Auto & Auto Ancillaries Sector Update : Yet another mega shift in motion; Ather – The frontrunner by Emkay Global Financial Services

Yet another mega shift in motion; Ather – The frontrunner

The Indian 2W industry is on the cusp of yet another ‘value migration’ as customer preferences shift to electric 2Ws (E-2Ws), which offer a trinity of superior cost-economics and convenience, aided by futuristic offerings (smart, intelligent, connected). Notwithstanding the near-term GST cut-led demand spike for ICE-2Ws, this shift is expected to coincide with the slowing domestic 2W industry growth (3% volume CAGR over FY26E-35E), as household (HH) penetration levels approach saturation (64%/85% in FY25/35E). We expect domestic E-2W volumes to expand ~13-15x over FY25-35E, forming ~60% of domestic 2W volumes, with key category growth barriers being addressed; domestic ICE-2Ws to nearly halve from current levels. Despite significant reduction in subsidies and GST cuts on ICE-2Ws, we note a sustained spike in E-2W penetration (7.4/8.1% in FY26YTD/Sep-25 vs 6/5% in FY24/25). The path to profitability is emerging strongly for E-2W OEMs, with sharply improving cost curves and >20% gross margin. We expect further consolidation in E-2Ws (as seen during previous mega-shifts), with a disproportionate share of the profit pool being enjoyed by category leaders. We believe Indian 2W OEMs, with their globally competitive size/scale and steepening learning curve, can withstand competition from Japanese OEMs (which have lagged in E-2Ws across ASEAN markets; traditional stronghold in ICE-2Ws). We prefer to play the E-2W theme with Ather Energy (initiate with BUY; TP of Rs925; 51% upside), Ola Electric (initiate with BUY; TP: Rs65; 30% upside), and TVS Motor (BUY; TP: Rs4,200; 20% upside). We downgrade HMCL to ADD (TP: Rs6,000; 8% upside) as its core portfolio faces electrification risk even as it is addressing legacy pain, valuation remains reasonable, and it becomes a proxy play on Ather; retain ADD on BJAUT (TP Rs9,500; 5% upside) as its strong exports franchise and is seen offsetting its weakening domestic franchise. We downgrade EIM to ADD (TP: Rs6,900) as valuations appear rich despite its premium motorcycle franchise being shielded from EV risk.

Domestic 2Ws stagnating; E-2Ws shift to a secular trend with 13-15x rise in 10Y

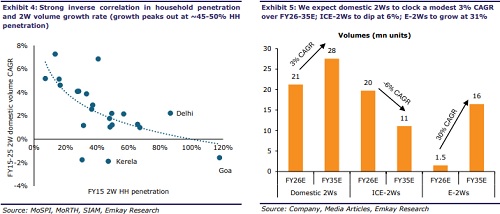

Per our state-wise household and sales analysis, 2W volume growth peaks at 45–50% penetration, showing an inverse correlation between penetration and growth. Over FY15- 25, the top-12 states rose only 1%, while the pan-India growth of 3% was driven by the rest of India (RoI; ‘Hindi’ belt) growing 4%. With RoI penetration at 55% (FY25)—also the level where growth tapered for the top states, 2W volumes face a material slowdown risk over FY25-35E. After the near-term GST-cut led demand spike, we expect the domestic 2W industry to stagnate at 3% CAGR over FY26E-35E. This is likely to coincide with the secular customer-preference shift toward E-2Ws, with volumes expected to rise 13-15x over FY25-35E, and a steep adoption curve akin to that seen during the geared scooters to motorcycle shift during the late 1990s in a base-case scenario. We highlight the possibility of an even steeper curve, as E-2Ws match all the 3 reasons for past mega shifts seen in the 2W industry, ie a) superior cost economics (upfront costs rapidly converging toward ICE-2Ws and operating costs at 1/10th of ICE-2Ws’), b) convenience (automatic transmission, better NVH), and c) futuristic (smart, intelligent, connected). Despite a staggered cut in central and state incentives (eg FAME-II and EMPS) to Rs5k/vehicle in FY26 vs Rs45k in FY23, we see a spike in retail E-2W penetration (7.4/8% in FY26TD/Sep-25 vs 5.8% in FY25) as key category growth barriers of charging, affordability, reliability, and resale value are being addressed.

Path to profitability emerging for E-2Ws; gross profit/vehicle above ICE-2Ws’

E-2W OEMs are already delivering >20% GM, translating into a gross profit/vehicle already above that of ICE-2Ws, led by >30% reduction in BOM cost (on tech-led cost curves as well as falling cell prices) over the past 3-4Y and despite a staggered subsidy cut. This is a crucial inflection point, as EVs were previously viewed as sub-scale and margin-dilutive. This has been led by a steep technology-/cost-curve seen in EVs with further scope to improve. We expect GM (for Ather/Ola) to cross 30%, as operating leverage, technology-led value engineering, and non-vehicle revenues (software subscriptions, accessories, etc) kick in. A sustained improvement in the gross margin of E-2Ws amid upward pressure on ICE-2Ws (and as emission norms continue to tighten) could trigger an acceleration in E-2W adoption, even as the profitability of E-2Ws improves significantly.

Consolidation in play, with a few players enjoying a disproportionate profit pool

The E-2W space is undergoing a rapid consolidation phase (like the ICE 2W industry in the past, when motorcycle/scooter’s shares eventually consolidated around a handful of scaled leaders like Hero/Honda who grabbed 50% of the motorcycle/scooter market respectively) as the category matures. Over the last 3Y, the top 5 OEMs (Ola, Ather, TVS, BJAUT, and HMCL) expanded their combined share to 85% (<60% in FY22), while smaller startups stagnated or exited. With EVs being capital-/tech-intensive, scale advantages in localization, vertical integration, and distribution will only accelerate this process, with a few leading players likely enjoying a disproportionate share of the profit pool. OEMs have also realized that sustainable growth lies in offering differentiated/superior value, deterring price wars. We expect Ather to be the winner among start-ups; TVSL among incumbents to further consolidate its position.

Key standouts – Ather, Ola, TVS; EIM well shielded; HMCL, BJAUT at crossroads

We prefer to play the E-2W theme with i) Ather Energy (initiate with BUY; TP: Rs925) as it is entering the scale up phase with brand and product now established, akin to Royal Enfield’s 2013-17 phase, ii) Ola Electric (initiate with BUY; TP: Rs65) as product and services issues are being resolved (reinforced by channel checks) which is increasing visibility for improving profitability, and iii) TVS Motor (BUY; TP: Rs4,200), which has been sucessful in consistently identifying consumer preferences, incubating multiple successful brands, and is also leading in EVs. We downgrade HMCL (ADD; TP Rs6,000) as its valuations are reasonable and HCML becomes a proxy-play on Ather, though its core product portfolio is exposed to electrification risk. We retain ADD on BJAUT (TP: Rs9,500), as its strong export franchise is offsetting its weakening domestic franchise. We downgrade EIM (ADD; Rs6,900) as its rich valuations limit the upside, although its premium motorcycle and exports franchise is shielded from EV risk.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354