Buy VA Tech Wabag Ltd for the Target Rs. 1,900 by Motilal Oswal Financial Services Ltd

Decent quarter; rich order book supports robust outlook

Revenue/adj. EBITDA/PAT up 19%/17%/20% YoY in 2QFY26

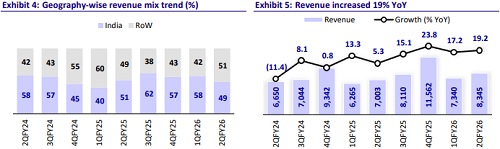

VA Tech Wabag (VATW) reported decent results in 2QFY26 as its revenue/adjusted EBITDA/PAT grew 19%/17%/20% YoY, 2-14% ahead of our estimates. Reported EBITDA declined 5% YoY, with a 10.7% EBITDA margin. However, adjusted to the forex gain of INR312m, which the company considers part of its continuing business, EBITDA margin stood high at 14.4%. In 1H, revenue/adj. EBITDA/PAT grew by a healthy 18%/17%/20% YoY. Adj. EBITDA margin stood at 13.8%, well within its guided range of 13-15%. Net cash position was maintained with INR5.6b at 1H-end (INR6.7b excluding HAM Projects).

~5x book-to-bill ratio supports 15-20% revenue CAGR guidance

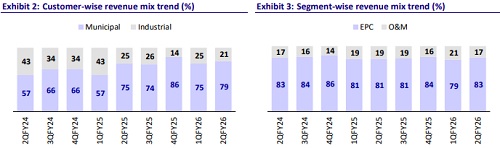

VATW's current order book of over INR160b (4.9x FY25 revenue) provides strong revenue growth visibility for the next 3-4 years. The company secured fresh orders of ~INR35b during 1H and is also a preferred bidder in projects worth over INR30b. Among the major order wins, the company secured new orders in 2Q in the Future Energy Solutions vertical, including UPW/ETP/ZLD system solutions for RenewSys Solar’s Hyderabad cell facility and a compressed bio-gas BOT project in Uttar Pradesh with a 15-year concession. In 1Q, it secured the muchanticipated Yanbu 300 MLD desalination project in Saudi Arabia and the BWSSB DBO project in Bengaluru. The ultra-pure water segment is expected to be an INR35b opportunity for VATW. While the current order book is more inclined toward EPC projects having high volumes and relatively lower margins, the company’s focus remains on profitable growth by selective bidding in highmargin EPC and O&M jobs. India, the Middle East, Africa, and CIS have a huge opportunity in the water sector. VATW’s strength will continue to lie in leveraging technology and tie-ups with local entities. With a strong bid pipeline of INR150-200b, VATW expects to capture orders worth INR60-70b annually. Thus, we expect a revenue CAGR of ~17% over FY25-28 (in line with the company’s guidance of 15-20% CAGR).

Focus remains on profitable growth and cash flows

VATW is tracking well on its guided adj. EBITDA margin range of 13-15% (1HFY26 at 14.4%, ~13.2% in FY24/25) and net-cash status (INR5.6b at 1H-end, INR6.7b excluding HAM Projects). Key margin levers include its healthy order book, execution of large projects (INR25.6b 400 MLD Chennai desalination plant, INR21b 300 MLD Yanbu desalination plant, INR14.2b Al Haer KSA ISTP plant), and greater focus on winning orders in the EP, O&M, industrial, and overseas segments and markets. Bad debt provisioning expenses have declined materially in the last 6-8 years owing to selective bidding in well-funded projects by sovereign funds or multilateral agencies. Since the launch of ‘Wriddhi’ in FY23, the company has already achieved a notable expansion in its EBITDA margin. Going ahead, we expect VATW's EBITDA margin to further expand to 15%, which is in the higher range of its guidance.

Valuation and view: Reiterate BUY

We broadly maintain our earnings estimates after decent 2QFY26 results. After delivering a CAGR of 4%/18%/28% in revenue/EBITDA/PAT over FY21-25, we estimate a CAGR of 17%/22%/23% over FY25-28. VATW's current order book of over INR160b (~4.9x FY25 revenue), preferred bidder in orders worth INR30b, and a strong bid pipeline of INR150-200b provide strong 15-20% revenue growth visibility for the next 3-4 years. Its greater focus on executing large-scale projects in highmargin segments such as EP, Industrial, and O&M augurs well for margins. The outlook for strong FCF generation, a net cash status, and expansion in return ratios makes VATW’s scrip attractive at ~19x FY27E EPS. We, thus, reiterate our BUY rating and a TP of INR1,900, based on 26x FY27E P/E (~+1SD on an improved outlook). (our IC note dated Jul’25)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)