Neutral MCX Ltd for the Target Rs. 6,000 by Motilal Oswal Financial Services Ltd

Earnings miss; product pipeline holds re-rating potential

* MCX posted a 61% YoY (in-line) growth in operating revenue, reaching INR2.9b. For FY25, operating revenue grew 63% YoY to INR11.1b.

* Total expenses rose 66% YoY/21% QoQ to INR1.3b (15% higher than estimates), driven by 75%/51% YoY increase in other expenses and staff costs. EBITDA stood at INR1.6b (57% YoY/down 17% QoQ) in 4QFY25, with EBITDA margins at 55% vs 56.3% in 4QFY24. For FY25, EBITDA stood at INR6.7b.

* The company reported a PAT of INR1.4b, up 54% YoY but down 15% QoQ (13% miss primarily due to higher costs). For FY25, PAT was INR5.6b.

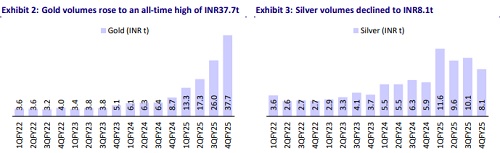

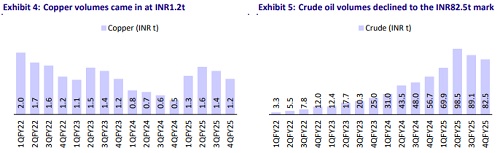

* The quarter reported healthy volumes with an overall jump of 101% YoY (futures volumes grew 38% YoY and options volumes surged 115% YoY). This momentum is expected to sustain, driven by new product launches and increasing participation.

* We have raised our estimates for expenses based on 4Q results. The impact has been offset by an increase in volume growth estimates for the futures segment. Resultantly, our earnings estimates for FY26/27 are broadly unchanged. We reiterate a Neutral rating on the stock with a one-year TP of INR6,000 (premised on 33x FY27E EPS).

Surge in options volumes boosts revenue growth

* The transaction fee for 4QFY25 stood at ~INR2.5b, up 56% YoY, comprising options and futures in the ratio of 71:29 (vs. 3QFY25 at INR2.7b in the ratio of 72:28).

* Options ADT surged 96% YoY to INR2.3t, largely supported by 339% YoY growth in bullion contracts and 64% YoY growth in energy contracts. Futures ADT rose 56% YoY to INR283b, fueled by 45%/74%/66% YoY growth in bullion/energy contracts/base metals.

* Other income stood at INR292m, growing 59% YoY and 27% QoQ (21% higher than our estimates).

* Total expenses (incl. SGF contribution) rose 66% YoY and 21% sequentially at INR1.3b, driven by higher tech and staff costs.

* Staff costs increased 51% YoY/39% QoQ to INR463m (38% above est.). Sequentially, the cost rose INR130m, 75% of which is attributed to a onetime performance-related expense. Other expenses were up 75% YoY/13% QoQ to INR849m (5% above est.) due to: 1) higher tech costs (up 56% QoQ) and 2) SGF contribution of INR177m vs INR30m in 4QFY24.

* Management indicated that expenses as a percentage of sales are expected to remain stable going forward.

* Client participation increased 39% YoY, with 1.3m traded clients—1.07m in options and 0.48m in futures—reflecting growth across all participant categories.

* Around 140 FPIs have been onboarded onto the platform, contributing to the overall Average Daily Turnover (ADT) growth. FPI’s contribution for 4QFY25 was INR165b in options and INR6b in futures, accounting for 7% of total turnover. While FPIs are currently permitted to trade only in cash-settled commodities (crude and natural gas), their contribution is expected to increase as new products become available.

* With respect to new launches, MCX is set to launch monthly silver options in 30kg, 5kg, and 1kg variants, following the successful rollout of a 10-gram gold options contract in Apr’25. The Exchange is actively working on introducing electricity contracts, index and weekly index contracts, as well as carbon credit contracts.

Key takeaways from the management commentary

* SGF’s contribution was at 7% of transaction income (with 1% each allocated to ISF and IPF), which increased INR149m YoY due to higher trading volumes and market volatility. Management expects this contribution level to persist. ? Capital expenditure is projected to continue, driven by regulatory changes and the need to expand network capacity to support higher trading volumes from clients.

* MCX retained the top spot in the Futures Industry Association (FIA) exchange rankings for crude and natural gas segments, and ranked second in the gold and silver segments.

Valuation and view

We expect MCX to register a Revenue/EBITDA/PAT CAGR of 24%/29%/27% over FY25-27E. MCX’s key growth drivers include: 1) new product launches; 2) continued volatility in key commodity prices (gold, crude oil, and natural gas) amid global uncertainties; and 3) sustained growth momentum in retail participation in the options market. We have raised our estimates for expenses based on 4Q results. The impact is offset by an increase in volume growth estimates for the futures segment. Resultantly, our earnings estimates for FY26/27 are broadly unchanged. We reiterate a Neutral rating on the stock with a one-year TP of INR6,000 (premised on 33x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412