Buy Archean Chemical Industries Ltd For the target Rs. 520 by the Axis Securites

Recommendation Rationale

Subdued Volumes for Bromine & Industrial Salt: During the quarter, the company witnessed a sequential degrowth in bromine and salt volumes. However, there was a slight improvement in price realisation for both products. The management expects a quarterly run rate of approximately 10 Lc for salt volumes, supported by healthy inquiries across its product lines. Additionally, the order book remains strong, with locked-in volumes for both bromine and salt for the next 6-12 months. Over the next few quarters, captive bromine consumption is expected to increase to 20-25% of total bromine production (from the current 5-7%), driven by increasing orders from Middle East customers.

New Initiatives: Archean’s step-down subsidiary, SiCSem Pvt. Ltd., is set to establish a Compound Semiconductor Facility in Odisha with an estimated investment of up to Rs 3,000 Cr. The project will receive a capital expenditure subsidy from the state government. The facility will integrate the entire process of manufacturing power devices, including a Wafer Fabrication Plant, positioning the company strategically in the semiconductor space. Additionally, the company is progressing towards commissioning the Oren Hydrocarbon plants and conducting SoP trials. Investments are being made to expand its product portfolio and optimise costs, reinforcing its long-term growth strategy.

Sector Outlook: Neutral

Company Outlook & Guidance: The company remains confident in its Bromine Derivatives project and the strategic acquisition of Oren, which is expected to contribute meaningfully to the topline in coming quarters. Additionally, the company anticipates sustained strong demand in the Industrial Salt segment and a recovery in the SOP segment beginning in FY26. Strategic investments have also been made in two UK- and US-based companies, which are projected to unlock new growth opportunities in semiconductors and energy storage.

Current Valuation: 9x FY27E (Earlier: 11x FY27E)

Current TP: Rs 520/share (Earlier: 730/share)

Recommendation: We change our rating on the stock from HOLD to BUY

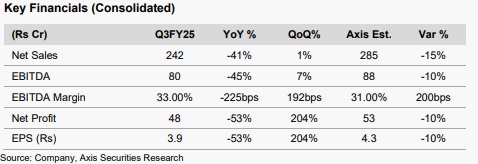

Financial Performance: Consolidated revenue stood at Rs 242 Cr, down 41% YoY and flat QoQ, missing our estimate by 15%. EBITDA was Rs 80 Cr, down 45% YoY and up 7% QoQ, falling short of our estimates by 10%. The EBITDA margin stood at 33%, down 225 bps YoY. The company's PAT was Rs 48 Cr, a significant drop of 53% YoY and up 204% QoQ, missing our estimate by 10%.

Outlook While Archean faced multiple challenges in the past two quarters, weather conditions have improved, and demand is expected to pick up going forward. The company’s long-term prospects remain intact, supported by its robust product portfolio and competitive positioning. The integration of Oren Hydrocarbons is progressing as planned and is anticipated to deliver substantial synergies starting FY26. Furthermore, the company is investing in new growth areas, which will aid in diversifying its revenue base and mitigating earnings volatility.

Valuation & Recommendation We have revised our estimates for FY25E/FY26E/FY27E downwards to reflect the weaker-than-expected price recovery in bromine and uncertainties surrounding the volume ramp-up. We now rate the stock at 9x FY27E (earlier 11x FY27E), considering a slowdown in growth. However, we believe the recent correction in the stock has factored in the worst and is now attractively valued. Accordingly, we are upgrading our rating from HOLD to BUY, with a target price of Rs 520/share. This TP suggests a 12% upside from the current market price (CMP).

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)