Buy Persistent Systems Ltd For Target Rs. 6,720 By Emkay Global Financial Services Ltd

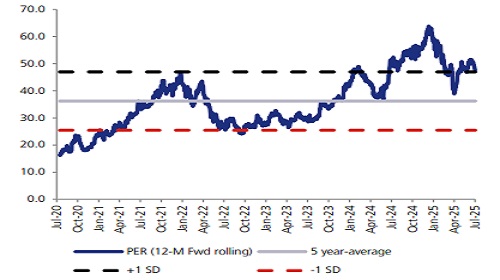

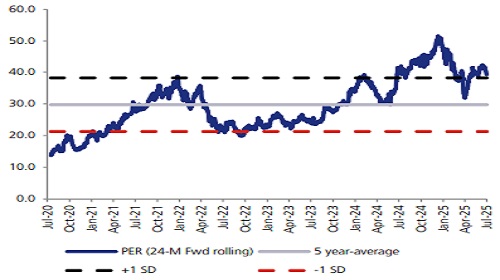

PSYS’ 3.3% cc QoQ growth, albeit below estimates (JMFe: 4%), was still creditable given the current macro. Sequential growth also belies a still strong YoY growth of 18.8%. If one were to nit-pick, higher contribution from license sale (38% QoQ) means services growth was softer at 2.5% QoQ (USD terms), fuelling concerns of slowdown. LTM TCV growth - 13% YoY - stayed below revenue growth, another investors’ argument against sustainability of growth momentum. One should however note that LTM book-to-bill is still healthy at 1.47x. Slowdown in top healthcare account, a key growth driver over past few quarters, may further compound worries. That said, PSYS’ strength has been to balance growth across portfolio of accounts. Double digit growth in top 6-10/11-20 client buckets underscores the point. We are therefore not flustered with client specific slowdown. Though we acknowledge that pickup in deal wins is needed to build confidence on FY27 growth outlook. PSYS’ head-start in AI-led platform approach puts it in a good stead. Out of prudence, we lower our FY26/27E USD growth to 16%/16% (from 18%/17%), driving 0-2% EPS cuts. PSYS’ multiples (42x FY27E) leaves limited scope of disappointment. That could weigh on near-term performance. We would advise buy on dips. Retain BUY with INR 6,720 TP.

* 1QFY26 – good but not great: PSYS reported 3.3% cc QoQ growth, missing JMFe: 4%. BFSI (+9% QoQ; USD terms) and Hi-tech (+3.6%) picked-up even as Healthcare & Life Sciences (-1.9%) declined due to offshore transitions in large accounts. Interestingly, growth was still led by top-accounts with top 6-10/11-20 cohorts growing 11.5%/13.5% QoQ in USD terms. EBIT margin declined 10bps to 15.5%, missing JMFe: 16.0%. Delayed ramp-ups and offshore transitions (-100bps), absence of earn-out reversal (-60bps), amortization (-40bps) and FX (-40bps) were headwinds to margins, while lower ESOP costs (+230bps) aided margins. PAT came in at INR 4,249mn (+7.4% QoQ), a slight miss from expectations (JMFe: INR 4,364mn).

* Deal wins and outlook: TCV/ACV for the quarter grew by 12.5%/14.2% YoY. Book-tobill of 1.34x, though still healthy, was at eight quarter low. ACV/TCV ratio increased to 74% (+110bps YoY). Management flagged elongated decision cycles in healthcare and parts of BFSI. While BFSI continues to anchor growth, Hi-tech and software vertical expected to remain stable, and Healthcare expected to rebound post transition. Client discussions remain active across platform-led programs, with SASVA and GenAI gaining traction. For now, the company reiterated USD 2bn revenue aspiration by FY27-end and 200-300bps margin expansion target, to be supported by pricing levers, platform productivity, and SG&A optimization. Wage hikes were deffered by a quarter, indicating a still soft supply-side and sustained margin pressure, much like the rest of the peer group.

* Lower EPS by 0-2%; Retain BUY: We still expect PSYS to reach its stated goal of USD 2bn run-rate by 4QFY27, but build a slightly gradual slope to reach there. We build 3.7% CQGR now (vs 4.1% earlier). As a result, our FY26/27E USD growth is now 16% each. Our margin assumptions are broadly intact, as we sense that management wants to strike a better growth-margin balance going ahead, prudent in current macro. BUY stays.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361