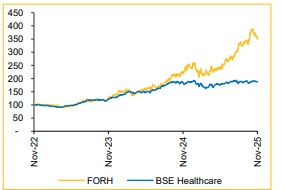

Buy Fortis Healthcare Ltd For Target Rs. 1,140 By Choice Broking Ltd

Positioned for Sustained Growth and Margin Expansion: FORH expects continued double-digit revenue growth, driven by higher occupancy, rising ARPOB and brownfield expansion. Hospital margin is seen to be improving toward 25%, supported by oncology, robotic surgeries and digital integration. Agilus Diagnostics targets steady mid-single-digit growth and 24–25% EBITDA margin through focus on specialised and preventive testing.

View and Valuation: FORH is progressing well with its cluster strategy, led by hospital margin expansion and diagnostics scale-up. We maintain our ‘BUY’ rating and revise our target price to INR 1,140 (from INR 1,000), based on an SoTP valuation (see Exhibit 2). We revise the hospital business multiple at 29x EV/EBITDA on an average of FY27–28E, reflecting ARPOB growth and capacity additions. We also revise the multiple of diagnostics segment at 25x EV/EBITDA on average of FY27–28E, factoring in margin improvement.

Strong Beat across Metrics; Margin and PAT Impress

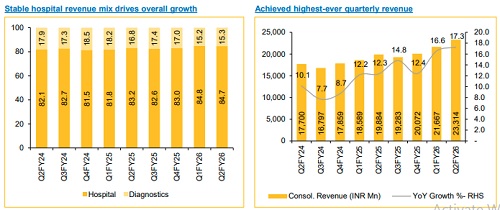

* Revenue grew 17.3% YoY / 7.6% QoQ to INR 23.3 Bn (vs CIE estimate: INR 23.1 Bn), driven by 13% increase in occupied beds.

* Hospital revenue grew by 19.3% YoY to INR 19.7 Bn; Diagnostic revenue increased by 6.9% YoY to INR 3.6 Bn.

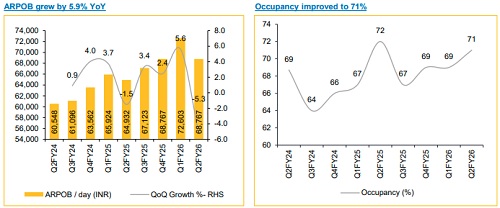

* ARPOB grew by 5.9% YoY to INR 68,767, with occupancy at 71%.

* EBITDA rose 27.9% YoY and 13.4% QoQ to INR 5.6 Bn; margin improved by 199 bps YoY and 122 bps QoQ to 23.9% (vs. CIE estimate: 23.3%).

* PAT grew by 38.7% YoY/22.1% QoQ to INR 3.1 Bn (vs. CIE estimate: INR 2.9 Bn), with a PAT margin of 13.1%.

Hospital Business: Sustaining Double-Digit Growth Momentum

FORH’s hospital business grew 19.3% YoY to INR 19,740 Mn, driving 85% of revenue. EBITDA rose 27.3% YoY to INR 4,520 Mn, with margin improving ~150 bps to 22.9%. ARPOB increased 5.9% to INR 25.1 Mn annually, led by a 29% surge in oncology and 66% in robotic surgeries. Occupancy rose to 71%, with 550 new beds added in H1. The company targets 400–500 new beds annually, supported by expansion in Noida, Jalandhar and FMRI. With international revenue up 26% and a focus on high-acuity care, we believe that FORH is wellpositioned to achieve ~25% hospital EBITDA margin over the next 2 years.

Agilus Diagnostics: Margin Recover, Strong Double-digit Growth in Sight

Agilus reported revenue of INR 3,570 Mn, up 6.9% YoY and EBITDA of INR 1,039 Mn, up 29.6%, with margin improving from 24% to 29.1%. Test volumes grew to 10.6 Mn, supported by 7 new labs and over 200 touchpoints, taking the total to 4,330. Agilus launched 19 genomic and oncology tests, expanding its high-value portfolio. With focus on digital automation and specialised diagnostics, we believe, Agilus will sustain 23–24% margin and steady mid-single-digit topline growth in FY26–27E.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)