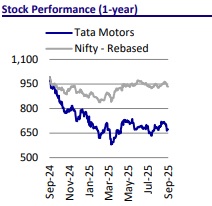

Neutral Tata Motors Ltd for the Target Rs. 686 by Motilal Oswal Financial Services Ltd

JLR continues to face headwinds

GST rate cuts to boost India PV/CV segments

We attended Tata Motors’ (TTMT) analyst meet hosted by the management to give updates on various business segments. The company’s India PV segment is witnessing a pickup in demand after GST rate cuts, and management expects the segment to post 8- 10% growth in 2HFY26. Moreover, TTMT expects to outperform the overall domestic PV segment on the back of its new model launches, leadership in the compact SUV segment, and rising demand for its EV and CNG variants. In CVs, management expects demand to pick up in 2H, backed by increased consumption and improving profitability of fleet operators. Synergy benefits with IVECO include complementary product and regional mix and commonality of sourcing and scale benefits. The demerger process is on track, with the effective date of 1st Oct’25. After the completion of all formalities, its PV entity is likely to get listed first, followed by the CV entity. At JLR, the cyber incident has disrupted production for most of Sep’25, and hence it has lined up funding lines to ensure that sufficient working capital is available at all times. While JLR has now indicated a phased production start, it is likely to take some time for production to return to normalcy. Nonetheless, JLR is facing several headwinds, which include: 1) tariff-led slowdown for exports to the US; 2) demand weakness in key regions like Europe and China; and 3) rising VME, warranty and emission costs. For the lack of any triggers, we reiterate our Neutral rating on TTMT with Sep’27E SoTP-based TP of INR686.

Here are the key takeaways from the analyst meet:

CVs: GST rate cuts expected to drive revival

* For the CV segment, the impact of GST rate cuts would be different across sub-segments. Quite a few customers avail input tax credit (ITC) on GST; hence, for such customers, the GST rate cut will not be a material benefit. For instance, in HCVs, about 60-70% of customers are B2B operators who claim ITC. In the case of ILCVs, around 40% of customers claim ITC. On the other hand, only 18% in SCVs claim ITC. Thus, the benefit of GST rate cuts is the highest for low-tonnage segments.

* Management has maintained its earlier growth guidance for CVs – flat growth or marginal decline in 1HFY26 and double-digit growth in 2H on the back of GST rate cuts.

* Beyond this, GST rate cuts would also help to reduce opex for fleet operators given that GST rates have been cut on components and consumables like lubricants. The GST rate cut is expected to reduce their opex by about 1-2%, as per management. This would, in turn, improve fleet operators’ profitability going forward, which can help them expand their fleet when demand picks up.

* The GST rate cut is expected to boost consumption for about one-third of household categories. This would, in turn, drive freight demand. As per management, freight demand, which has been growing at 5-7%, can now potentially see 100bp additional growth thanks to this boost.

* On the infrastructure side, MHCV demand has been volatile this year. In states like Uttar Pradesh, the year started with weak traction in construction and roadrelated projects. However, the latest trends point to a turnaround, with activity gradually picking up again. Notably, Sep’25 has already registered encouraging demand for tippers, despite heavy rainfall in several parts of the country. This is an important signal that infrastructure-related demand is reviving, and going forward, it should provide an additional leg of support to overall CV demand revival.

* Over the past few years, TTMT has consciously stayed away from the EV market. However, a few large tenders are now coming up. With the payment security mechanism now addressed, TTMT will look to participate in most of these large tenders. One of the prominent upcoming tenders is from CESL for 11k e-buses. TTMT’s EV business has evolved over the years, and management is now confident of delivering EBIT positive performance at the bus operating level in EVs.

* With the launch of ACE Pro, TTMT has introduced a refreshed product and it is gaining traction in the market. With these new developments in the SCV space, TTMT management is confident of regaining some of the lost market share in the segment.

IVECO acquisition update

* Overall, management sees more than 20 distinct synergy levers across cost optimization, R&D, supply chain, product portfolios, and geographic reach. They are highlighted below:

* TTMT hopes to generate significant scale benefits with the acquisition. The combined entity of TTMT and IVECO would hold the No. 4 position in the global MHCV market (6T+) in terms of volumes. It is pertinent to note that the No. 2 and No. 3 players are only about 10,000 units ahead.

