NBFC Sector Update :Tale of two giants By Elara Capital

Back in August 2024 in our report titled ‘Top-up loans–ticking time bomb’, we had underscored credit risk concerns in unsecured retail lending, recommending investor prudence. We are now building in a more optimistic stance, driven by favorable lead indicators. While risk-adjusted growth is on a rebound with fresh delinquency flows being arrested, peak asset quality stress is on the horizon (between Q4FY25 and Q1FY26) for consumer financiers. Such a scenario bodes well for Bajaj Finance (BAF IN) and SBI Cards and Payment Services (SBICARD IN) and we upgrade BAF to BUY and SBICARD to Accumulate rating. Refer individual Company sections for details

Consumer finance – Measured-yet-encouraging uptrend: A confluence of positive macroeconomic trends – declining interest rates and liquidity infusion, better rural credit offtake vs urban, anticipated 8 th Pay Commission led salaries and allowances rise, budgetary impetus through tax cuts/subsidies and allocation towards healthcare and education and a favorable monsoon – are re-establishing unsecured retail lending landscape. NBFCs’ focus on bad assets resolutions and regulatory compliance led to a short-term dip in disbursals during 9MFY25, but personal (PLs) and consumer durable loans are now rebounding. Return of growth in PLs since the past 2-3 months (Refer RBI’s bank credit data -Exhibit 4), traction in fintech loans in INR 5mn, and NBFCs continuing to gain market share in the segment are initial indicators of healthy growth rebound in the space. New credit card issuances were hit since Q1FY24, but both markets leaders; viz, HDFCB and SBICARD have witnessed marginal yet consistent increase in credit card issuances market share since 3 months. SBICARD has turned towards prioritizing market share growth driven by favorable trends in new customer behavior

Asset quality woes not fully behind, but lead indicators indicate improving dynamics: Notwithstanding the unavailability of latest official quarterly data, industry insights provide a preliminary indication of: (i) heightened prudence & reduced disbursal limits to new-to-credit (NTC) across segments, keeping fresh delinquencies in check, (ii) leveraging seamless data access via account aggregator platforms (iii) 10-20bps improvement in collection efficiencies across key segments in past 2-3 months (iv) no meaningful drop yet in 30 & 90dpd stock but reduction in the bucketing movement across and (v) no peaking out of FY24 delinquencies but positive trends in fresh FY25 customer cohort (especially in credit card segment). Although asset quality woes are not entirely resolved, the aforesaid indicators portend a sectoral rebound.

Upgrade BAF to BUY, SBICARD to Accumulate: BAF and SBICARD are well-set to partake the retail cyclical uptrend. BAF – stage set for elephant to dance yet again: BAF is primed for a rating upgrade. While changes in key management have contributed to the recent uptick in its valuation, the strategic edges that could pivot a re-rating that should enable a sustained 25% AUM and 25% EPS CAGRs are yet to fully play out. BAF is poised to deliver a 24% NII CAGR, translating into 4.9% RoA and 21% RoE through FY24-27E. We revise BAF to BUY from ACCUMULATE, valuing its standalone book at 5.0x FY27E P/ABV and BHFL at 3.8x FY27E P/ABV to arrive at a raised SoTP-TP of INR 11,161 (from INR 8,892). Key risk to our call is continued elevated credit costs

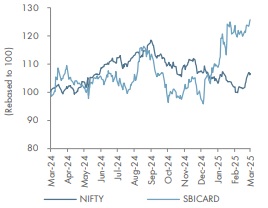

SBICARD – situation at a defining moment: SBICARD is on the verge of a crucial turning point, with challenges in the credit card industry seemingly reaching a peak and business focus shifting back. Factoring in a calibrated CIF accretion, modest fee expansion, stagnancy in high interest-bearing assets, we envisage an 11.5% CIF CAGR, a 14.5% spend CAGR, an 18.7% NII CAGR and a 20.7% receivables CAGR, translating into 16.5% EPS CAGR through FY24-27E with RoAs at 4.4% and RoEs at 21.1% in FY27E. We upgrade SBICARD to Accumulate from Reduce, as it is set to ride the consumer discretionary wave. We raise our DCF-based TP to INR 965 (from INR 796), valuing SBICARD at 24x FY27E P/E. Key risk to our call is persistent elevated credit costs.

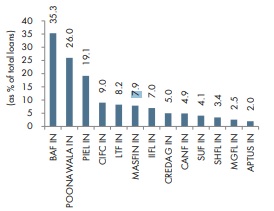

BAF, POONWALA, PIEL dominate the unsecured credit market (Q3FY25)

BAF versus Nifty 12M

SBICARD versus Nifty 12M

Please refer disclaimer at Report

SEBI Registration number is INH000000933

Tag News

Realty Sector Update :Developers, Flexible Office Space and Construction by Choice Institut...