Pharma Sector Update : Indian Pharma in Focus: Assessing Risks and Opportunities Amid US Tariffs by Choice Broking Ltd

Branded Pharma Faces Tariff Pressure, Generics Safe

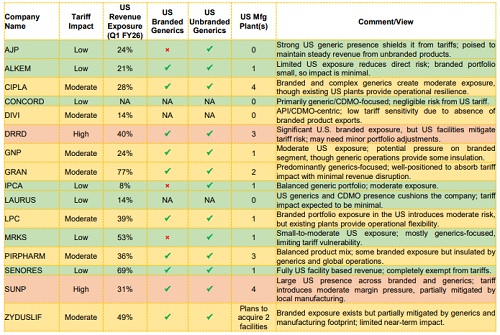

With the US imposing a 100% tariff on imported branded and patented drugs, Indian exporters of branded generics face strategic recalibration. We believe pure-play generic companies such as AJP, ALKEM, GRAN, and MRKS are largely insulated due to their product mix, while firms with both generic and branded portfolios — SUNP, DRRD, CIPLA, ZYDUSLIF, and LPC — face moderate revenue and margin risk, mitigated by existing US manufacturing operations. SENORES, generating all US revenue through its local plant, remains fully exempt and structurally advantaged. Overall, the immediate impact is limited, but companies with significant branded exposure may need to consider US capacity expansion or alternative market diversification (including through inorganic expansions)

What Has Happened?

* US Tariff Escalation Creates a Structural Shift for Branded Exporters The United States has imposed a 100% tariff on imported branded and patented pharmaceutical products effective October 2025, with exemptions only for companies manufacturing locally. Unbranded generics - which dominate India’s export basket - remain outside the immediate scope, but ambiguity persists around complex generics, Biosimilars, and CDMO products. This development forces branded generic exporters to consider either establishing US manufacturing capacity or rerouting sales to alternative geographies.

* China Duty Removal Offers a Counterbalance and Realignment Opportunity China’s recent removal of its 30% import duty on Indian pharmaceutical products presents a timely offset. While the US remains India’s most critical pharma market, the policy divergence between its protectionist stance and China’s accommodative approach is likely to influence capital allocation decisions. Companies with existing flexibility or strategic intent in China — particularly GRAN, CIPLA, and GNP — are positioned to benefit from this policy tailwind.

US Exposure and Tariff Sensitivity Across Coverage Companies

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

Energy Sector Update : Q2FY26 Quarterly Results Preview by Choice Institutional Equities