Buy Yatharth Hospital & Trauma Care Ltd For Target Rs. 640 By Choice Broking Ltd

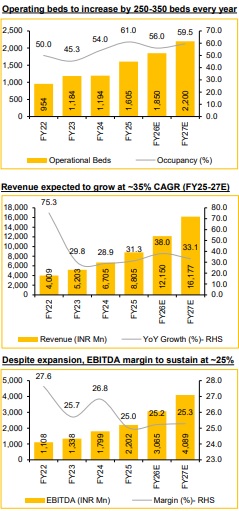

Business Overview: YATHARTH is a leading hospital chain in North India with 7 multi-specialty facilities (2 upcoming facilities in next month) and a strong presence in the Delhi-NCR region. The company has more than doubled its bed capacity postCOVID, from 1,100 in FY21 to 2,300 in FY25, while maintaining a solid occupancy rate of 61% and an ARPOB of INR 31,441 as of Q4FY25. Looking ahead, it aims to expand capacity to ~3,000 beds by FY28E, primarily focused in Delhi-NCR, and drive revenue growth at a ~30% CAGR while sustaining its current EBITDA margin levels at 25%.

Is YATHARTH’s Strategic Bed Expansion Set to Drive Significant Growth in Delhi-NCR?

YATHARTH is on track to surpass 3,000 bed capacity by FY28, driven by a focused capacity expansion strategy that strengthens its footprint in the high-growth Delhi-NCR market. The new hospitals will provide super-specialty services from launch, enabling higher ARPOB and a faster ramp-up period. With EBITDA breakeven anticipated within 12–15 months, this expansion is poised to deliver robust volume growth and improved operating leverage. Two new hospitals with capacities of 400 and 300 beds are expected to be fully operational within 6 months of their respective launches (July’2025). Additionally, brownfield expansions in Greater Noida and Noida Extension will add 250 beds each. We project that, with average occupancy levels exceeding 60%, these expansions will meaningfully enhance topline growth and patient volumes across North India.

Is YATHARTH Set to Benefit from India’s Booming Oncology Market and Medical Tourism Revival?

YATHARTH has experienced headwinds in its international patient revenue segment—contributing approximately 10–12% of total revenue—due to prevailing geopolitical tensions. Despite this, the company remains well-positioned to capitalize on the resurgence of medical tourism, supported by its strategic expansion within the Delhi-NCR region, particularly within a 50-kilometer radius of key international airports. Furthermore, YATHARTH’s focus on high-margin specialties such as oncology, which is well-aligned with rising global demand. Oncology increases ~3x in FY25, contributing 10% to Group’s revenues & ~19% to Noida Ext. revenue. With the Indian oncology market projected to grow at a CAGR of approximately 15% over the next five years, the company is poised to leverage this growth to further strengthen its market position and accelerate revenue expansion.

Why Invest in YATHARTH?

Our analysis suggests that YATHARTH is well-positioned to benefit from the increasing demand for healthcare services in India, underpinned by its strategic expansion initiatives and stable EBITDA margins. The company has demonstrated healthy operational performance, with ARPOB increasing by 16% over the past two years to INR 31,441 in Q4FY25. While this remains below the industry average of INR 50,000–75,000, it highlights meaningful headroom for growth as YATHARTH’s brand visibility and positioning continue to improve. With the stock currently trading at 19x EV/EBITDA, it presents a compelling opportunity for longterm investors seeking exposure to the structural growth in India’s healthcare sector.

Near Term Triggers: Operationalization of Two New Facilities in July 2025: New Delhi (300+ Beds) and Faridabad (400 Beds).

Recommendation: We currently have a ‘BUY’ rating on the stock with a target price of INR 640.

Key Risks:

* Competition: The rise of new or well-established competitors in the healthcare sector could erode market share and reduce patient inflow, impacting the hospital’s growth and sustainability.

* Operational Challenges with Expansion: The planned expansion of bed capacity to 3,000 beds could pose operational challenges.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131