Buy Vinati Organics Ltd for the Target Rs. 2,100 by Motilal Oswal Financial Services Ltd

Healthy margin expansion and ATBS capacity addition strengthen growth visibility

Earnings in line

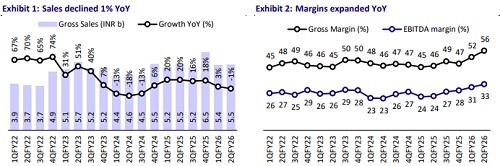

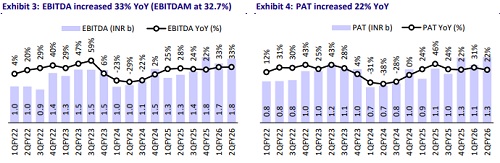

* Vinati Organics (VO) reported a strong operating performance in 2QFY26, as EBITDA surged 33% YoY to INR1.8b. Gross margin expanded to 56.5% from 45.8% in 2QFY25, while EBITDAM expanded 850bp YoY to 32.7%. PAT grew 22% YoY to INR1.3b (est. in line).

* For FY26, VO expects revenue growth across ATBS, Butyl Phenols (BP), and Anti-Oxidants (AO) segments, supported by favorable demand trends and capacity additions. VO has completed the phase 1 expansion of its Acrylamide Tertiary-Butyl Sulfonic Acid (ATBS) production capacity by 10,000mtpa to cater to the growing global demand and reduce order backlogs.

* We largely maintain our earnings estimates for FY26/FY27/FY28. We value VO at 35x FY27E EPS to arrive at a TP of INR2,100. Reiterate BUY rating on VO.

Gross margin expansion drives earnings

* Revenue came in at INR5.4b (est. INR6.3b), down 1% YoY/up 1% QoQ.

* Gross margin stood at 56.5% (vs. 45.8% in 2QFY25 and 52% in 1QFY26).

* EBITDAM came in at 32.7% (+850bp YoY, +210bp QoQ).

* EBITDA stood at ~INR1.8b (est. INR1.7b), up 33% YoY/8% QoQ.

* Adjusted PAT stood at INR1.3b (est. INR1.2b), up 22% YoY/14% QoQ.

* In 1HFY26, revenue/EBITDA/Adj. PAT grew 1%/33%/26% YoY to INR11b/INR3.4b/INR2.4b.

* Cash flow from operations stood at INR4.2b in Sep’25 vs. INR3.1b in sep’24.

* CFO Mr. N. K. Goyal has retired after reaching the age of superannuation, as per company policy. The board has appointed Mr. Gulshan Kr. Sakhuja as CFO (Designate), with effect from 6th Nov’25. Mr. Sakhuja is a Chartered Accountant with professional experience of more than two decades. He has been associated with VO since Dec’24.

Valuation and view

* VOPL has commissioned a plant for MEHQ and Guaiacol, along with other products (Anisole, 4-MAP, Iso Amylene, etc.), to be commercialized in FY26. We expect them to be the key growth drivers for VO going forward.

* VO continues to be one of the largest producers of AOs in India. While Chinese competitors continue to pose a threat to the supply, the long-term outlook for the segment remains positive on the back of a novel AO for lubricant additives, further strengthening of the portfolio.

* We expect growth to be driven by capacity expansion of ATBS by 10,000mtpa, enabling VO to cater to growing global demand and reduce order backlogs.

* We broadly maintain our FY26/FY27/FY28 estimates and expect a CAGR of 21%/35%/33% in revenue/EBITDA/PAT over FY26-28. The stock trades at ~27x FY27E EPS of INR61 and ~19x FY27E EV/EBITDA. We value the stock at 35x FY27E EPS to arrive at a TP of INR2,100. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)