Buy Life Insurance Corporation Ltd for the Target Rs. 1,080 by Motilal Oswal Financial Services Ltd

Strong growth in VNB; VNB margin expands 140bp YoY

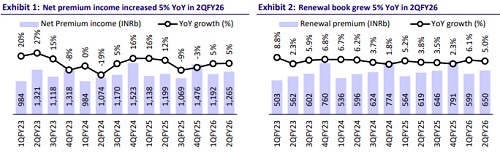

* In 2QFY26, LIC reported net premium income of INR1.3t (in line), which grew 5% YoY. Renewal premium grew 5% YoY to INR650b and single premium grew 8% YoY to INR508b. First year premium declined 3% YoY to INR108b.

* New business APE declined 1% YoY to INR164b (in line), with individual APE declining 11% YoY to INR101b and group APE rising 24% YoY to INR62.7b. For 1HFY26, APE grew 4% YoY to INR290.3b.

* Absolute VNB grew 8% YoY to INR32b (16% beat). VNB margin expanded YoY to 19.3% from 17.9% in 2QFY25 (vs our expectation of 17%). For 1HFY26, VNB grew 12% to INR51b, reflecting a VNB margin of 17.6% (+140bp YoY).

* Management expects premium growth to recover in 2HFY26, and its focus remains on absolute VNB growth. VNB margin expansion will be driven by the product mix shift toward non-par, cost optimization, higher contribution from high-ticket size products, and improvement in persistency.

* We have kept our APE estimates unchanged. However, we have increased our VNB margin estimates by 80bp/80bp/100bp for FY26/27/28, considering the 1HFY26 performance, and slightly reduced our commission estimates, leading to ~10% rise in earnings for FY26/27/28. Reiterate BUY with a TP of INR1,080 (premised on 0.6x Sep’27E EV).

Product mix shift to non-par results in VNB margin expansion

* Individual APE declined 11% YoY, driven by a 27% YoY decline in par APE to INR60.2b. Non-par APE grew 29% YoY to INR40.9b, leading to a rise in APE contribution to 25% from 19% in 2QFY25, thus resulting in strong VNB margin expansion during the quarter.

* During 1HFY26, within the non-par segment, LIC witnessed 113.1% YoY growth in ULIP APE, while individual savings APE declined slightly by 2%, resulting in 30.5% YoY growth in non-par APE. This was offset by 18% YoY decline in par APE, leading to 5.5% YoY decline in 1HFY26 individual APE.

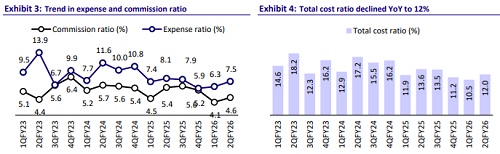

* Commission expenses declined 12% YoY to INR57.7b, and operating expenses fell 3% YoY to INR94.6b, resulting in a 160bp YoY improvement in the expense-to-management ratio to 12%.

* Income from investments in policyholders’ accounts grew 3% YoY to INR1.1t, while it increased 42% YoY to INR20.6b in shareholders’ accounts. Total AUM grew 3% YoY to INR57t. Yield on investment for policyholders’ accounts declined slightly to 8.9% in 1HFY26 from 9% in 1HFY25.

* On the distribution front, contribution from the agency channel was 92% in 2QFY26 (95% in 2QFY25), with individual NBP declining 12% YoY. Individual NBP from bancassurance grew 34% YoY, with contribution growing to 4.6% (3.1% in 2QFY25). The alternate channel witnessed strong growth of 88% YoY,

* LIC maintains the highest agency force in the country with ~1.5m agents, of which 48.2% have a vintage of more than five years. This constitutes 47.1% of the industry’s agency force. The company now has tie-ups with 93 bancassurance partners, 291 brokers, and 175 corporate agents, reflecting a massive distribution network spread across the country.

* The 13th/37th/61st month persistency stood at 68.2%/61.3%/55.1% in 2QFY26. The 25th month persistency declined significantly YoY to 62.6% (65% in 2QFY25), owing to a decline in the number of small-ticket policies sold post product modifications in Oct’24.

* Solvency ratio stood at 213% (198% in 2QFY25). EV at the end of 1HFY26 was at INR8.1t (INR8.2t at the end of 1HFY25).

Highlights from the management commentary

* Following the Master Circular effective 1st October 2024, LIC modified all its existing products to comply with the new regulatory norms. This included raising the minimum sum assured, which led to a temporary decline in the number of small-ticket policies sold and impacted persistency in certain segments.

* The EV movement was majorly impacted by MTM changes and improvements in the present value of future profits. While the fair value component declined due to market movement, PVIF gains more than offset the reduction, resulting in EV improvement compared to March 2025 levels.

* The GST exemption on life insurance premiums triggered a strong revival in demand. Between 5th Sep’25 and 22nd Sep’25, policy sales were almost at a standstill, as customers deferred purchases owing to the GST exemption. However, from 1st October 2025, there has been a sharp recovery in sales, with management expressing confidence that this momentum will sustain in the coming quarters.

Valuation and view

* LIC reported a strong quarter with respect to profitability, led by the rising contribution of the non-par business. The company maintains its industryleading position and expects a strong growth trajectory, driven by wider product offerings, higher ticket sizes, improvement in agency channel productivity, continued growth in bancassurance and alternate channels, and strong demand post GST exemption. A shift toward higher-margin non-par products and improvement in persistency will boost VNB margin going forward. The company is also working on enhancing its digital capabilities for cost optimization.

* We have kept our APE estimates unchanged. However, we have increased our VNB margin estimates by 80bp/80bp/100bp for FY26/27/28, considering the 1HFY26 performance, and slightly reduced our commission estimates, leading to ~10% rise in earnings for FY26/27/28. Reiterate BUY with a TP of INR1,080 (premised on 0.6x Sep’27E EV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412