Automobile and Automobile Ancillaries Sector Update by Choice Broking Ltd

We revise our automobile sector outlook, from Neutral to Positive, given the favourable developments in recent times. In light of these developments, we have re-evaluated estimates and updated our stock recommendations. However, considering the sharp rally in recent weeks, most of the positives are already priced in, leaving limited upside for most of the companies.

What has changed

* GST restructuring set to unlock overall auto demand: On the domestic front, the recently-announced change in GST structure, presents a major opportunity for the automobile sector. Small cars, two-wheeler and threewheeler segments have moved to the lower 18% slab. Also, the rate changed for tractors, from 12% to 5%, and the large car segment to a flat rate of 40%; are positive signs. This reduction is expected to boost demand, which was negatively impacted due to high vehicle prices driven by stricter emission and safety norms. OEM led price hikes also added to the overall cost of ownership, especially for entry-level buyers.

* Rare earth supply chain gets a breather: China has lifted restrictions on the export of rare earth magnets to India, which are crucial for making electric motors used in EVs and advanced auto components. While, this is a positive for the automobile industry providing a short- to mediumterm relief before the festive season, this should be taken with caution given China’s “now-you-get-it, now-you-don’t” policy. Over a longer term, the OEMs and government should focus on creating a robust supply chain by developing alternative sources and technologies.

* Diversified trade strategy could cushion auto sector from US tariff volatility: While US tariffs continue to present challenges, India is actively exploring alternative opportunities through trade diversification and improved foreign relations. The ongoing conversation on the India-UK Free Trade Agreement (FTA) represents a strategic opportunity; India seeks to expand its market access and strengthen ties with the UK. Additionally, India has observed incremental improvements with China, particularly since border disengagement efforts began in late 2024. These developments aim to foster more stable bilateral ties and open up channels for expanded trade which could benefit key domestic industries, at least on the supply chain side.

* Favourable rural tailwinds and government capex to drive 2W, tractor and CV demand: Government-driven capital expenditure is expected to support long-term demand for CVs after monsoons. At the same time, a strong monsoon and higher kharif sowing are anticipated to boost rural income, which bodes well for 2W and tractor demand.

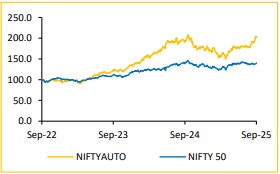

Rebased Price Chart

Impact of GST rate rationalization

What has happened

The government’s recent GST rate cut for the auto sector, effective September 22, 2025, marks a transformative boost for automotive demand and profitability in the industry.

Key Changes:

* Motorcycles of engine capacity exceeding 350cc: GST has increased, from 28% to 40%.

* Motorcycles with engine capacity under 350cc: Now taxed at 18% (reduced from 28%).

* Small cars: GST slashed from 28% to 18%.

* Cars over 4m length, above 1200cc for petrol and above 1500cc for diesel: GST has increased, from 28% (total tax including cess of 43– 50%) to 40% without cess.

* Three-wheelers: GST has reduced, from 28% to 18%.

* Trucks and buses: GST has been cut down to 18% (from 28%).

* All auto parts: All auto parts, regardless of type or HS code, are taxed at 18%.

* Tractors: GST reduced, from 12% to 5%.

* EVs: GST for all segments retained at 5%.

Our View:

* Implementation of the new rates on September 22, the first day of Navratri, addresses previous concerns regarding a possibly damp festive season.

* The increase of GST on large cars is a positive at 40% rate due to the removal of compensation cess (earlier the total tax including cess was 43–50%).

* PVs: The change in GST for the small car segment is positive for MSIL, as the company is the largest manufacturer of small cars. MM is also a major beneficiary, with all the changes being positive for the company (Passenger vehicles, Tractors and Commercial vehicles).

* 2Ws/3Ws: TVSL, BJAUT, HMCL are set to gain from GST reduction for 2Ws, while TVSL and BJAUT will also benefit from the reduction in rate for the 3W segment. EIM will benefit from the rate changes for the less than 350cc motorcycles (90% of domestic sales/81% of total sales), while, the rate change to 40% for above 350cc motorcycles (10% of domestic sales sales/6% of total sales) will be a small negative for EIM.

* CVs: The reduction in GST for trucks and buses is a positive for AL as a pure-play CV player.

* Auto ancillaries: Changes in GST boosting the auto sector are likely to increase vehicle sales and production. This growth will drive higher demand for auto parts and components, positively impacting ancillary companies in the industry.

* Concern for dealers: While these GST reforms reduced prices of vehicles, the dealers are feared to face a loss due to the discontinuation of compensation cess from September 22, 2025. Dealers with old stock bought at higher cess rates lack clarity on the refund mechanism, causing working capital stress.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131