Buy PI Industries Ltd for the Target Rs. 4,300 by Motilal Oswal Financial Services Ltd

Weak CSM business drags performance

Earnings above estimates, driven by higher gross margin

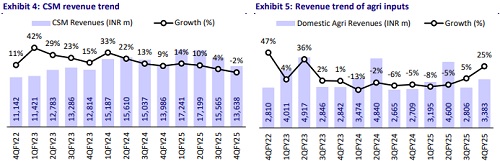

* PI Industries (PI) reported muted revenue growth in 4QFY25 (up 3% YoY), due to a decline in CSM (down 2%; mix 76%), while the domestic agrochem business witnessed strong traction (up 25% YoY; 19% mix). Pharma revenue was up 19% YoY (Mix 5%) while reported EBITDA loss of ~INR1.8-1.9b. Consol. EBITDA margin remained stable, led by a favorable product mix and tight overhead management.

* FY25 remained a challenging year due to macro headwinds, which are likely to persist in 1HFY26, with a gradual recovery expected in 2H. However, a strong development pipeline (90+ molecules are currently in the active pipeline with over 45% in advanced stages of development) should support double-digit growth over the medium to long term.

* Factoring in a weak 4Q performance and lower guidance for FY26, we cut our FY26/FY27 earnings estimates by 8%/5%. However, PI maintained its double-digit growth guidance for the long term. We reiterate our BUY rating with a TP of INR4,300 (premised on 33x FY27E EPS).

Margins continue to remain stable despite macroeconomic headwinds

* PI’s consolidated revenue stood at INR17.9b (est. in line), up 2.6% YoY.

* EBITDA stood at INR4.5b (est. INR4.3b), up 3% YoY. EBITDA margins marginally expanded 10bp YoY to 25.5% (est. 24.4%). Gross margins came in at 55.1% (up 120bp YoY). Employee expenses rose 80bp YoY to 11%. Other expenses increased 30bp YoY to 18.5% of sales. Adjusted PAT was down 11% YoY at INR3.3b (est. INR3.1b).

* Agrochemical (CSM Export and Domestic Agrochem) revenue stood at INR17b (up 2% YoY), EBIT increased 10.8% YoY to INR5.3b, and EBIT margin came in at ~29.3% (up 230bp YoY), led by better product mix.

* Export (CSM) revenue declined 2% to INR13.6b, while the new products experienced a growth of ~31% YoY. Domestic agrochem revenue grew 25% YoY to INR3.4b.

* Pharma revenue stood at INR850m (~6% of total export revenue), up 19%/ 33% YoY/QoQ.

* CFO stood at INR14b in FY25 (vs. INR20.2b in FY24). Net working capital days increased to 73 days as of Mar’25 from 54 days as of Mar’24.

* In FY25, revenue/EBITDA/adj. PAT increased 4%/8% to INR79.7b/ INR21.7b, while adj. PAT declined 1% YoY to INR16.6b.

Highlights from the management commentary

* Guidance: Management guided mid-single-digit revenue growth in FY26 as the overall industry faces near-term macro challenges, including extreme climates, geopolitical issues, and pricing pressures. The company aims to increase its current volume levels, with demand expected to improve in 2HFY26. EBITDA margins to be ~25% in FY26.

* Pharma: PI targets pharma CRDMO revenue to be 3x over the next 3-4 years, with improved order book visibility supported by a robust pipeline, good traction of new CRDMO inquiries, and the aim of onboarding new pharma clients.

* Capex and tax rate: Capex in FY26 is expected to remain in line with FY25 levels, i.e., in the range of INR8-9b, with PI strategically directing investments towards new product development. The effective tax rate would be ~23% for FY26.

Valuation and view

* PI’s growth trajectory remained muted in this quarter due to macro headwinds, and near-term challenges (1HFY26) are likely to persist. However, 2H is likely to see an improving demand scenario resulting in both volume and pricing growth.

* The company’s medium-to-long-term growth will be led by: 1) continued stable growth momentum in the CSM business due to the rising pace of commercialization of new molecules, 2) a strong domestic market, and 3) rampup of the pharma segment.

* We expect a CAGR of 12%/10%/9% in revenue/EBITDA/adj. PAT over FY25-27. We reiterate BUY with a TP of INR4,300 (premised on 33x on FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412