Auto Sector Update : Nov 2025 auto sales volume performance by InCred Equities

Autos

Nov 2025 auto sales volume performance

* Nov 2025 volume eased from its festive season peak of Oct, while the low base benefit provided strong growth in 3Ws and tractors. CV turnaround sustains.

* For volume surprise, we prefer Hero MotoCorp, Maruti Suzuki, and Tata Motors CV. Profit drivers are strong for Bajaj Auto, M&M, and Ashok Leyland.

* With Nifty auto sector forward P/E valuation just above the 10-year mean, we maintain Overweight rating. OEMs preferred over auto-component makers.

Nov 2025 sales volume highlights

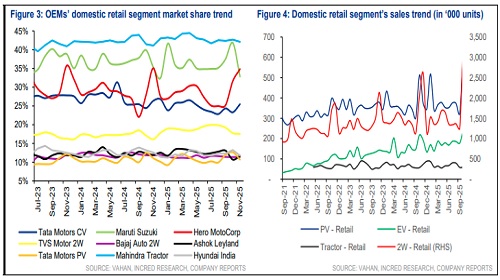

* YoY growth leaders/laggards: Leaders were Hero MotoCorp (+32%), Ashok Leyland (+29%), Tata Motors Commercial Vehicles (+28%), TVS Motor Company (+28%), Tata Motors Passenger Vehicles (+28%), Maruti Suzuki (+26%), and Eicher Motors (+23%). Laggards were Hyundai Motor India (+9%) and Bajaj Auto (+8%).

* MoM growth leaders/laggards: Post-festive season, a decline see across OEMs, with major ones being Escorts Kubota (-44%), Mahindra & Mahindra or M&M (-29%), Eicher Motors (-19%), and Bajaj Auto (+13%).

* Beat vs. our expectations: Ashok Leyland (+15%), Tata Passenger Vehicles (+12%), TVS Motor Company (+8%), and Hero MotoCorp (+6%).

* Miss vs. expectations: Tata Motors Commercial Vehicles (-11%), Hyundai Motor India (-8%), & Eicher Motors (-6%).

* Vahan retail sales: Nov 2025 yoy retail performance was led by tractors (+57%), ahead of cars (+29%) and electric vehicles or EVs (+12%). Two-wheelers or 2Ws, however, saw a 4% decline. MoM trends reflected typical post-festive season moderation across most categories, with tractors being the exception, (+78%). As regards market share, Tata Motors trucks, M&M tractors and Hero MotoCorp 2Ws strengthened their positions, while Maruti Suzuki (cars) lost market share.

Cyclical demand recovery in play; maintain Overweight stance

* After a sharp rally in Nifty Auto Index, post Goods and Services Tax (GST) rate cut in Aug-Sep 2025 (9%), it took a breather in recent months to underperform. The last one month witnessed sharp returns for select stocks like Ashok Leyland (ADD), Bharat Forge (HOLD), Samvardhana Motherson International or SAMIL (ADD), & Apollo Tyres (ADD).

* Nov 2025 volume beat favors our ADD rating on Ashok Leyland and Hero MotoCorp. The volume miss favours our REDUCE rating on Hyundai Motor India.

* We feel macroeconomic stimulus measures like income-tax rate reduction, interest rate cut and Pay Commission salary revision will drive a two-to-three-year demand cycle recovery and therefore we reiterate our Overweight rating for the sector, as forward P/E valuation is just above the 10-year mean level. In the car segment, we prefer Maruti Suzuki, and M&M over Hyundai Motor India. In 2Ws, we prefer Hero MotoCorp and Bajaj Auto over Eicher Motors and TVS Motor Company.

Above views are of the author and not of the website kindly read disclaimer