* Management also expects strong synergy benefits in Latin America, where IVECO holds No. 3 market position, despite not having introduced its latestgeneration products there. Management believes that TTMT’s products can be introduced into this region, positioned below IVECO offerings, thereby minimizing cannibalization risks and further fortifying the group’s presence in Latin America.

* One of the immediate opportunities is in reducing its operating expenses. Management noted that this can be achieved through two non-financial levers: i) design-to-value initiatives – leveraging TTMT’s frugal engineering capabilities to optimize product development; and ii) platform sharing – using common platforms to bring down costs significantly.

* A detailed review of IVECO’s supply chain highlighted clear opportunities to increase sourcing from Eastern Europe and Asia. Importantly, management has confirmed that this can be done while staying within covenant constraints, pointing to considerable headroom for cost efficiency improvements .

* Further, both companies currently spend around 40% of their R&D budgets on similar projects. This overlap presents an opportunity to rationalize investments and avoid duplication while accelerating development cycles.

* In terms of financial synergies, there are potential revenue synergies in terms of catering to certain niche CV segments in India such as heavy-duty deep mining tippers and tractor-trailers. These are segments where TTMT does not currently participate due to low volumes. These segments are currently dominated by European players, and IVECO’s presence provides a pathway for TTMT to tap into them.

* The partnership would strengthen TTMT’s presence in three major growth markets globally: India, the Middle East & Africa, and Latin America. In Africa, TTMT already operates with in-house distribution, while in the Middle East, both companies work with different distributors, opening up opportunities for synergy.

* IVECO is particularly strong in the intercity bus segment in Europe, with a commanding 55-60% market share. However, it is less dominant in intra-city buses, where electrification is accelerating and players like BYD are gaining ground. TTMT’s proven track record in competing with BYD in India gives it confidence in the combined entity’s ability to tackle competition in the intra-city e-bus market in Europe as well. Additionally, Agratas (TTMT’s battery arm) is expected to play a key role in strengthening the EV offering within a few quarters.

PVs: Discounts remain high despite GST rate cuts

* Management has recalled that the PV segment had gone through a tough phase in the period before the GST rate cuts. Even SUVs, which typically hold stronger pricing power, had to be pushed with discounts. This weakness created significant pressure not only on OEMs but also on dealers, making profitability difficult across the chain.

* Between 15th Aug and the pre-Shradhh period, the industry witnessed a double-digit decline in demand. However, from 5th Sep onward, demand recovery was clearly visible. While the industry is seeing almost 20%+ growth in bookings on YoY basis, TTMT is seeing 25% growth. In the medium to long term, TTMT expects the industry to revert to its normal growth multiplier of 1.2x-1.3x of GDP growth.

* For the industry, 1HFY26 volume remained flat YoY. After the GST rate cut, management expects 2H to deliver 7-8% growth. Nevertheless, overall full-year growth may still come in below 5% given the weak 1H.

* A notable trend is that customers are increasingly considering models above their original price band. This trend is favoring popular models, with both higher-end and entry-level models seeing strong demand.

* In the hatchback segment, TTMT expects incremental demand to come from customers migrating out of the used car market.

* After the GST rate cut, management expects the compact SUV segment (Nexon) and the sub-compact segment (Punch) to be in a sweet spot. TTMT, being a market leader in each of these segments, is expected to benefit from this trend.

* In the larger SUV segment, Harrier and Safari volumes were earlier restricted due to the lack of multi-powertrain options. Having recently launched the EV variants, TTMT now plans to launch these models in petrol as well. In fact, Harrier EV, with a waiting period of 6-8 months, is now outselling its ICE counterpart. Further, a pickup for TTMT is expected in this segment, with the planned launch of petrol variants in 2H, which will allow TTMT to participate in segments where it currently has no presence. This is also among the most profitable models for TTMT alongside Nexon.

* In CNG, the industry is recording 20% volume growth, whereas TTMT is sharply outpacing the industry with strong 50% YoY growth. Almost 45% of TTMT’s PV sales now comes from CNG and EVs.

