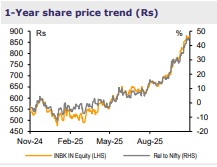

Buy Indian Bank Ltd for the Target Rs.900 By Emkay Global Financial Services Ltd

Sustained focus on profitable and prudent growth

Indian Bank (INBK) continues to rank among the best performing PSBs, and our recent interaction with the MD and CEO, Binod Kumar reaffirms the bank’s firm focus on delivering sustainably higher profitability over growth. The bank clocked strong ~14% credit growth in 2Q; however, it conservatively guided for 10–12% credit growth, with a positive bias, subject to no compromise on margins. The bank also plans to ramp up its otherwise weak non-fund business growth to drive up fees. NIM shall moderate a tad in Q3, due to bunching-up of MCLR pricing in 3Q, while inching up a bit in 4Q, subject to no rate cut. ECL impact on CAR could be ~150bps, however, the bank has proactively started making provisions to limit the transitional impact on 1-Apr-27. The bank believes that better operating leverage (mainly non-staff cost) and focus on fees should partly offset the eventual moderation in AUCA recovery and ECL provisions, to help sustain RoA>1-1.1%. We remain positive on Indian Bank, backed by its superior return profile and credible management, and retain BUY with a recently raised target price of Rs900 (1.3x Sep-27E ABV). We, however, remain watchful of the evolving developments around PSBs’ consolidation, currently under discussion at the ministry level, in which Indian Bank could potentially be involved.

Focus on margin management and driving up of non-lending fees

Traditionally, Indian Bank focused on profitability over growth, reflected in its current credit growth guidance of 10-12% (with a positive bias), subject to no compromise on margins. The bank has recently used IBPC to manage its cost of funds, leading to nearly flattish margins in 2Q at 3.2%. However, it expects some moderation in NIM during 3Q, due to delayed repricing of the MCLR portfolio, and then inching up in 4Q, subject to no rate cut. The bank has invested heavily in tech in the past few years and now intends to reap the benefits by reducing business acquisitions and servicing costs. Separately, it now intends to focus on non-fund business (being otherwise lower among PSBs), to drive up non-lending fees apart from PSLC fees. Thus, the bank believes that better operating leverage, non-lending fees, and treasury gains (if G-sec yields soften) would partly offset the impact of LLP normalization (incl ECL impact) and written-off NPA recovery.

Robust asset quality and provision buffers to ease transitional impact of ECL

Indian Bank is one of the best among peers, in terms of asset quality; its headline GNPA ratio stands at 2.6%, while NNPA ratio is at an industry-low of ~0.2% (to the envy of even some PVBs), which would improve further (GNPA <2%), per the bank. It targets keeping slippages <1%, with expected recoveries of Rs55-65bn, incl AUCA (asset under collection) recoveries of Rs20-25bn in FY26. The bank has limited exposure to MSMEs exporting to the US, thereby limiting any significant NPA risk from this segment. However, it expects that ECL impact could be 1.5% (1-Apr-27) on CET 1, based on the current draft norms, for which it has already started making provisions and expects some relief from the RBI as well.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354