour availability, we believe construction activities will pick up, thereby supporting volumes in the coming months. Over the medium term, we expect industry volume growth of ~6–7%, supported by the government’s continued focus on infra and housing, alongside improving demand trends in both rural and urban markets and incremental support from GST rate cut.

* Quiet start to 3QFY26: Spot US petcoke CIF and landed prices at Indian ports currently stand at USD 113/tn and USD 129/tn, respectively — about 5% higher than the 2QFY26 average. This is expected to increase input costs by INR 35–40/tn. While the industry has generally seen a sequential profitability recovery in 3Q (typically INR 150–200/tn), the current quarter appears challenging (likely below historical range) due to softer cement prices, rising fuel costs, and a gradual pace of demand recovery.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

Tag News

Capital Goods Sector Update : Assessing Middle East risk exposure in light of US-Iran war b...