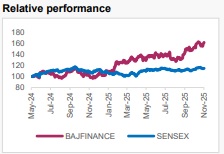

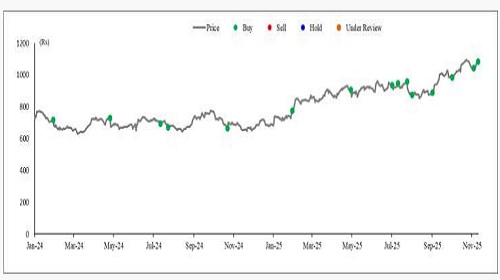

Buy Bajaj Finance Ltd For Target Rs. 1,200 - Axis Securities Ltd

Credit Cost Improvement in H2; Growth Guidance for FY26 Cut!

Est. Vs. Actual for Q2FY26: NII – INLINE ; PPOP – INLINE; PAT – INLINE

Changes in Estimates post Q2FY26

FY26E/FY27E/FY28E (%): NII -1.8/-1.8/-1.6; PPOP -1.2/-1.3/-1.4; PAT -1.5/0.0/+0.2

Recommendation Rationale

* Festive Cheer Spurs Growth: BAF reported a robust festive season (Navratri – Diwali) business growth driven by a strong consumption-led growth. This was supported by the structural reforms in income tax and GST, lifting consumer sentiment and spurring consumption. The company disbursed a record 6.3 Mn consumer loans, recording a growth of 27% YoY in volume and 29% YoY in value terms. Overall disbursement volume during this period was 7.4 Mn loans, recording a growth of 26% YoY, compared to the previous festive period. During the same period, the company added 2.3 Mn new customers, with ~52% being NTC. BAF not only witnessed a surge in disbursements, but also a premiumization trend with consumers shifting to higher-quality products (mainly TVs and ACs) for better lifestyles.

* Growth Guidance Cut Due to Captive 2/3Wheeler and MSME: BAF has been witnessing stress in the SME and Captive 2/3 Wheeler business (book running down). Taking corrective measures, BAF has cut 25% of its unsecured MSME volumes in the SME business and expects growth to settle at 10-12% in FY26. The management has guided for the worst to be behind by Q4FY26/Q1FY27, post which the company will look to recalibrate growth in the segment. Resultantly, driven by slower growth guidance in the Mortgage business (BHFL) and the SME segment (collectively contributing 42% of the portfolio), the management has cut its growth guidance to 22-23% for FY26. However, the strong traction in the newer segments of Gold, New Car Financing, LAP, and Tractor loans should partially offset the impact of slowdown from these 2 segments. We expect BAF’s growth momentum to revert to its normalized growth rate of ~24-25% CAGR over the medium term as the SME book resumes its growth trajectory.

* Asset Quality and Credit Costs to Improve Over H2: During Q2, credit costs were elevated in 2 & 3-wheeler and MSME business. The management indicated that the increase in GNPA is a seasonal phenomenon; however, a higher contribution was from MSME (+6bps) and Captive business (+12bps). However, BAF has taken significant credit actions in the MSME business and expects credit costs to gradually taper over H2. The captive 2/3 Wheeler business has been running down and expects the contribution to credit costs to be meaningfully lower in H2 (vs 9% currently) and further lower in FY27. The portfolio quality in the other segments continues to remain pristine. The company also restructured standard advances to the tune of Rs 288 Cr (vs Rs 219 Cr QoQ) and does not expect any significant restructuring in H2. The management has maintained its credit costs guidance of 185- 195bps for FY26, with credit costs settling at the upper end of the guidance. However, wth improvement in the troubled portfolios, BAF expects FY27 credit costs to be materially lower. Our credit cost estimates are largely in line with guidance, and we pencil in credit costs to range between 1.8-2% over FY26-28E.

Sector Outlook: Positive

Company Outlook: The slower growth delivery in FY26 is in line with the company's principle of pulling back growth while prioritizing asset quality. However, with strong traction continuing in the newer segments and normalcy returning in the SME book from Q4/Q1FY27, we expect growth delivery of 24-25% to resume from FY27 onwards. NIMs are expected to remain steady as the company intends to pass on the benefit of the rate cut to customers. Improving operational efficiency should gradually drive down Opex ratios. With meaningful improvement in credit costs from FY27 onwards, we expect BAF to revert to RoA/RoE delivery of 4.5%/20-22% over FY27-28 vs 4.4/19.5% in FY26.

Current Valuation: 5.1x Sep’27E ABV Earlier Valuation: 5.2x FY27E ABV

Current TP: Rs 1,200/share. Earlier TP: Rs 1,160/share

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance:

* Operational Performance: BAF added ~4.1 Mn customers (+4% YoY/-12% QoQ) during the qtr. vs 4.0/4.7 Mn customer YoY/QoQ, taking the total customer base to 110.6 Mn customers (+20/4% YoY/QoQ). The company booked ~12.2 Mn loans during the quarter. (+26/-10% YoY/QoQ). AUM growth was healthy at 24/5% YoY/QoQ, with growth healthy across most segments, except auto financing (winding down captive business) and SME Business (+18/-2% YoY/QoQ).

* Financial Performance: NII grew by 22/5% YoY/QoQ, in line with our expectations. NIMs (calc.) were flat QoQ and stood at 9.55% vs 9.53% QoQ. Non-interest income grew by 13%/flat YoY/QoQ. Opex grew by 18/4% YoY/QoQ with C-I Ratio steady at 32.6% vs 32.7% QoQ. PPOP grew by 21/5% YoY/QoQ. Credit costs stood at 201bps vs 198bps QoQ. Earnings growth was strong at 23/4% YoY/QoQ.

* Asset Quality deteriorated with GNPA/NNPA up 21/10bps QoQ to stand at 1.24/0.6% vs 1.03/0.5% vs QoQ. PCR stood at 52% vs 51% QoQ.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633