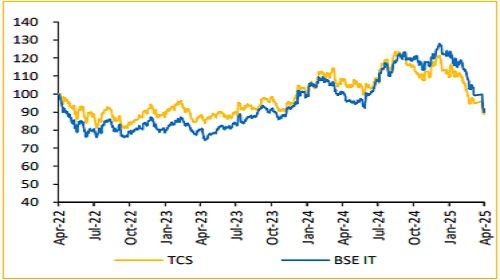

Buy Tata Consultancy Services Ltd For Target Rs. 3,950 By Choice Broking Ltd

TCS misses Q4FY25 estimates by narrow margins.

* Revenue for Q4FY25 came at INR 644.8Bn up 5.3% YoY and 0.8% QoQ (vs Consensus est. at INR 648.4Bn).

* EBIT for Q4FY25 came at INR 156.0Bn, down 2.0% YoY and 0.4% QoQ (vs Consensus est. at INR 161.4Bn). EBIT margin was down 180bps YoY and 28bps QoQ to 24.2% (vs Consensus est. at 24.8%).

* PAT for Q4FY25 came at INR 122.2Bn, down 1.7% YoY and 1.3% QoQ (vs Consensus est. at INR 127.4Bn).

TCS secures USD 12.2Bn in Q4FY25, may face revenue conversion challenges:

In Q4FY25, TCS reported a strong TCV of USD 12.2Bn, it’s secondhighest ever, achieved without any mega deals. This broad-based growth was led by North America (USD 6.8Bn), BFSI (USD 4Bn), and the consumer business (USD 1.7Bn). TCS remains optimistic about FY26 being better than FY25, despite macroeconomic uncertainties. However, we expect that risks persist around converting TCV into sustained revenue, as global economic volatility has caused delays in decision-making and heightened scrutiny on discretionary spending. Sectors like Insurance, Retail, Healthcare, and Auto are seeing pronounced caution. While the FY25 TCV pipeline remains strong at USD 39.4Bn, ongoing uncertainty could delay execution. The deal mix and average tenure remain stable, with AI and GenAI emerging as major growth drivers across IT and business applications. Despite positive momentum and a strong pipeline, the timing of revenue realization may be impacted if economic headwinds continue, posing a risk to near-term growth.

EBITM target unchanged at 26% to 28%; Wage hike decisions expected later in FY26:

TCS saw a contraction in its EBIT margin, which stood at 24.2% in Q4FY25 and 24.3% for FY25. This was due to factors such as wage hikes, promotions, and investments in infrastructure and capabilities. While the long-term margin target remains 26% to 28%, we anticipate that headwinds like economic uncertainty and the absence of currency benefits may affect margins. However, efficiency gains from growth and improved productivity, along with the winding down of the BSNL contract, should support margin improvement in FY26. The attrition rate remained elevated at 13.3%. However, management believes that this should not be a cause for concern. Additionally, TCS added 625 employees in Q4, bringing the total headcount to 607,979 by the end of FY25. The company will continue hiring, especially in digital skills and AI, with wage hike decisions expected later in FY26, depending on market conditions.

View & Valuation:

TCS has surpassed a topline of INR 30Bn and continues to report industry-leading margins. Despite this, there are mixed signals surrounding the company’s future performance. While FY26 performance is expected to be better than FY25, ongoing macroeconomic challenges may introduce delays in client decision-making and discretionary spending, which could impact topline growth. Considering these factors, we expect Revenue/ EBIT/ PAT to grow at a CAGR of 7.2%/ 10.7%/ 10.8%, respectively, over FY25-FY27E and maintain our rating to ‘BUY’ with a downward revised target price of INR3,950, which implies a PE multiple of 24x (maintained) based on the FY27E EPS of 164.6.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131