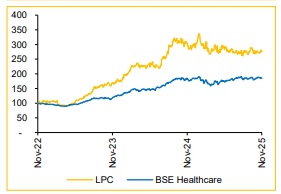

Buy Lupin Ltd For Target Rs. 2,375 By Choice Institutional Equities

Execution Strength Intact; High-value Launches support Growth in FY26

We continue to believe LPC will sustain its strong growth trajectory, led by high-value launches in North America and India. The company has demonstrated strong execution in scaling up new products, such as Tolvaptan, Mirabegron, Albuterol and gSpiriva, reinforcing confidence in its differentiated pipeline. Management has revised EBITDA margin guidance upwards to 25–26% (from 24–25%) for FY26E, supported by a lower mix of in-licensed products in India. While margin may contract ~100bps in FY27E due to planned higher R&D spend, we expect normalisation as newer complex launches ramp up. We forecast revenue/EBITDA/PAT to grow at a CAGR of 12%/15%/12% over FY25–28E and continue to value the stock at 25x the average of FY27–28E EPS, arriving at an unchanged TP of INR 2,375. We maintain our BUY rating.

Strong all-round Performance with Robust Margin Expansion

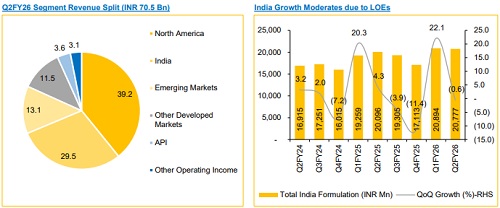

* Revenue grew 24.2% YoY / 12.4% QoQ to INR 70,475 Mn (vs. CIE estimate: INR 64,109 Mn).

* EBITDA grew 74.7% YoY / 35.5% QoQ to INR 23,413 Mn (vs. CIE estimate: INR 17,468 Mn); margin expanded 959 bps YoY / 567 bps QoQ to 33.2% (vs. CIE estimate: 27.2%).

* APAT increased 73.3% YoY / 21.2% QoQ to INR 14,779 Mn (vs. CIE estimate: INR 11,655 Mn).

US to Continue Double-digit Growth, Supported by New Launches

North America delivered another quarter of strong growth, led by Tolvaptan (180- day exclusivity), market share gains in Mirabegron and traction from complex launches. While Tolvaptan exclusivity will expire soon, we expect North America to remain the key growth engine. Upcoming launches, such as Risperdal Consta (first Indian company to receive approval) and Pegfilgrastim are wellpositioned to offset the exclusivity loss, with additional entries planned in biosimilars and respiratory segments. VISUfarma integration further strengthens the ophthalmology pipeline for the US. Overall, we expect North America to sustain double-digit growth.

India to Recover from H2; LOE Impact Offset by Strong Launch Pipeline

India growth was moderate in Q2, weighed down by loss of exclusivity (LOE) in two large diabetes brands. However, H2 is expected to recover, aided by a strong pipeline across respiratory, cardiac, GI and CNS therapies. The management remains confident of being in the first wave of Semaglutide launch. Lower contribution from in-licensed products (~6% of India revenue vs. 12% FY25) is structurally positive, improving gross margin. With over 80 planned launches in India over the medium term, we maintain our view that the company would continue to outperform IPM by ~1.2x.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131