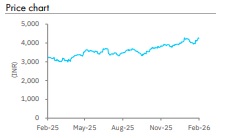

Buy Titan Company Ltd for Target Rs 5,000 by Elara Capitals

Growth momentum to continue

Titan Company (TTAN IN) reported a good Q3; revenue grew by 43.3%, 9.3% ahead of our estimates, owing to healthy festival season demand in the jewelry business, gold price increase (42% YoY ex-Bullion), strong exchange program traction, and sharp rise in gold prices. The eyecare division delivered growth of 17.9%, led by 8% volume growth and a 9.9% rise in average selling price (ASP). The watches division grew 14%, led by robust festival demand and the emerging business delivered 14.9% YoY growth. EBITDA margin came in at 10.7%, driven by premiumization in the jewelry business even as studded share declined. We retain Buy with a higher TP of INR 5,000 based on 60x December 2027E P/E.

Resilient jewelry growth despite headwinds in gold prices: TTAN posted strong Q3 revenue growth of 43.3% YoY to INR 254bn, 9.3% ahead of our estimates, led by robust growth in the jewelry segment, which grew 42% YoY (ex-Bullion and digi-gold sales), driven by 32% Like for Like (LFL) growth in Tanishq, Mia, and Zoya. CaratLane grew 42.3% YoY, led by 23% LFL growth, and healthy 35% YoY growth in the studded portfolio. Buyer growth in gold jewellery was flat, while new buyers share improved 300bp QoQ to 45% (from 42% in Q2FY26; 48% in Q3FY25). The international business grew 83.1% YoY, aided by both store expansion and strong LFL growth. Newly acquired Damas will be included in the international business from Q4FY26.

Steady growth in watches, eyecare and emerging businesses: The watches division delivered 14% YoY growth to INR 13bn in Q3, fueled by strong festival demand and 17% growth (20% YoY secondary growth) in the analog segment, but smartwatches declined ~27% YoY due to volume contraction despite steady ASP. The eyecare business grew 18% YoY to INR 2.3bn, driven by double-digit growth in lenses and mid-teens growth in sunglasses. Volume growth for the division was ~8% and management expects similar 8-10% volume growth coupled with ASP growth, due to higher preference toward international brands. Emerging businesses saw 14.9% YoY growth to INR 1.4 bn, propelled by a 110% surge in women's bags (both volume and ASP gains), a 24% increase in fragrances (higher Skinn & Fastrack volume), and 7% secondary growth in Taneira (double-digit ASP offset by softer volume).

Stable margin despite the sharp rise in gold prices: EBIT margin for the jewelry segment (Tanishq, Mia & Zoya) stood at ~10.9%, up 129bp YoY (down 50bp adjusted for customs duty one-off). EBIT margin for CaratLane clocked in at 13%, owing to operating leverage and cost management initiatives. Management expects CaratLane margin to reach in the low double digits once business scales up. Adjusted international jewelry margin came in at 5% after adjusting for primary sales of ~INR 2bn.

Retain Buy with a higher TP of INR 5,000: We increase our revenue estimates by 8% for FY26 and 9.5% each in FY27 & FY28 to incorporate Damas in the international business and higher gold prices. Hence, we raise our EPS by 11.8% for FY26E, 13.9% for FY27E and 13.5% for FY28E. We retain Buy with a higher TP of INR 5,000 from INR 4,540 on 60x (unchanged) December 2027E P/E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933.