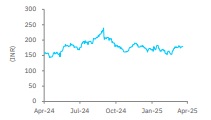

Buy Indian Energy Exchange Ltd For Target Rs. 234 By Elara Capital

Continued volume momentum drives earnings

Indian Energy Exchange (IEX IN) reported an 18% YoY increase in traded electricity volume to 31,747MU in Q4FY25, driven by strong growth across segments — REC trading hit a record 6.8mn (up 108% YoY), DAM rose 14% YoY to 16,931MU, RTM surged 29% YoY to 9,650MU, and the Green Market doubled to 1,925MU. Despite a 9% YoY dip in DAM prices to INR 4.43/unit and an 8% YoY decline in day ahead contingency volumes, topline grew 17% YoY to INR 1.4bn, with PAT up 21% YoY to INR 1.2bn on healthy volume growth. IEX is expanding into new segments, Green RTM, and Carbon Credit trading and is awaiting regulatory approvals for an 11-month contract (40bn unit potential), which should boost volumes. Reiterate Buy with TP raised to INR 234 (from INR 220).

Traded volume rose 18% YoY in Q4FY25: IEX reported an 18% YoY growth in electricity traded volume in Q4FY25 to 31,747MU. IEX recorded the highest quarterly trade of renewable energy certificate (REC) in Q4FY25. A total of 6.8mn of REC’s were traded in the quarter, marking a 108% YoY rise. In Q4FY25, market clearing price(MCP) in the day ahead market(DAM) was INR 4.43/unit, down 9% YoY. The DAM segment registered 16,931MU in Q4FY25, as compared with 14,916MU in Q4FY24, up 14% YoY. The real time market (RTM) segment registered 9,650MU in Q4FY25 as compared with 7,505MU in Q4FY24, up 29% YoY. The total volume on term ahead market (TAM) in Q4FY25 was 3,241MU, down 8% versus Q4FY24 level. In Q4FY25, the green market segment achieved a volume of 1,925MU, a rise of 100% versus Q4FY24 level.

Topline increased 17% YoY, bottomline up by 21% YoY: Revenue increased 17% YoY to INR 1.4bn, driven by healthy volume growth. Employee expenses increased 11% YoY to INR 114mn. EBITDA increased 16% YoY to INR 1.2bn. Other income rose 16% YoY to INR 323mn. PAT increased 21% YoY to INR 1.2bn.

Foray into new product segments to drive volume: IEX is broadening its product offerings, with regulatory approvals awaited for new products. It is awaiting approval for its 11 month long duration contract, which can unlock substantial volumes, with an estimated 40bn units of market potential. It has filed a petition with Central Electricity Regulatory Commission (CERC) to launch green RTM. CERC has issued draft procedures for trading Carbon Credit Certificates, for both obligated as well as non-obligated entities through power exchanges. This should result in trading of Carbon Credit Certificates on IEX, in the near future

Reiterate Buy with TP raised to INR 234: We retain our positive outlook on IEX, given the rise in short-term power market share in India along with an increase in the market share of power exchanges. Also, IGX and the upcoming Carbon Credit Exchange offer an edge to investors. We introduce FY28E and expect an earnings CAGR of 18% in FY25-28E. We reiterate Buy with a higher DCF-TP at INR 234 (from INR 220) on improved earnings growth and robust trading volume.

Please refer disclaimer at Report

SEBI Registration number is INH000000933