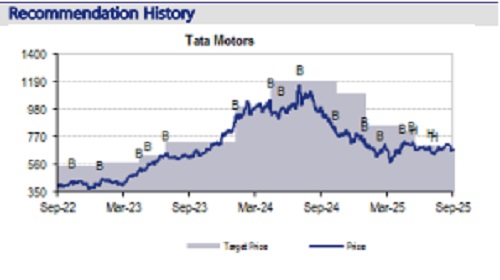

Reduce Tata Motors Ltd For Target Rs. 689 By JM Financial Services Ltd

Tata Motors (TTMT) hosted an analyst meet ahead of the demerger of its passenger vehicle (PV) and commercial vehicle (CV) businesses with 14th Oct’25 as the tentative record date. The CV business will be carved out and listed by early November, potentially causing shortterm stock volatility due to PV-only revaluation till CV gets listed. On the JLR front, it faced a cyberattack on 31st Aug’25, with production resuming in phases from 25th Sep. Retail and wholesale volumes were stable due to sufficient inventory, though liquidity will get impacted - the quantum of which is not yet measurable. Demand is stable across the US, the UK, and China. JLR, however, will absorb the impact from the lower luxury tax threshold in China. On IVECO, the company highlighted that the complementarity with IVECO is highly significant, with synergies expected to surpass those achieved with JLR and the transaction would be EPS accretive from day one. On the CV side, the management expects GST rate rationalisation to benefit smaller CV segments like SCVs and ILCVs, where more buyers don’t claim ITC. It projects double-digit CV growth in 2HFY26, aided by festive demand and GST rationalisation. On the PV front, festive season bookings have surged 25–30% YoY, driven by GST cuts, leading to strong demand. TTMT has seven new launches planned in the next 12 months, including ICE and EV models, with hybrids under consideration based on market demand. We change our rating from ‘HOLD’, as per our previous rating system, to ‘REDUCE’ in the new rating system with a Mar’27 SOTP-based TP of INR 689.

* Price to get volatile post record date: TTMT is set to undergo a strategic demerger, with a tentative record date of 14th Oct’25 marking a key milestone in the process. The demerger will separate its CV and PV businesses into distinct entities, enhancing focus and unlocking long-term value. Post that date, the CV segment will be carved out of the listed entity (Tata Motors Ltd), which may lead to increased stock volatility, primarily driven by the rebalancing of the PV-only valuation. The newly formed CV entity is expected to be listed by early-November, approximately 30 days after getting all regulatory approvals (pending completion of some formalities). Post the listing of the CV business, it will be renamed Tata Motors Ltd, while the PV business will operate under the name Tata Motors Passenger Vehicles Ltd (TMPV).

* Impact of cyberattack on JLR is to be seen: The management of JLR confirmed that the cyberattack on 31st Aug’25 was not covered by insurance, as no such coverage currently exists for incidents of this nature. While sales have resumed, and production restarted in a phased manner from 25th Sep, the company noted that retail and wholesale volumes were not materially impacted due to sufficient inventory levels. However, the attack will affect JLR’s liquidity, though the management stated it is currently difficult to quantify the exact impact. Going forward, the focus remains on how quickly JLR can scale up production. On the demand front, the outlook remains positive: US demand is resilient with the tariff uncertainty resolved, UK maintains similar momentum, and China demand is stable although JLR will absorb near-term cost pressure due to the reduction in luxury tax threshold from RMB 1.3mn to RMB 0.9mn.

* GST rationalisation, mixed effect on CVs: On the domestic front, the recent GST rate rationalisation is expected to have a mixed impact across the CV portfolio. The effect is most pronounced in segments where buyers do not claim input tax credit (ITC). In HCVs, where nearly 60–70% of customers are B2B and avail ITC, the impact is relatively muted. In contrast, ILCVs (40%), buses (5%), and SCVs (18%) see a more significant share of non-ITC-taking buyers, making these segments more sensitive to the GST cuts. Interestingly, the greatest positive impact is expected in smaller vehicle categories, where a higher proportion of end-users benefit directly from reduced costs. Additionally, GST reduction on components like tyres and consumables could help lower operating expenses by 1-2%, thereby providing a modest boost to fleet operators’ margins. Overall, the GST revisions provide a tailwind for profitability, particularly in the domestic SCV and ILCV segments. The management expects double-digit growth in the CV segment during 2HFY26, while 1HFY26 is likely to be flat to slightly negative. Overall, FY26 growth for the CV business is expected to be in mid-single digits.

* IVECO transaction, synergies galore: The company highlighted that the complementarity with IVECO is highly significant, with synergies expected to surpass those achieved with JLR. Except for a higher power-to-weight ratio in Europe, the product platforms are largely similar, enabling deeper integration. Approximately 40% of R&D and product development spends overlap, offering substantial cost-saving potential. On the revenue side, opportunities include entry into niche segments such as deep mining trucks in India, alongside leveraging IVECO’s strong No. 3 market position in Latin America. In the >6T category, the combined entity is expected to rank as the fourth-largest global player, with the management guiding for the transaction to be EPS accretive from day one.

* Domestic PVs, strong festive demand: The festive season has begun on a robust note, with bookings rising 25–30% YoY, supported by the recent GST rationalisation. Over the long term, the company expects CNG to account for 25-30% of industry volume, EVs at ~20%, diesel at ~5%, with the remainder split between ICE petrol and hybrids. For 2HFY26, domestic industry volume is projected to grow 7–8%, while full-year FY26 growth is expected to remain below 5%. The company has lined up seven launches over the next 12 months, comprising four ICE models (notably the Sierra petrol) and three EVs (Punch EV, Tiago EV, and Sierra EV). The management also indicated that a hybrid offering could be introduced if market demand arises. Additionally, the used car market is witnessing a shift towards hatchbacks post-GST cuts. Lastly, the management indicated that the current fleet will be compliant with the upcoming CAFÉ norms.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361