Buy ICICI Prudential Life Insurance Ltd For Target Rs. 290 By JM Financial Services

Margins stable, all eyes on 2H growth

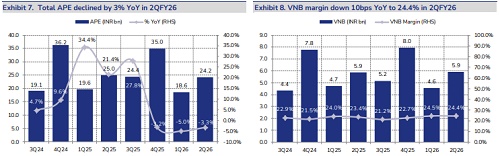

ICICI Prudential Life Insurance reported in line results, with a VNB of INR 2.4bn in 2Q, in line JMFe, +1% YoY. 2Q margins came in strong at 24.4%, flattish QoQ, +100bps YoY. The VNB includes the impact of loss of ITC benefits following GST 2.0. Going forward, the company expects stronger growth with GST 2.0 making products attractive, an uptick in ULIPs and a weaker base to grow on, starting from Dec’25. The insurer has disappointed on growth so far, with agency channel APE contracting 21% YoY and direct channel contracting 9% in 2Q. We cut our FY26e VNB estimate by 1% (with a 2% cut in individual APE growth). We believe IPRU will return to growth in latter half of 3Q, and believe current valuations offer a good entry point. We value IPRU at 1.7x FY27e EVPS (against 1.8x earlier) of INR 431 to get a target price of INR 730 (down from INR 760). We reiterate BUY.

* While APE contracted 3% YoY, expect strong growth in 2H: The insurer saw a 33% growth in individual APE in 1HFY25, after which growth fell to 2%/-8% in 2HFY25/1HFY26. We cut our FY26e growth in individual APE by 2pps to 9% YoY – this implies a 22% growth in 2H and a 11% growth on a two-year CAGR, against 10% in 1H. Growth in group APE has been strong at 20% in 1H, following a 46% growth in 2HFY26 – we expect this to normalise further to 11% in 2H. This decline in growth should come in with improving margins, as credit life picks up, with an improving macro in micro-finance lending.

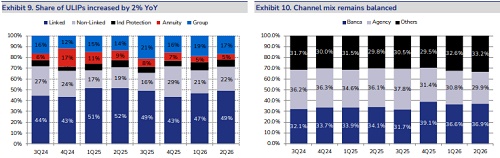

* VNB grows 1% after a 3% decline in 1Q, despite a 3% contraction in total APE: VNB margins of 24.4% in 2Q were 40bps ahead of JMFe. This was led by a growth of 12% in non-linked savings, alongside a shift to non-par from par, and improving rider attachment and higher Sum Assured on the ULIPs. Within non-linked savings, non-par share improved from 1/3rd to a half, which along with the 12% growth in non-linked business, implies a 60%+ growth. Other than this, product mix was weak, with a contraction in annuity (-47% YoY) and an expansion in group savings (+88%). While individual protection (+2%) and group protection (-2%) were weak, protection segment performed better than company-level growth. Despite the impact of GST 2.0, we raise our margin estimate moderately to 24.3% for FY26e.

* Valuations and view – expect rerating with a return to APE growth: At CMP, the stock trades at inexpensive valuations of 1.6x/1.4x FY26e/FY27e EV, implying 13/11x FY26/FY27e EVOP. The stock trades at a significant discount to HDFC Life and SBI Life and trades >1 SD below its mean valuations since listing. We cut our VNB estimates by 1% for FY26e and target price to INR 730. We remain positive on the stock with an expected growth uptick towards and steady VNB margins. We reiterate BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

Tag News

Liberty General Insurance launches `Liberty Assure?, a value-driven add-on cover to enhance ...