Buy Coforge Ltd for the Target Rs. 1,930 by Choice Broking Ltd

Business Overview:

COFORGE is a global digital services and solutions provider, ranked among the top 20 Indian software exporters, serving global clients like British Airways, ING Group, SEI Investments, Sabre, and SITA. Over the years, COFORGE has set up subsidiaries in the US, Singapore, Australia, UK, Germany and Thailand, mainly to market and mobilize projects for the software division. The company has business partnerships with large IT companies across the world.

How is COFORGE set to outgrow peers despite macro challenges?

COFORGE is well-positioned to lead industry growth in FY26E due to several key strengths

* Firstly, the company’s disciplined execution and unique intensity in delivering results sets it apart from peers. COFORGE emphasizes growth through solution-based, proactive large managed services deals, focusing on expanding wallet share within existing clients rather than relying solely on client budget increase. This strategy ensures resilience through economic cycles, supported by a strong signed order book and a robust deal pipeline.

* Having a proven history of building deep pools of specialized architects and industry-specific experts further differentiates COFORGE from peers. Despite macroeconomic fluctuations the company’s strategic pivot towards large deals is quite instrumental in the growth and profitability that it has witnessed so far.

Why Invest in COFORGE?

COFORGE’s execution intensity is led by weekly large-deal proposals & disciplined pursuit of key bets;

(1) Hyper-Specialization in industries like Travel, Financial Services, & Healthcare.

(2) Enabling differentiation through deep domain expertise.

(3) Deep Engineering Capabilities, led by AI-driven development & platforms like Forge-X.

This supports rapid software development & legacy modernisation, positioning engineering excellence as a core growth driver. COFORGE reported a robust Q1FY26, with 5 large deal wins leading to record order intake of USD 507 Mn & an executable order book of USD 1.55Bn (+46.9% YoY). Sequential USD revenue rose 9.6%, setting the stage for a strong FY26E, with H2 expected to outperform H1, driven by revenue realization from recent wins. Travel led vertical growth (+32.3%), while BFS declined slightly (-1.1%). The Americas remained key, contributing 56.7% of revenue. Post Advantage-Go’s exit, estimates are revised.

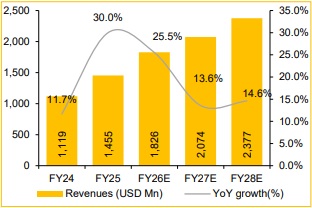

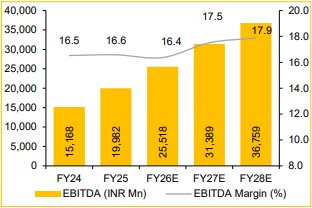

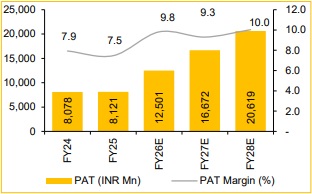

Given these factors, we expect Revenue / EBITDA / PAT to grow at a CAGR of 19.5% / 24.8% / 34.7% over FY25–FY28E. Rolling forward to FY28 estimates & taking average FY27E & FY28E EPS of INR 55.1, we arrive at a revised Target Price of INR 1,930 with a PE multiple of 35x & have maintained our rating to BUY.

Valuation:

We currently have a ‘BUY’ rating on the stock with a target price of INR 1,930.

Key Risks:

Slower TCV Conversion: Amidst global macro-economic challenges there is a possibility of clients spending gradually, thereby slowing down the actual revenue conversions from TCV won, which we believe could be a key risk factor to the company’s growth and profitability in FY26E.

Currency exchange volatility: Fluctuations in foreign currency exchange rates can affect profit margins and financial stability, especially in global contracts.

Geopolitical Policy Impact on the IT sector: A significant portion of the COFORGE’s revenue is derived from the US market. Policy shifts under the Trump administration and global geopolitical tensions may reduce capital flows into the IT sector, leading to short-term investment slowdowns and impacting growth.

Revenue expected to grow at 17.8% CAGR over FY25-28E

EBITDA expected to grow at 22.5% CAGR over FY25-28E

PAT expected to grow at 36.4% CAGR over FY25-28E

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)