Insurance Sector Update: Protection takes off by Kotak Institutional Equities

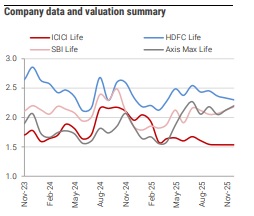

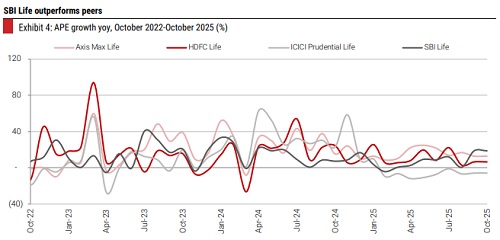

GST exemption and spillovers from previous months have driven a strong month for life companies. LIC, SBI Life and Axis Max Life reported strong APE growth of 18-20% yoy, while HDFC and ICICI Prudential Life reported muted APE growth of 4-7% yoy; LIC was up 20%, with 61% growth in sum assured. Most importantly, sum assured growth was strong at 35% for private players; SA growth momentum has doubled for the top four private players, i.e., about 4.5X APE growth for the month.

Growth in premium picks up in October 2025

Overall APE growth picked up to 17% for industry and 15% for the private sector in October 2025. The pickup was broad-based, with private players (ex-Top 4) reporting 17% yoy APE growth. Surprisingly, Aditya Birla Sun Life, Bajaj Life, HDFC Life and ICICI Prudential Life reported APE growth of <10% yoy during the month.

Mixed trends for listed players

* Axis Max Life reports strong growth. Axis Max Life reported strong 18% APE growth in October 2025 and 18% in YTD2026. Sum assured growth was elevated at 79% during the month, up from 16-38% reported in the previous six months. NoP growth was also strong at 58% yoy in October 2025.

* Bajaj Life reports muted growth. Bajaj Life reported APE growth of 7% in October 2025, similar to 4-9% growth reported in the previous two months. Sum assured growth was also muted at 8%. Growth was largely driven by value (ATS up 6% yoy); NoP was largely flat yoy. The reason for weakness in Bajaj is not clear and will be discussed in the forthcoming earnings call.

* HDFC Life reports muted growth. The company reported muted 7% APE growth in October 2025; individual APE growth was a tad better at 9.4% yoy. Growth was driven by both volume (NoP up 3.5% yoy) and value (ATS up 5.5% yoy) growth. Sum assured growth was strong at 52% yoy, up from 13-34% reported in the previous six months.

* ICICI Prudential’s growth remains muted despite pickup. ICICI Prudential Life reported muted 3% yoy APE growth in October 2025 (down 3.3% in 2QFY26 and 5% in 1QFY26). Sum assured growth also picked up to 23% (3.7% in 2QFY26).

* Sharp uptick in growth for LIC. Individual APE growth picked up to 28% yoy for LIC in October 2025, driven by NoP growth of 126%. Average ticket size was down 43% yoy to Rs21,283 in October 2025. Sum assured growth was also strong at 61% yoy.

* SBI Life sustains momentum. SBI Life reported 20% APE growth in October 2025 and 19% in September 2025, up from 0-12% reported in the previous five months. Growth was largely driven by a pickup in ticket sizes (up 14% yoy); NoP growth was moderate at 5% yoy. Sum assured growth was also strong at 45% yoy.

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137

More News

IT Sector Update : Bharat sovereign AI stack crystallizing by InCred Equities