Neutral Lupin Ltd for the Target Rs. 2,100 by Motilal Oswal Financial Services Ltd

Record US sales/emerging market recovery boosts earnings

Work-in-progress to build a pipeline in the inhalers/injectable space

* Lupin (LPC) delivered better-than-expected performance for the quarter, with a 9%/30%/28% beat on revenue/EBITDA/PAT. Strong traction in the US and emerging markets, supported by production-linked income (PLI), led to a positive surprise in both revenue and profitability.

* LPC achieved an all-time high quarterly sales run rate of USD315m in the US, led by strong traction in limited-competition products and minimal price erosion in the base portfolio.

* LPC’s efforts to revive business in Brazil/SA have strengthened its Emerging Markets performance, with upcoming launches to support growth in Brazil.

* While YoY growth in the domestic formulation (DF) segment may appear muted, excluding in-licensed products, the DF business grew 10.7% YoY in 1HFY26, outperforming IPM. With a rising chronic share and increased sales force, LPC is well-positioned to sustain this industry-leading growth in the DF segment

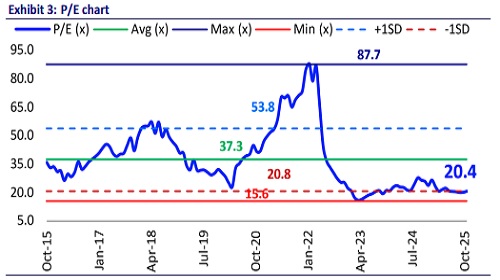

* We raise our earnings estimate by 13.5%/4%/2% for FY26/FY27/FY28, factoring in: a) the strong off-take of products (gTolvaptan/Mirabegron/Spiriva) in the US market, b) improved business prospects in emerging markets, and c) product pipeline in DF markets. We value LPC 21x 12M forward earnings to arrive at a TP of INR2,100.

* After a strong revival from earnings decline (FY22-23) to robust growth in FY24-25, the growth trajectory is expected to continue in FY26. However, intense competition in current high-value products in the US is likely to constrain YoY growth in FY27/FY28. Accordingly, we reiterate a Neutral stance on the stock.

Product mix/operating leverage drives strong margin expansion YoY

* LPC’s 2QFY26 revenue grew 27%YoY to INR70.5b. (our est. INR64.5b).

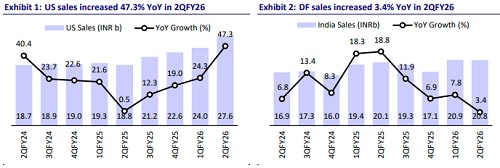

* US sales grew 47.3% YoY to INR27.6b (up 41% YoY in CC to USD315m; 39% of sales). Emerging market sales grew 45.3% YoY to INR 9.2b (13% of sales). Other developed market sales grew 18.9% YoY to INR8b (12% of sales). Domestic formulation (DF) sales grew 3.4% YoY to INR20.7b (29% of sales).

* API sales decreased 12.8% YoY to INR2.5b (4% of sales).

* Gross Margin (GM) expanded 460bp YoY to 74.1% due to a reduction in raw material costs.

* EBITDA margin expanded 800bp YoY to 30.3% (our est: 25.5%, largely due to improved GM. The benefit was partly offset by higher employee costs (+250bp YoY as % of sales).

* As a result, EBITDA grew 72.8% YoY to INR21.4b (vs our est: INR16.5b).

* Adj. PAT grew 72.8% YoY INR13.3b (our est: INR10.3b).

* For H1FY26, revenue/EBITDA/PAT grew 19%/45%/48% YoY

Highlights from the management commentary

* LPC revised its EBITDA margin guidance upwards to 25-26% for FY26 vs the earlier guidance of 24-25%. However, EBITDA margin for 2HFY26 will be lower compared to 1HFY26 due to increased R&D spending and a decline in PLI income.

* LPC expects the USD1b US sales run rate to sustain in FY27.

* It also indicated EBITDA margin to sustain at 24-25% in FY27.

* LPC guided for R&D spend to range between 7.5% and 8.5% of sales for FY26. ~70 % of the R&D spend is allocated towards complex products.

* US growth remained strong, led by exclusivity of Tolvaptan /continued traction in Mirabegron and g-Spiriva, offsetting mild price erosion.

* The Biosimilar portfolio will start contributing to revenue from FY27 onwards and intends to have five products commercialized by FY30. Specifically, LPC targets b-Pegfilgrastim by the end of the month, while Ranvizumab is expected around mid-CY26.

* LPC plans to invest USD250m over the next five years to build a manufacturing facility in Coral Springs, Florida, designed to produce over 25 critical respiratory medicines, including albuterol inhalers.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412