Buy Kirloskar Oil Engines Ltd for the Target Rs.1,600 by Motilal Oswal Financial Services Ltd

Retains strong performance

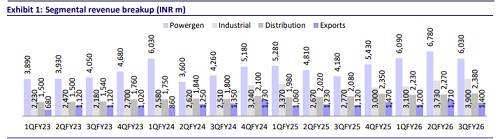

Kirloskar Oil Engines’ (KOEL) 3QFY26 revenue, adjusted for the transfer of its B2C division, was once again ahead of our expectations, driven by strong growth in the powergen, industrial, and export segments. The company is benefitting from strong growth in both LHP and HHP segments, followed by industrial segment. Over the next few years, we expect KOEL to gain from 1) incremental sales from HHP too in overall powergen segment, 2) further ramp-up in industrial segment from large orders won in previous years in nuclear and defense segments, 3) CPCB 4+ products coming up for warranty renewal, which can ramp up distribution segment growth, and 4) further penetration in export markets. This improved revenue mix can result in margin improvement from current levels, with B2C too now being transferred from standalone business. We incorporate the transfer of B2C segment to its subsidiary and cut our EPS estimates by 6%/9%/3% for FY26/27/28. We increase our core business multiple for KOEL from 25x to 28x after we reduce the discounting vs. the market leader as KOEL has been continuously gaining market share. We arrive at a revised SoTP-based TP of INR1,600 on Mar’28E EPS. Retain BUY.

Strong performance for B2B

The company completed the transfer of its B2C segment to its wholly owned subsidiary through a slump sale. As a result, YoY growth rates are not comparable. On restated financials, revenue grew 35% YoY to INR13.8b, reflecting an entirely B2B revenue base and coming in ~10% ahead of our estimated B2B revenue of INR12.7b. Gross margin declined by 40bp YoY and 50bp QoQ, and EBITDA margin stood at 12.2% in 3QFY26 vs. 10.3% in 3QFY25 (restated) and 14.0% in 2QFY26, with the sequential decline driven by elevated other expenses. Adjusted PAT came in at INR1,022m vs. our est. of INR1,227m. For 9MFY26, revenue/EBITDA/PAT grew 16%/17%/15% to INR43b/INR5.6b/ INR3.6b, with EBITDA margins at 13.1% and net cash of INR3b.

Powergen segment performance remained healthy

The powergen segment grew 44% YoY to INR6b in 3QFY26 (11% higher vs. est), supported by a low base of last year. KOEL’s powergen revenue growth for 9MFY26 stood at 33% YoY vs. 17% for Cummins, indicating that KOEL has gained market share in this period. Powergen segment growth was largely driven by the LHP segment, supported by incentive schemes at channel and retail levels. The HHP segment also delivered strong 235% YoY growth in 3QFY26. Demand momentum remained healthy from infrastructure, real estate, manufacturing and data centers. Improving market share and traction across products ranging from 1,000 kVA to 3,000 kVA was also supported by ongoing sales and service capability building and consultant-led selling for HHP gensets. We expect powergen revenue to grow at a 20% CAGR over FY25-28.

Industrial segment growth trajectory remains strong

Industrial segment revenue grew 41% YoY/5% QoQ to INR4b in 3QFY26, 17% ahead of our estimate, supported by strong demand from the defense, nuclear, and marine segments. Growth was broad-based across these segments, while the construction and mining segment remained subdued during the quarter due to a temporary phase of inventory correction at OEMs. We expect industrial segment to further benefit in FY27 from volume ramp-up from large-sized nuclear and defense orders bagged in previous years. We bake in 24% revenue CAGR for FY25-28.

Distribution & aftermarket segment positioned for steady growth

Distribution and aftermarket segment grew 14% YoY to INR2b in 3QFY26, largely in line with our estimate. Growth was driven by higher spare parts sales and service contracts, supported by an expanding installed base. The segment mainly comprises spare parts and services, while overhauls under the ‘New Life’ brand remain a small part of the mix. The company continues to improve service penetration through higher AMC coverage and stronger service capabilities. We expect this segment to clock revenue CAGR of 14% over FY25-28, supported by a growing installed base and continued focus on services

Exports to see gradual scale up

Exports grew 25% YoY to INR1.4b in 3QFY26. Growth was supported by continued traction in international markets, particularly in the Middle East and Africa, with a sustained focus on building capability, capacity, and coverage across regions. The company strengthened its presence in South Africa by setting up its own entity and continues to invest in the US market through its Americas subsidiary, though the business remains at an early stage. Across regions, the company is evaluating different go-to-market models based on market requirements. We expect export revenue to clock a 17% CAGR over FY25-28

Margin expansion expected over the medium term

EBITDA margin improved ~190bp YoY to 12.2% in 3QFY26 (on restated financials), supported by better operational efficiency. Sequentially, margins declined by ~180bp due to product mix and operating leverage loss. Gross margins remained stable at ~35%, with no material pressure from commodity costs. The transfer of the B2C business to LGM is expected to result in a slight improvement in standalone margins going ahead. We expect EBITDA margins of 14%/14.5% for FY27/28.

Arka Fincap (AFHPL) business scaling gradually

AFHPL’s revenue increased 7% YoY to INR2b in 3QFY26, with total AUM at ~INR77b as of Dec’25. The wholesale book stood at ~INR26b, while the rest comprised retail and SME lending, including used vehicle financing and small-ticket loans against property. The company continues to build a more granular portfolio, supported by ~110 branches and ~1,600 employees. Asset quality remained stable, with gross NPAs at ~1.2% and net NPAs at ~0.3%. We expect Arka Fincap to scale up steadily over the medium term, supported by portfolio diversification and disciplined risk management.

Financial outlook

We cut our estimates by 6%/9%/3% for FY26/FY27/FY28E to factor in 3Q performance and transfer of B2C segment to its wholly owned subsidiary. We thus expect a revenue CAGR of 15% over FY25-28, driven by 20%/24%/14%/17% CAGR in powergen/industrial/distribution/exports. Over FY25-28E, we bake in a 170bp improvement in margins to build in better product mix and operating leverage benefits. We expect an EBITDA/PAT CAGR of 19%/21% over the same period.

Valuation and recommendation

The stock is currently trading at 32.8x/26.3x P/E on FY27/28E earnings. Adjusted for subsidiary valuation, KOEL is trading at 28.8x/23.1x P/E on FY27/FY28E earnings, which is still at a significant discount to the market leader. We increase our core business multiple for KOEL from 25x to 28x after we reduce the discounting vs. the market leader as KOEL has been continuously gaining market share. We arrive at a revised SoTP-based TP of INR1,600 on Mar’28E earnings. Retain BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412