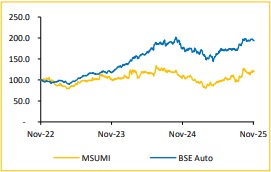

Reduce Motherson Sumi Wiring Ltd For Target Rs. 48 By Choice Broking Ltd

Near-term Margin Under Pressure, Recovery in Sight

EBITDA Margin is Expected to Remain Under Pressure in the Near-Term:

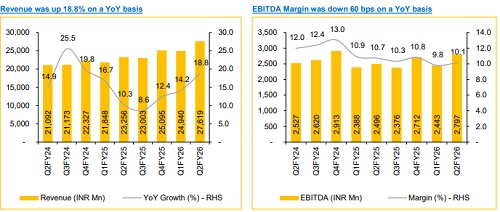

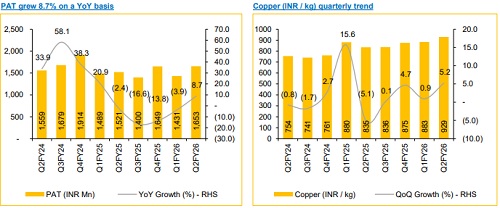

MSUMI reported a highest ever quarterly revenue of INR 27,619 Mn, with 19% YoY growth and 12% YoY rise in EBITDA. However, EBITDA margin declined 60 bps YoY, driven by higher raw material costs, staff expenses and greenfield project outlays. Despite headwinds from rising copper prices and negative EBITDA from ramping greenfield projects, the company achieved sequential margin improvement. We believe EBITDA margin will remain under pressure in the next few quarters, primarily due to start-up costs and raw material headwinds. We expect H2FY26E margin to stay strained and moderate thereafter in FY27E, with further improvement in FY28E as new plants ramp up production and volumes materialize.

View and Valuation: We revise our FY26/FY27E EPS estimates upwards by 0.7%/2.2%, respectively and arrive at a target price of INR 48 (maintained), valuing the company at 33x (maintained) average FY27/28E EPS. Conversely, we reiterate our ‘REDUCE’ rating on the stock, factoring in uncertainty about future margin improvement.

Q2FY26 results: Revenue beat, while margin pressure persists

* Revenue was up 18.8% YoY and up 10.7% QoQ to INR 27,619Mn (vs CIE est. at INR 26,022Mn).

* EBITDA was up 12.1% YoY and up 14.5% QoQ to INR 2,797Mn (vs CIE est. at INR 2,706Mn). EBITDA margin was down 60bps YoY and up 33bps QoQ to 10.1% (vs CIE est. at 10.4%).

* PAT was up 8.7% YoY and up 15.5% QoQ to INR 1,653Mn (vs CIE est. at INR 1,624Mn).

Best ever Quarterly Performance in terms of Revenue: MSUMI posted robust revenue growth (+19% YoY) during the quarter, outpacing industry growth, driven by higher premiumisation, volume gains and increased participation in new model launches. The recently operational greenfield facility is ramping up as planned and upcoming projects at Navgam (Gujarat) and Pune (Maharashtra) are expected to further strengthen long-term growth visibility. With a growing EV revenue share and expanding order book, MSUMI remains well positioned to capture opportunities arising from the automotive industry’s transition toward EV and hybrid powertrains. Continued capacity expansion and incremental order wins underpin steady medium-term growth momentum.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131