Buy Max Financial Services Ltd for the Target Rs.2,200 by Motilal Oswal Financial Services Ltd

Industry-leading growth trajectory continues; VNB margin up YoY

* Axis Max Life Insurance’s (MAXLIFE) APE grew 30% YoY to INR27.3b (11% beat due to better-than-expected APE for Dec’25). For 9MFY26, APE grew 21% YoY to INR69.1b.

* MAXLIFE’s VNB rose 35% YoY to INR6.6b (12% beat), resulting in a VNB margin of 24.1% (MOFSLe: 24%) vs. 23.2% in 3QFY25. For 9M, VNB grew 30% YoY to INR16.3b, reflecting a VNB margin of 23.6% (21.9% in 9MFY25).

* EV at the end of 9MFY26 stood at INR281.1b, reflecting an annualized operating RoEV of 16.9% (17.3% in 9MFY25).

* The management aims to sustain 300–500bp faster growth than the industry, with better growth likely for FY26 than what was guided earlier (15-17%). 1/3 of the GST impact (300-350bp) has been mitigated in 3QFY26, with full mitigation expected in the next few quarters.

* We raise our APE estimates by 4% each in FY26/FY27/FY28, considering the 3Q performance and strong growth in Jan’26. Our VNB margin estimate remains intact. We reiterate our BUY rating on the stock with a TP of INR2,200, premised on 2.2x FY28E EV.

Product mix shift from ULIP to traditional

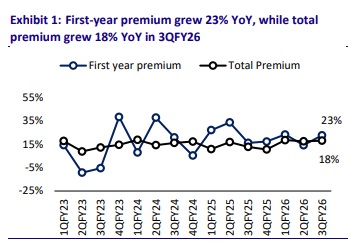

* Gross premium income grew 18% YoY to INR97b (in line). Renewal premium grew 16% YoY to INR60.5b (in line). The stable growth momentum drove market share expansion to 9.8% during 9MFY26 from 9.3% in 9MFY25.

* VNB margin expansion of 90bp YoY was largely driven by a product mix shift in 3QFY26, with non-par savings contribution increasing to ~29% (~26% in 3QFY25) and protection contribution rising to ~17% (~14% in 3QFY25), while ULIP contribution declined to ~37% (~45% in 3QFY25).

* The high-margin protection and health segments witnessed an APE growth of 57% YoY during 9MFY26 to INR9.3b, with rider APE growing 95% YoY. Annuity APE posted 107% YoY growth to INR6.3b during 9MFY26. Group credit life continues to witness recovery, growing 45% YoY in 3QFY26.

* MAXLIFE launched the Online Savings Plan Plus and Corporate Advantage in Retirement and Employee Benefit Smart Plan during the quarter.

* On the distribution front, the proprietary channel maintains strong growth momentum, growing 29% YoY during 9MFY26. For the quarter, offline APE witnessed growth of 43% YoY, while online APE witnessed strong 75% YoY growth. The partnership channel grew 13% YoY during 9MFY26, driven by the scaling of new bank partnerships. Axis channel witnessed 7% YoY growth, while other banks experienced 47% YoY growth in 3QFY26.

* The opex-to-GWP ratio increased 90bp YoY to 15.8% during 9MFY26.

* Persistency on the premium basis rose across long-term cohorts, especially in the 25th-month (+400bp YoY to 76%) and 61st-month (+300bp YoY to 56%). However, the 13th-month persistency dipped 200bp YoY to 85%.

* AUM grew 12% YoY to INR1.93t. The solvency ratio stood at 201% in 9MFY26 vs. 196% in 9MFY25.

Key highlights from the management commentary

* Focus remains on maintaining strong growth while keeping the VNB margin at ~25%. Any excess margin will be invested back in the business for distribution scale-up and further process enhancements.

* With respect to product-level margins, Par margins have been stable while Protection margins are improving. Non-par savings margins have been under some pressure post surrender regulations, while ULIP margins are improving due to higher sum assured. Credit life margins have been stable.

* Apart from large bank partnerships (Axis Bank and Yes Bank), MAXLIFE has also achieved the highest counter share in some of the new bank partnerships. Agency channel performance improved meaningfully in 3QFY26, positioning the same on the top among peers after a gap of several years.

Valuation and view

* MAXLIFE maintains a better-than-industry APE growth trajectory. VNB margin continues to witness YoY expansion, supported by strong APE growth and increased contribution of protection and non-par segments during 3QFY26. The proprietary channel continues to drive growth across offline (+43% YoY) and online channels (+75% YoY), while the bancassurance channel posted strong growth in non-Axis partnerships (+47% YoY). The persistency trends improved across almost all cohorts.

* We raise our APE estimates by 4% each in FY26/FY27/FY28, considering the 3Q performance and strong growth in Jan’26. Our VNB margin estimate remains intact. We reiterate our BUY rating on the stock with a TP of INR2,200, premised on 2.2x FY28E EV.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412