Reduce L&T Finance Ltd For Target Rs. 240 By Emkay Global Financial Services Ltd

Stable quarter; positive outlook on growth and credit cost

LTF posted broadly steady Q2FY26 results, with overall AUM growth at 15% YoY (~5% QoQ) led by strong disbursements across the retail segment (incl MFI, PL, GL). Margin (NIM+fee) was broadly stable at 10.22%, while NIM improved by ~18bps on account of moderating CoF (~26bps QoQ) and credit cost improving QoQ to 2.41% (2.98%, net of macro provision utilization of Rs1.5bn). Greenshoots visible in MFI, focus on acquiring prime/near-prime customers, and broader rollout of Cyclops are expected to help contain FY26 credit cost at 2.3-2.5% (LTF aspires to reduce it to 2% in the medium term). Also, the mgmt plans rebuilding macro buffers using recoveries from the SR book, where several accounts are in the advanced stage of resolution. Building in the Q2 performance and the H2 outlook, we tweak our estimates – increase FY26-28E RoE by 15-60bps and FY26-28E EPS by 2-5%; we retain REDUCE while revising up Sep-26E TP by 14% to Rs240 (from Rs210), implying FY27E P/B of 2.0x.

Stable quarter, with visible improvement in MFI

LTF logged PAT of Rs7.3bn – ~5% QoQ/YoY growth, marginally hit by continued elevated credit cost (at 2.41%), which has started declining and is expected to moderate further in coming quarters. Overall AUM growth was 5%/15% QoQ/YoY, led by robust disbursements (~Rs189bn) across products. Margins (NIMs+Fees) were broadly stable at 10.22%, while NIMs improved by ~18bps led by CoF moderation. Fee income in the quarter moderated, on change in asset mix due to slower growth in the MFI segment resulting in rising share of low-yielding product in overall AUM. Asset quality was largely stable, with GS3/NS3 at 3.27%/1%; the mgmt has utilized Rs1.5bn of the macro prudential buffer in MFI. RoA/RoE for the quarter improved slightly to 2.41%/11.33%.

Medium-term growth guidance of 20-25%; credit cost of ~2%

The mgmt informed that MFI stress is expected to peak in Q2, and the segment is likely to see demand recovery/improving collection efficiency. While it expects a strong demand recovery in H2FY26 led by good monsoons, festive demand, and revival in capex spend, the mgmt reiterated growth guidance of ~20-25%. Credit costs are expected to ease to ~2% as benefits from the Cyclops implementation start to materialize, increasing the share of prime customers, with pressure from the MFI segment subsiding and opex moderating on reduced collection cost. However, yield saw some moderation due to the changing product mix and Cyclops implementation, leading to better quality customer selection, with NIM + fee staying at ~10-10.5%. The mgmt also plans to create a macro buffer (not product-specific) from recovery in the SR book’s resolution (FY27-28E).

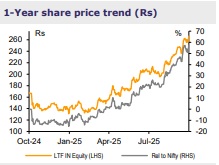

We maintain REDUCE; increase TP by ~14% to Rs240

To reflect the Q2 show/developments in MFI and MSME segments, we slightly raise FY26- 28E disbursement and AUM growth. We cut margin by ~5-15bps and credit cost by 5- 25bps due to the changing asset mix and focus on prime customers; this leads to 2-5% rise in EPS over FY26-28E. We retain REDUCE on the stock and raise Sep-26E TP by 14% to Rs240, implying FY27E P/B of 2.0x.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)