Buy Tata Consultancy Services Ltd For Target Rs. 3,970 By Elara Capital

Valuations undemanding

We upgrade Tata Consultancy Services (TCS IN) to BUY from Accumulate as: i) valuations are closer to pre-Covid levels, ii) given the continued thrust by clients to spend on technology, iii) strong TCV and iv) short-lived tariff related impact, as indicated by the management. Q4 revenue came in tad below our estimates and margin for Q4 was hit by tactical interventions – Planned promotion of some senior employees and certain brand-related spends. TCS ended FY25 with 4.2% growth in CC terms and 3.8% in USD terms. We cut our FY26E revenue numbers to reflect an uncertain environment, which may impact growth in H1, which typically is a strong half. We expect the growth to rebound in FY27. We have tweaked our FY26/27 margin estimates to reflect a rise in cost due to an uptick in attrition. TCS has strengthened its leadership by appointing its COO and chief strategy officer, both from the Tata Group.

Q4 revenue hit by a pause in certain projects

TCS reported a revenue de-growth of -1% (-1% QoQ in CC) in Q4 due to continued weakness in discretionary spend as well as a pause in certain programs by the clients. In INR terms, the drop was limited due to INR depreciation against USD growth as revenues in INR growth were up 0.8% QoQ.

Geography-wise and in USD YoY, North America and continental Europe reported a drop of 2.3% and 0.7%, respectively. Growth in the UK market also came down to 1.4% YoY compared with close to double-digits in the earlier quarters. India market grew 27% YoY and its revenue contribution is now ~8.4% (down from ~10% in Q3FY25).

Vertical-wise and in USD YoY, Consumer business, Life Sciences, Manufacturing and Communications continued to report a drop, even as BFSI and Energy reported some growth. TCS recorded a TCV of USD 12.2bn in Q4 and USD 36.4bn in FY25. Q4 TCV for BFSI, Retail and North America was USD 4.0bn, USD 1.7bn and USD 6.8bn, respectively.

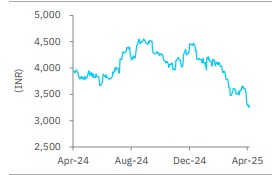

Price chart

EBIT margins were down QoQ due to tactical interventions:

EBIT margin contracted 30bps QoQ to 24.2%. There was an impact of 100bps in Q4 due to tactical interventions in the form of promotions of a few senior employees, effective from 1 January 2025. There was an additional 60bps impact due to certain brand-related expenses. This was largely mitigated by a shift in revenue mix (towards more international) as well as continued efforts on cost rationalization. An additional 40bps tailwind has come from currency in Q4. TCS is yet to decide on wage hikes for FY26 due to uncertain environment.

Upgrade to BUY; TP pared to INR 3,970:

We cut FY26E USD revenue estimates to ~2% (from 7% earlier) to factor in short-term tariff related disturbance. We build in recovery from FY27 and factor in 6.5% growth in FY27E. We cut FY26E/27E EBIT margin estimate by 20/10bps, as we continue to build in lower-than-guided margin. We also cut multiple from 28x to 26x to reflect weak FY26. So, we cut TP to INR 3,970 from INR 4,530. Demand recovery may lead to some uptick in attrition and TCS may have to incur incremental costs without compromising on capturing demand. We upgrade TCS to BUY from Accumulate as valuations are undemanding.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)