Buy Happy Forgings Ltd for the Target Rs. 1,200 by Motilal Oswal Financial Services Ltd

Record high margins despite weak export demand

Demand across key segments likely to revive from here

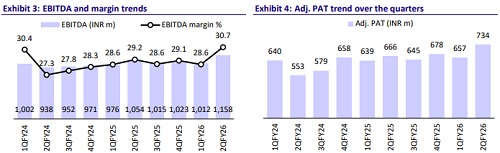

* Happy Forgings’ (HFL) 2QFY26 PAT at INR734m was largely in line with our estimate. The key highlight of 2Q was its record high margins at 30.7% (+150bp YoY) in a weak demand environment, especially in exports.

* HFL’s superior financial track record compared to its peers serves as a testament to its inherent operational efficiencies and is likely to be a key competitive advantage going forward. Given this, we expect HFL to continue to outperform core industry growth. Overall, we expect HFL to post a CAGR of 17%/20%/22% in standalone revenue/EBITDA/PAT during FY25-28E. We reiterate our BUY rating on the stock with a TP of INR1,200 (based on 27x Sep’27E EPS).

Margins improve sequentially despite global headwinds

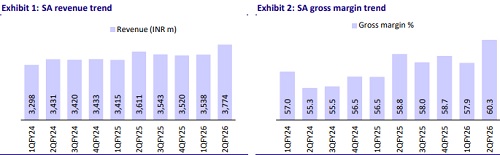

* HFL’s revenue was INR3.8b in 2QFY26, up 4.5% YoY, and was largely in line.

* Revenue growth was driven by 5.2% volume growth, while realizations remained largely stable YoY at INR251 per kg.

* Revenue growth was driven by healthy demand across domestic (CVs, tractors, PVs, and non-auto) segments, while exports remained muted due to weak end-market conditions and customer de-stocking amid the evolving tariff situation.

* Despite the adverse global macro, EBITDA margins expanded 150bp YoY to a record high level of 30.7%, ahead of our estimates of 28.8%.

* EBITDA came in at INR1.1b, up 10% YoY and 6% ahead of our estimates on the back of improved gross margins (+150bp YoY).

* However, lower other income at INR63m (INR83m in 2QFY25 and INR104m in Q1FY26) limited PAT growth.

* PAT stood at INR734m, up 10.2% YoY, and was broadly in line.

* HFL’s 1HFY26 CFO stood at INR2.2b, while capex was INR2.1b. Cash surplus at the end of Sep’25 stood at INR3.15b.

Key highlights from the management commentary

* Revenue growth is expected to come from the execution of new orders in PV, off-highway (large axle for German OEMs), new lines for wind and heavy tractor, and the industrial business over the medium term. GST rate cuts are likely to further support growth in the domestic markets. Thus, FY27 revenue growth is likely to be much better than the current fiscal.

* With its focus on diversification, they expect the mix for CV + farm to come down to about 50% over the next few years, and the balance to be contributed by Industrial + Off-highway + PV + Others.

* CV business is likely to improve in the coming quarters led by a pick-up in domestic demand and revival of volumes from a key exports OEM.

* While the 2H outlook for the US/European tractor industry remains subdued with an anticipated uncertainty for FY27, the momentum in the off-highway segment is expected to improve in FY27 with new programs ramping up.

* For the new INR6.5b capex for heavy forgings, the company has already garnered orders worth INR3.5b.

* In the US, demand for components in the 50% tariff bracket has sharply reduced, and management is hopeful of a downward revision for this tariff in the coming quarters.

Valuation and view

* HFL is expected to outperform the industry on the back of its healthy order backlog. A recovery in domestic CV demand, a healthy tractor outlook, and strong order wins in Industrials and PVs should help to offset the weakness in export markets in the near term.

* HFL’s superior financial track record compared to its peers serves as a testament to its inherent operational efficiencies and is likely to be a key competitive advantage going forward. Given this, we expect HFL to continue to outperform core industry growth. Overall, we expect HFL to post a CAGR of 17%/20%/22% in standalone revenue/EBITDA/PAT during FY25-28E. We reiterate our BUY rating on the stock with a TP of INR1,200 (based on 27x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412