* EVs have seen a strong bounce back in the past few months, with PV industry volumes growing 67% YoY in the current fiscal. This pickup has largely been driven by the launch of M&M EVs and Harrier EV.

* Management has indicated that the reason EVs are seeing a marked pickup in the higher-end segment is that most of the roadblocks for the EV transition are addressed by that segment (range anxiety + quick charging + long life warranty). With this, TTMT expects its market share in EVs to have improved to 45% in 2Q from 33% in 1Q. The target is to get back to over 50% share in EVs in the coming years on the back of its new launches (three new launches, including facelifts for Punch and Tiago and new Sierra EV).

* Management aims to launch the much-awaited Sierra in 4Q, while teasers are likely to start from 3Q. It also plans to launch a mid-cycle upgrade of Punch and expects this model to cross 20k units per month after the upgrade.

* Management has indicated that TTMT has already gained ~2% market share in Vahan and targets to increase its Vahan share in PVs to 16% from 13% currently. Over the medium term, TTMT aspires to reach 20% share, supported by the launch of seven new products (three EVs and four ICE) and 23 refreshes.

* Management expects to improve PV margins from hereon. Some of the levers include a richer mix, operating leverage benefits and continued cost-cutting efforts.

* Discounts in September, however, have continued at levels that were there preGST as most OEMs look to take maximum benefit of this festive period.

CNG adoption likely to continue to rise

* Management highlighted that CNG now accounts for over 20% of total industry volumes. Growth has been particularly strong in the compact SUV segment, which is emerging as a sweet spot for CNG adoption. Within this segment, Nexon CNG has led the trend, reinforcing TTMT’ positioning in this category.

* Despite broader market sluggishness, CNG volumes are growing by ~20%, suggesting that consumer acceptance remains robust. This resilience is supported by infrastructure expansion, with ~8,000 city gas distribution stations currently operational, with the potential to scale up to 15,000 stations in the coming years.

* Management believes that with this infrastructure build-out and growing consumer preference, the share of CNG in the overall market could rise structurally to 25-30% over the long term.

* By CY30, TTMT management expects the following to be the powertrain mix in the domestic PV industry: CNG: 25%, EV: 20%, Diesel: 5%, Petrol: 50%.

Understanding demerger timelines

* The demerger process is on track and it has already received NCLT approval.

* The effective date for the demerger is 1st Oct’25.

* Once all approvals are in place, the PV entity will be listed first, possibly in Oct, which will be followed by the listing of its CV entity (likely to be in Nov), subject to completion of all pending formalities.

JLR update

* JLR’s production problems began on 31st Aug, when a cyberattack forced it to halt vehicle manufacturing across its three UK plants. Given that its internal systems were hacked, it was forced to shut down its production facilities for almost the entire month of Sep.

* On 29th Sep, JLR announced a phased restart of its production. It is likely to take several weeks before the production goes back to full capacity.

* While the production was shut, its retails were not materially impacted as they had sufficient inventory in the system. They have also managed to do wholesales in Sep, albeit at a slower rate.

* However, given that the production was shut for almost one month, JLR would need immediate near-term working capital to ensure that its supply chain is up and running in this time.

* One of the major risks is to ensure that liquidity measures are in place in the interim, which has now been taken care of. Over the weekend, the UK government has indicated that it would provide loan guarantees worth GBP1.5b to JLR. JLR is likely to continue the liquidity support for few more quarters until the production is up and running normally. The forensic examination is underway at the moment and till it is concluded, management has refrained from giving out details on the matter given the sensitive nature of the event.

* The other unknown factor is the insurance claim, if any, that JLR would need to meet once these case findings are concluded. However, JLR would surely use this as an opportunity to beef up its IT systems going forward.

* The US has imposed a 15% tariff on European imports and 10% on UK imports. Management has indicated that TTMT would bear the impact of luxury tax that has been raised in China from 1Q.

* In terms of demand, management indicated that the US continues to be resilient and China will also hold up. While the UK has remained stable, demand in Europe has seen some initial signs of recovery in Aug.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)