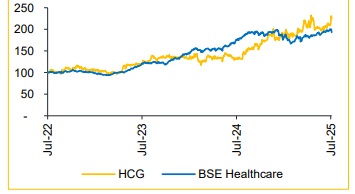

Add Healthcare global enterprises Ltd For Target Rs. 700 By Choice Broking Ltd

HCG streamlines for high-margin oncology growth

HCG is strategically realigning its facility portfolio to focus exclusively on specialised oncology care, transitioning away from the multi-specialty model. This shift is aimed at enhancing its value proposition for international patients while deepening its presence in core domestic markets.

Additionally, plans are underway to divest the fertility business, allowing the company to streamline operations and concentrate resources on higher-margin, faster-growing oncology segments. Through this focused strategy, the company targets achieving a revenue growth of 15–20% and an EBITDA margin of ~20% by FY28.

We maintain our estimates and introduce FY28E projections. We forecast revenue/EBITDA/PAT to grow at a CAGR of 17.1%/22.3%/87.6% over FY25– FY28E. Valuing the stock at an EV/EBITDA multiple of 17x (unchanged) on the average of FY27 and FY28 estimates, we arrive at a revised target price of INR 700 (earlier INR 590), maintaining our ADD rating.

Result misses our expectations with increased finance cost

* Revenue came at INR 6.1 Bn (vs. CIE est. of INR 6.5 Bn), up 16.7% YoY and 4.8% QoQ.

* ARPOB stood at INR 44,751, up 0.7% YoY and 1.2% QoQ, while occupancy improved to 67.1% vs. 65.6% in Q1FY25.

* EBITDA came at INR 1.1 Bn (vs. CIE est. of INR 1.2 Bn), up 18.6% YoY and 2% QoQ. EBITDA margin came at 17.6% (vs. CIE est. of 17.8%), expanded 28 bps YoY and contracted by 50 bps QoQ.

* PAT came at INR 0.05 Bn (vs. CIE est. of INR 0.18 Bn), down 60.7% YoY and 35.5% QoQ, due to higher interest and tax expenses.

Scaling capacity to fuel the next phase of growth: 900-beds by FY28

HCG is set to expand its operational capacity by ~900 beds over the next 3 years, targeting ~2,700 beds by FY28E. This growth will be driven by a combination of organic expansions, brownfield developments, and strategic acquisitions. The focus remains on high-ARPOB, high-demand markets like Bengaluru and Ahmedabad to maximize returns. We believe, as these new centers ramp up, they are expected to provide substantial operating leverage and reinforce long-term growth trajectory. HCG’s transition to KKR as a strategic investor is a significant development. KKR, with its profound experience in global healthcare investments, brings not only financial strength but also strategic vision, helping HCG’s long-term goals.

High ARPOB Growth in Metro Clusters Driving Margin Expansion

HCG’s metro centers in Bangalore, Ahmedabad, Mumbai, and Kolkata are critical margin drivers due to their higher ARPOB levels. The Bangalore flagship center reports an ARPOB of INR 75-80K, while the Mumbai and Kolkata centers report ARPOBs of INR 60K, significantly higher than the company’s overall ARPOB of INR 44,750. We expect that as the patient mix shifts towards high-end therapies and ALOS reduces, ARPOB is expected to grow by 6-7% in FY26. This ARPOB-led revenue optimization, particularly in high-end metro clusters, ensures that HCG’s profitability trajectory remains strong despite sector-wide pricing pressures.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131