Buy Britannia Industries Ltd for the Target Rs. 7,150 by Motilal Oswal Financial Services Ltd

Growth visibility improving; swift margin recovery

* Britannia Industries (BRIT) posted consolidated revenue growth of 4% YoY in 2QFY26 (below). Adjusted for the GST transition impact, sales growth would have been ~6-6.5% YoY, as the business faced short-term headwinds in September due to de-stocking. BRIT expects the transitional impact to normalize progressively in 3QFY26. By the end of October, the company had revised ~65% of its SKUs with updated grammages and prices, with full completion expected by mid-November. Rural markets continued to outpace urban markets. The company remains focused on driving healthy, volume-led growth through region- and consumer-centric products, enhanced distribution, and strong price competitiveness.

* GM expanded 20bp YoY and 140bp QoQ to 41.7% (above), driven by relatively stable commodity prices. Employee expenses declined 22% YoY on account of SAR devaluation, while other expenses declined ~7% YoY, leading to a beat on EBITDA margin, which expanded 290bp YoY to 19.7% (above). BRIT has normalized its A&P spends, with annual A&P spends as a % of sales for FY26 expected to revert to historical levels. We model an EBITDA margin of ~19% for FY26-28.

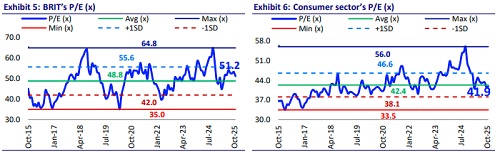

* While we have been constructive on the packaged food industry following the GST rate revision (majorly from 18% to 5%), given that these are pureplay businesses expected to witness limited transitional impact, BRIT stands out as a key beneficiary. With 60-65% of its portfolio comprising LUPs/price pack (INR5/10 price packs), the company is well positioned to capitalize on the GST rate revision. We expect the earnings growth trend to improve from 2HFY26 onwards, given: 1) improving macro drivers for consumption, 2) market share gains as the rate reduction narrows the pricing gap between organized and unorganized players, 3) continued focus on distribution expansion, 4) product innovation serving as a key impetus, and 5) softening of key raw material costs (peak cost cycle is behind). We model an 11% and 16% revenue and PAT CAGR for FY25-28E. With positive green shoots in growth, we upgrade BRIT to a BUY rating with a TP of INR7,150 (premised on 50x Sep’27E EPS).

Miss on revenue but beat on EBITDA

* Revenue growth at ~4%: BRIT’s consolidated total revenue rose 3.7% YoY to INR48.4b (est. INR50.2b). Adjusted for the GST transition impact, sales would have grown ~6-6.5% YoY. Consolidated net sales (excluding other operating income) rose 4% YoY to INR47.5b (est. INR49.3b) in 2Q. Other operating income declined 13% YoY to INR0.9b (on a high base). On account of the GST transition, we believe volume decline would have been in low single digits.

* Lower operating expenses boost margin: Consolidated gross margin expanded 20bp YoY and 140bp QoQ to 41.7% (est. 40.8%), driven by relatively stable commodity prices. Employee expenses declined 22% YoY, while other expenses declined ~7% YoY, leading to a beat on EBITDA margin, which expanded 290bp YoY and 330bp QoQ to 19.7% (est. of 17.4%).

* Double-digit PAT growth: EBITDA rose 22% YoY to INR9.5b (est. INR8.7b). APAT rose 23% YoY to INR6.6b (est. INR6.1b).

* In 1HFY26, net sales/EBITDA/APAT grew 6%/11%/11% YoY, respectively.

Highlights from the management commentary

* Around 60%-65% of BRIT’s portfolio comprises LUPs/price packs (INR5/10).

* The company expects the transitional impact to normalize progressively in 3QFY26. As of end-October, the company had revised ~65% of its SKUs, and by mid-November, all SKUs are expected to reflect revised grammages and prices.

* Adjusted for the GST transition, BRIT sales growth in 2QFY26 could have been higher by 2-2.5%, as September sales were impacted by 6-7%.

* The top three national-level players command ~70% of the market share, while significant regional players account for ~10-12%. The remaining 15% is held by value players.

* Dairy is trending below BRIT’s expectations. The cheese market, which had witnessed high growth until last year, has now moderated. BRIT expects cheese growth to rebound in the near term.

Valuation and view

* We raise our EPS estimates by 3-5% for FY26-28.

* We remain constructive on the packaged food industry, as the GST rate cut from 18% to 5% is expected to boost volume growth. With 60-65% of BRIT’s portfolio comprising INR5/10 price packs, the company stands out as one of the key beneficiaries of this rate revision.

* We expect earnings growth trend to improve from 2HFY26 onwards, given: 1) improving macro drivers for consumption, 2) market share gains as the rate reduction narrows the pricing gap between organized and unorganized players, 3) continued focus on distribution expansion, 4) product innovation serving as a key impetus, and 5) softening of key raw material prices (the peak cost cycle is behind). We model 11% and 16% revenue and PAT CAGR for FY25-28E. With positive green shoots in growth, we upgrade BRIT to a BUY rating with a TP of INR7,150 (premised on 50x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412