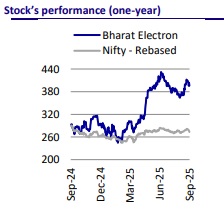

Buy Bharat Electronics Ltd for the Target Rs. 490 by Motilal Oswal Financial Services Ltd

RFP issued for much-awaited QRSAM project

As per press reports, the Indian Army has issued a tender to Bharat Electronics (BHE) for the QRSAM project, also known as Anant Shastra, worth INR300b. The Indian Army will procure 5-6 regiments of the indigenously developed ‘Anant Shastra’ surface-to-air missile weapon systems and BHE will be the lead integrator. This order enhances BHE’s order book to more than INR1t now. Along with this order, we also expect BHE to benefit from orders for next-generation corvettes, electronics warfare, follow-on orders for electronics for 97 Tejas Mk1A, loitering munition programs, and export opportunities. We maintain our estimates and reiterate BUY on BHE with a TP of INR490, based on 45x Sep’27E earnings.

Key Investment Thesis

Award of Anant Shastra (QRSAM) project

The Indian Army has issued a tender to BHE for the much-awaited QRSAM project, which was developed by DRDO. The Defence Acquisition Council had cleared the procurement proposal for this project shortly after Operation Sindoor in May’25. This project is worth nearly INR300b and would strengthen the Indian Army's air defense system. This mobile system can search, track and engage targets on the move, with a firing range of around 30km, complementing existing MRSAM and Akash systems. BHE will be the lead integrator for this project. We also expect the award of missiles for QRSAM to flow through to Bharat Dynamics (BDL). Our estimates already factor in the award of this project, and we expect the execution to commence primarily from FY27 onward.

Other projects in pipeline for BHE

Beyond this QRSAM project, over the next 12-18 months, we expect the company to benefit from the finalization of orders for next-generation corvettes, multiple subsystem orders for the MF-STAR radar program, which are currently under configuration and pricing discussions with shipyards, Shatrughat and Samaghat electronic warfare (EW) systems, follow-on order for 97 LCA Mk1A, aircraft and loitering munition programs such as MALE-class drones. BHE is also well positioned across 8-10 items for an emergency procurement program and has also tied up with players for EoI for AMCA program. These orders, coupled with its existing strong order book of more than INR1t, now will help BHE sustain 15-17% revenue growth over the next 5- 7 years.

BHE can potentially target large number of items from TPCR 2025 roadmap

From the recently announced technology and capability road map, TPCR 2025, we expect BHE can target wide-ranging opportunities across all three services, with the Army focusing on EW systems, radios, radar modules, and dronecountering solutions; the Navy seeking advanced radars, sonar suites, ESM systems, integrated masts, maritime communication networks, and tactical 4G/5G systems; and the Air Force requiring secure communication networks, surveillance radars, EW suites, IFF systems, and AI/ML-based data fusion. Under TPCR 2025, annual potential ordering for the sector can be USD25-30b over the next couple of years.

Financial outlook

Our estimates already factor in large-sized order inflows from QRSAM and nextgeneration corvettes to materialize between FY26 and FY27. We also bake in longer gestation period for these orders and expect a sales/EBITDA/PAT CAGR of 18%/17%/17% over FY25-28. We expect OCF/FCF to remain strong over FY26-28, led by control over working capital. Further, the company has a cash surplus of INR94b (as of FY25), providing scope for further capacity expansion.

Valuation and view

BHE is currently trading at 48.2x/40.3x/33.8x on FY26E/FY27E/FY28E EPS. We maintain our BUY rating and two-year forward TP of INR490, based on 45x Sep’27E earnings.

Key risks and concerns

A slowdown in order inflows from the defense and non-defense segments, intensified competition, further delays in the finalization of large tenders, a sharp rise in commodity prices, and delays in payments from the MoD can adversely impact our estimates on revenue, margins, and cash flows.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)