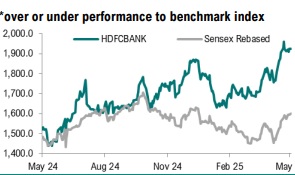

Buy HDFC Bank Limited for Target Rs. 2,192 by Geojit Financial Services Ltd

Poised for Steady Growth

Incorporated in August 1994, HDFC Bank provides a range of financial services including corporate and retail banking, custodial services, treasury and capital markets, project advisory services, and capital market products.

• In Q4FY25, HDFC Bank saw a notable 9.2% YoY increase in interest income to Rs. 86,779cr. The growth was primarily fuelled by a significant rise in interest generated from lending activities that was up 4.8% YoY and substantial increases in investment-related income (+23.5% YoY) and other banking funds (+49.5% YoY).

• Net interest income (NII) rose 11.3% YoY to Rs. 39,793cr driven by strong loan growth. Net interest margin (NIM) was stable at 3.54%.

• Pre-provisioning operating profit fell 6.9% YoY to Rs. 29,379cr, primarily due to a 25.5% YoY decline in other income. Nevertheless, the bank's operational efficiency showed improvement, with a 10.6% drop in operating expenses and cost-toincome ratio improving to 39.8% (down 150bps YoY).

• Reported profit after tax (PAT) ultimately rose 6.9% YoY to Rs. 18,835cr, driven by a substantial 72.4% YoY reduction in provisions, which was largely attributed to the improvement in asset quality.

Outlook & Valuation

Going forward, HDFC Bank is well-positioned to capitalise on improving liquidity conditions, robust capital foundation, vast network and enhanced technological capabilities to drive strong loan expansion. Moreover, favourable asset composition, improvement in borrowing mix and lower funding costs should continue to support margins over the coming years. Asset quality has remained steady, with the proportion of NPA not expected to increase significantly in the future. With an efficient operating model and a robust provisioning coverage underpinned by highquality assets, the bank is poised for sustained growth. Therefore, we reiterate our BUY rating on the stock, based on 2.6x FY27E BVPS, with a revised target price of Rs. 2,192.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345